Cybersecurity has taken a back seat to artificial intelligence investing. However, I think that's a huge mistake. The reality is, with the rise of advanced AI comes increased risk of cyberattacks, as it becomes easier to find system exploits. This means it could be a strong few years for cybersecurity providers, and investors that don't have exposure to this important field should consider adding some.

Two stocks that I think will excel over the next decade in the cybersecurity sector are CrowdStrike (CRWD 0.20%) and SentinelOne (S +0.70%). These companies are both operating in the same sector, but are each worthy investments.

Image source: Getty Images.

AI-powered cybersecurity is the next evolution

Both CrowdStrike and SentinelOne deploy the same type of cybersecurity solutions. Each uses AI agents to determine what constitutes normal operation and what constitutes a threat. Then, when an agent detects a threat, it shuts down access to limit any damage done. This has proven to be an incredibly successful business model and has led to strong growth for both companies.

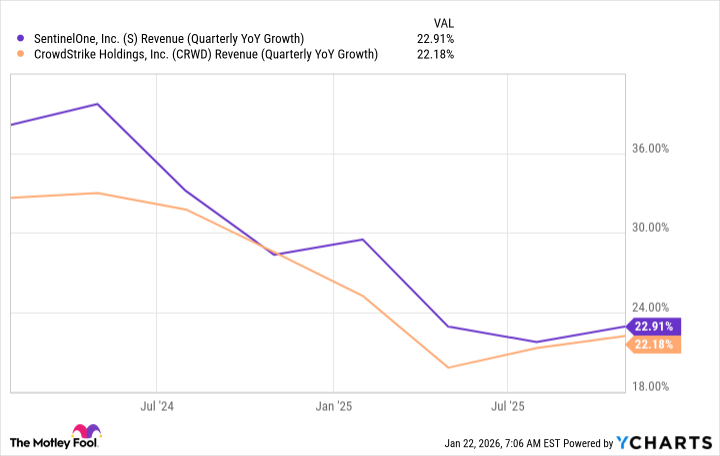

S Revenue (Quarterly YoY Growth) data by YCharts

Both companies have fairly similar growth rate patterns, which reflects the overall state of cybersecurity spending. It's still growing at a healthy rate, but it has slowed down a bit as resources are deployed elsewhere to bring generative AI technologies into businesses. Still, greater than 20% growth is nothing for investors to be upset about.

The market for cybersecurity spending is still expanding and expected to double over the next few years. CrowdStrike believes that its 2026 total addressable market is $140 billion, but it is expected to increase to $300 billion by 2030. That showcases clear growth in the cybersecurity industry, and anyone involved in the space with a strong offering will see strong growth as a result.

NASDAQ: CRWD

Key Data Points

There is plenty of room for multiple winners in this space, as there are several different cybersecurity solutions necessary to create a proper protection solution for a business. Still, CrowdStrike and SentinelOne are competitors, so why am I recommending both?

Each stock represents a different investment style

CrowdStrike is the leader in this field and has generated nearly $4.6 billion in revenue over the past 12 months, versus SentinelOne's $956 million. With the two posting similar growth rates, it's unlikely SentinelOne will ever catch up to CrowdStrike. However, it needs to continue growing to reach a strong profitability threshold, something that CrowdStrike has nearly done.

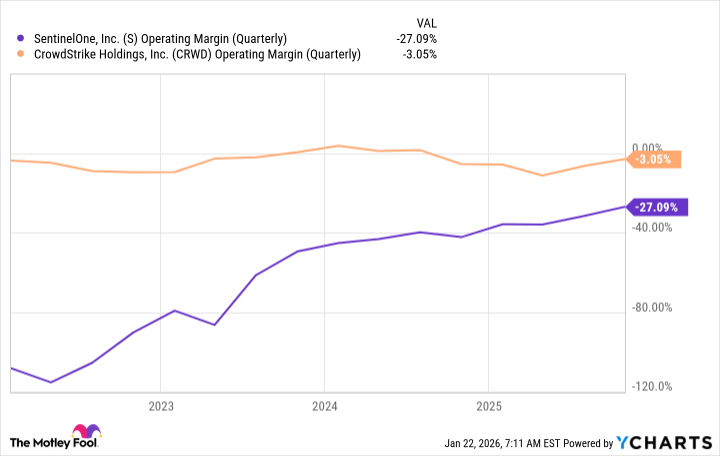

S Operating Margin (Quarterly) data by YCharts

CrowdStrike constantly hovers around having a positive or negative operating margin, while SentinelOne is still making its way toward full profitability. The market is a bit skeptical it can do this, which is why it trades at such a massive discount to its peer.

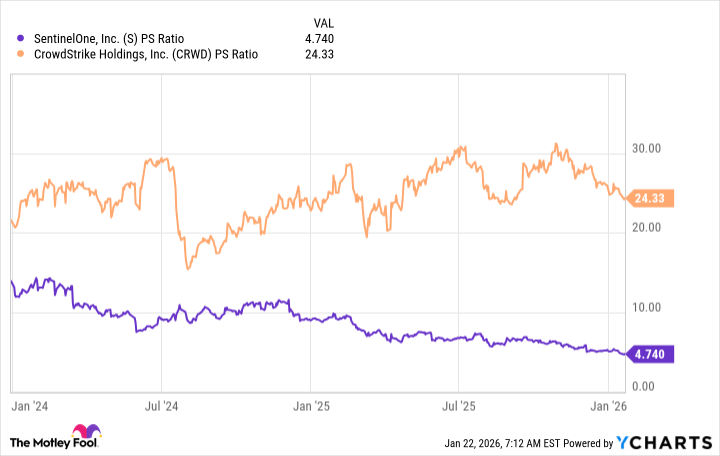

S PS Ratio data by YCharts

Although it used to trade at a much higher valuation level, SentinelOne now trades below five times sales. That's a pretty cheap price considering the long-term growth trends in cybersecurity, SentinelOne's own growth rate, and its steady track to becoming profitable. I think this could be an excellent long-term investment, as it's a fairly cheap software stock with great long-term potential.

NYSE: S

Key Data Points

CrowdStrike is far from cheap. At 24 times sales, it's above the normal 10 to 20 times sales I'd expect for such a software company. However, it's recognized as the best-in-class investment opportunity in the cybersecurity sector, so it gets a premium valuation. I think CrowdStrike will continue to lead from here, so the valuation is justified. Note that its stock growth rate will likely be tied to its revenue growth rate, where SentinelOne could also benefit from a rising valuation.

Both stocks make sense to own for the long term, as cybersecurity is only going to get more important with the rise of AI-assisted attackers.