Netflix (NFLX 2.13%) shared some impressive stats with investors when it announced its fourth-quarter 2025 results on Tuesday afternoon. The streaming titan has surpassed 325 million paid memberships, giving it a global audience approaching 1 billion. And those viewers watched a total of 96 billion hours of video on its platform in the second half of 2025, up 2% year over year.

Moreover, the company beat estimates for the quarter, reporting 18% revenue growth, an operating margin of 25%, and 30% growth in operating income.

Yet despite all that, following the report, Netflix shares dropped by about 5% in after-market trading. And perhaps investors had good reasons to be pessimistic.

NASDAQ: NFLX

Key Data Points

Netflix's purchase of Warner Bros. will be expensive

Netflix intends to acquire Warner Bros. from Warner Bros. Discovery (WBD 0.51%). On the same day that it released its earnings report, it also announced that it was amending its bid from a cash and stock offer to an all-cash transaction. The revised bid still values the assets at the same price as before -- $27.75 per share, for an equity value of $72 billion -- but by making this change, Netflix hopes to smooth the path for Warner Bros. Discovery shareholders to approve its offer and reject the competing hostile takeover bid of Paramount Skydance.

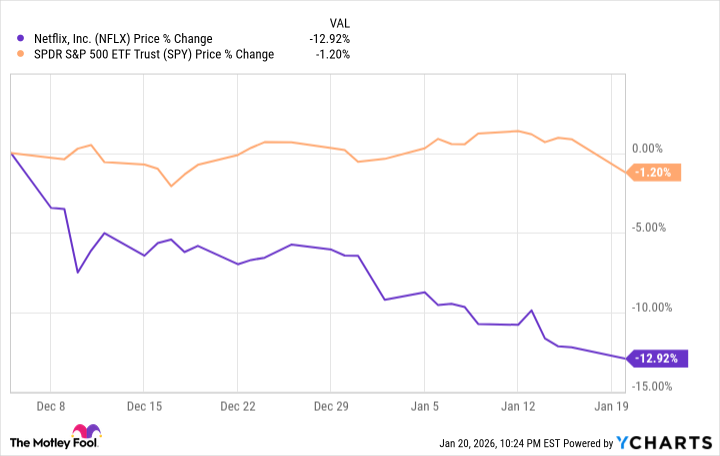

But investors remain unconvinced that this massive acquisition is a good deal for the streaming leader. Between Dec. 5, 2025, when the company announced its original offer, and Jan. 20, Netflix stock fell by 12.9%. That compares to a decline of 1.2% for the S&P 500 index.

To help finance the Warner Bros. acquisition, Netflix has arranged for $42.2 billion worth of bridge loans. And for now, it's pausing share buybacks to free up more cash to pay down the debt it will be taking on.

Image source: Getty Images.

A massive content budget

Last year, Netflix spent about $18 billion on programming -- both creating original shows and movies, and licensing content from other media companies. It expects to spend 10% more than that in 2026. In one sense, that can be viewed as just a necessary cost of doing business for a streaming service. It needs a wide array of offerings to attract diverse audiences and boost subscribers. But investors are concerned that its 2026 plans might be getting too costly, especially when factoring in the price it's paying for Warner Bros.

Indeed, the real problem might be that it's not spending enough on creating its own content. The price it's offering for Warner Bros. is four times as much as Netflix spent on content overall in 2025. It might be better off investing that $72 billion in developing fresh series and movies in the hopes that some become the next Stranger Things or KPop Demon Hunters.

With all the uncertainty surrounding how the battle to buy Warner Bros. will play out, and a price tag for it that some already view as too high, it's no wonder that investors are skittish about Netflix stock. I wouldn't rate it as a buy in the current environment, except for patient investors.