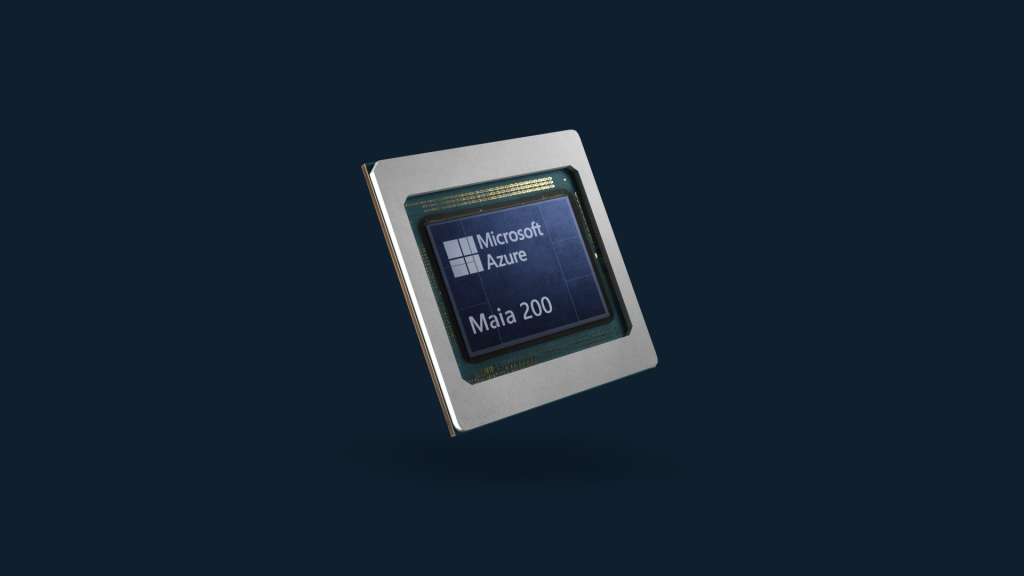

Here's an AI stock that'll crush the market in 2026, and no, it's not Nvidia (NVDA +1.10%). Microsoft (MSFT +2.19%) is going to have the best year among the AI leaders. Why is that? Because on Jan. 26, the software company revealed its long-awaited Maia 200 chip.

NASDAQ: MSFT

Key Data Points

This is Microsoft's second-generation in-house chip that's used for artificial intelligence (AI) inference. Inference is the "doing" stage of AI, where trained AI models move into solving real problems.

Microsoft's Maia 200 is ready to compete

Microsoft lagged behind its competitors in designing its own AI chips. This release marks an important milestone in the AI race between the tech industry's giants. The Maia 200 chip is built on Taiwan Semiconductor's 3-nanometer process.

Image source: Getty Images.

Maia 200 will directly compete with Nvidia's inference GPUs as well as Amazon's Trainium and Alphabet's Google TPU. Microsoft says Maia 200 has 30% better performance than its competitors for the same price. This bang-for-the-buck advantage is significant as price sensitivity grows in the sector. Microsoft's AI team will be the first to use Maia 200, but wider availability is expected to roll out in the near future.

Microsoft's deployment of Maia 200 reduces its reliance on third parties. As the company rolls out the chip to a wider audience, it will also generate new revenue, including its availability for rent for Azure cloud customers. Maia 200's predecessor was not available to rent.

Microsoft's stock is down a little over 2% to start 2026. The software company's forward price-to-earnings (P/E) ratio is currently under 30. Microsoft surpassed $3.5 trillion in market cap in 2025, and by that metric is the fourth-largest company in the world. Still, a successful launch of Maia 200 could mean serious growth for Microsoft as it sends a significant counterpunch to Nvidia's dominance.

NASDAQ: NVDA

Key Data Points

Expect to see results in late 2026

I anticipate Maia 200's impact to really pick up steam as we head into the latter part of 2026. Azure and Microsoft's cloud businesses will continue to grow substantially throughout the year. Microsoft reported a 40% increase in Azure and other cloud services revenue in its first quarter fiscal year 2026 earnings report.

As Microsoft moves Maia 200 from in-house to general availability, I expect this chip to make a real mark in the AI chip race and help accelerate Microsoft's growth in Azure and cloud services. Will it overtake Nvidia? That's probably not likely, but it could do some serious damage and help Microsoft stay atop the leaderboard.

You heard it here: Microsoft will be the AI stock of the year.