When you hear the phrase "chip company," your first instinct may be to think about Nvidia (NVDA +0.63%), AMD (AMD 0.24%), or maybe even Frito-Lay.

However, there is another major player behind the scenes that I think deserves more attention. Nvidia and AMD don't manufacture anything; they design the chips and outsource the work. While this is a great business model, so is the one employed by Taiwan Semiconductor Manufacturing (TSM 0.86%), the chipmaker known as TSMC to which they send the majority of their work.

AMD and Nvidia aren't alone in utilizing TSMC's services. Other major companies like Apple (AAPL +0.78%) also utilize its foundry services. TSMC is the hidden player behind many major technological advancements over the past few years. While the designers (like Apple or Nvidia) get most of the glory, TSMC is the silent partner that's doing a lot of the work.

This has led to solid stock gains over the past few years, but I think there is plenty of room to run, and the stock looks like an incredible buy for 2026.

Image source: Getty Images.

TSMC expects monster AI growth

It's no secret that TSMC is one of the huge beneficiaries of all the artificial intelligence (AI) spending going on. If you hear of an AI hyperscaler putting up a data center, odds are high that a significant portion of the chips inside the various computing units were created in TSMC's facilities.

In the past, that meant coming from Taiwan. However, the company has worked to diversify its footprint, and now chips for Blackwell graphics processing units (GPUs) come from TSMC's facility in Arizona. This reduces the concern about what effect a Chinese takeover of the island of Taiwan would have on the business, although it would still shake up the stock a lot.

That's still a major concern with the stock for many investors, but the reality is that a conflict in Taiwan would plunge the markets into disaster, and there would be no safe haven for investors. As a result, it's not high on my list of concerns for the stock.

NYSE: TSM

Key Data Points

Taiwan Semiconductor is experiencing a change from AI that is unlike anything it has experienced. Management has updated its guidance for AI chip growth, and it believes AI-related revenue will rise at nearly a 60% compound annual growth rate (CAGR) from 2024 to 2029. 2026 is getting toward the middle of the projection, but we haven't even crossed the halfway point yet. So, there's still plenty of growth to go for TSMC, which is why management had guided for nearly 30% revenue growth for 2026.

Many projections estimate that elevated data center spending will last through at least 2030, and if that pans out as many expect, TSMC will be a must-own stock during that time frame. Fortunately for investors, it's priced at a reasonable level and looks like a steal compared to some other stocks on the market.

TSMC's stock is reasonably priced

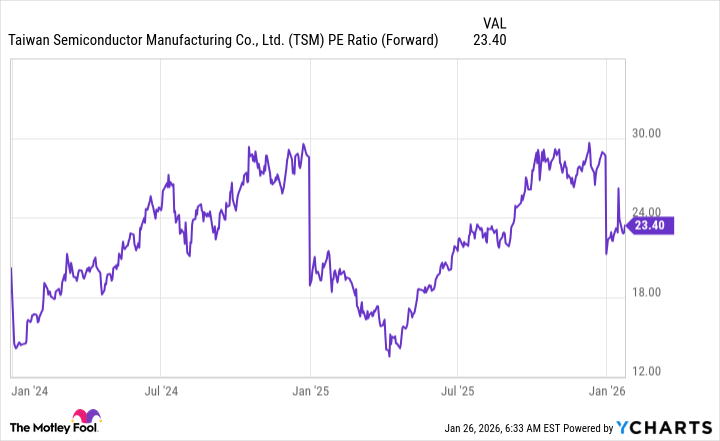

At 23.4 times forward earnings, TSMC's stock looks like a great buy.

TSM PE Ratio (Forward) data by YCharts

Most big tech companies trade for around 30 times forward earnings, yet aren't growing their revenue at nearly as fast a pace as TSMC. Furthermore, the S&P 500 (^GSPC 0.13%) trades for 22.2 times forward earnings, so it is barely priced at a premium to the broader market.

It's not often you have the opportunity to purchase a stock that trades at about a market-average premium that is growing at nearly a 30% pace. It's even more rare to find one that has well-established growth trends that aren't expected to decline until nearly five years later. This makes TSMC a pretty easy stock pick, and I'm extremely confident it will crush the market over the next five years and be a major winner in 2026.