Investors have long had a unique take on Royal Caribbean (RCL 6.37%) stock. Despite its position as the second-largest cruise line behind Carnival, it supports a market cap twice the size of its larger rival. Royal Caribbean tends to attract a higher-spending customer, and observers tend to perceive its ships as more innovative.

Such conditions may leave investors wondering how to approach Royal Caribbean stock. Should they hold for the long-term or treat it as a trade?

Image source: Getty Images.

The state of Royal Caribbean and its stock

Long-term investors will probably like what they see in Royal Caribbean stock. The cruise line has capitalized on a revived demand for cruise vacations that appears unaffected by an uncertain economy. In the third quarter of 2025, it reported 112% occupancy in an industry that defines 100% occupancy as two passengers in every cabin.

Consequently, it earned just over $3.5 billion in net income in the first nine months of 2025, a 51% year-over-year increase. These rising profits have allowed it to service and pay down its $21 billion debt load left over from the pandemic.

The increased income has also helped Royal Caribbean build new ships. It launched the Star of the Seas in 2025 and plans three additional ships over the next three years to help it meet the strong demand for cruise vacations.

Not surprisingly, such conditions have helped its stock outperform the S&P 500 over the last five years.

NYSE: RCL

Key Data Points

Investors may also like its valuation. Although its 18 P/E ratio is slightly higher than Carnival's at 16 times earnings or Norwegian Cruise Line Holdings' at a 14 P/E ratio, Royal Caribbean's earnings multiple is far lower than the S&P 500 average of 31.

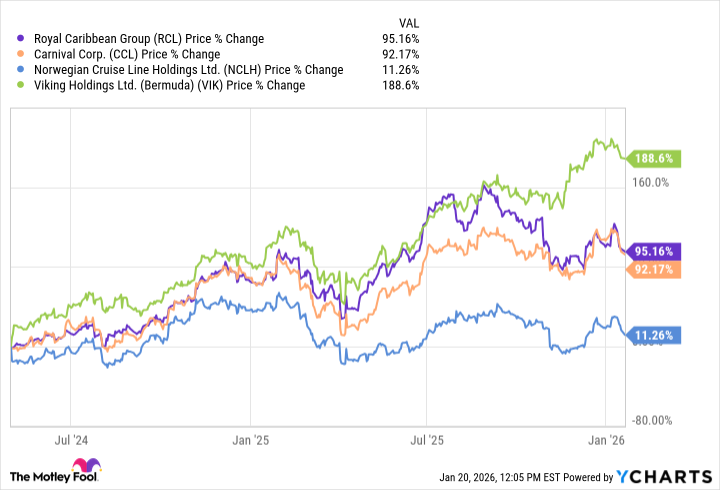

Admittedly, the most significant reason to consider treating Royal Caribbean as a trade may come from a newer and more upscale competitor, Viking Holdings (VIK 6.28%). Viking has created a lucrative niche among high-end cruisers with smaller ships and experience-oriented cruises. This approach has allowed Viking to generate more than 4% of the industry's revenue while carrying less than 1% of all cruise passengers.

Since its May 2024 IPO, Viking has dramatically outperformed all cruise line stocks, and at a P/E ratio of 32, investors appear far more willing to pay a premium for the stock. Nonetheless, investors will have to wait to see whether that trend can continue over a longer-term time horizon.

Is Royal Caribbean a long-term investment or a trade?

Ultimately, considering Royal Caribbean's track record, investors should treat its stock as a long-term holding. Despite maintaining a relatively low valuation, it has managed to grow bigger than Carnival on a smaller customer base, and it outperformed the S&P 500 over the last five years.

Royal Caribbean faces a formidable challenge from Viking. However, even if Viking proves its staying power, it will likely not stop Royal Caribbean from outperforming the S&P 500.