Experienced dividend investors know that the consumer-packaged goods industry is prime territory for above-average yields and, in many cases, steadily rising payouts. Those perks are necessary because the consumer staples sector isn't known as a growth stock haven.

Based on yield, one of the sector's dividend dynamos is Conagra Brands (CAG +0.71%). The maker of Birds Eye frozen vegetables and other food brands sports a dividend yield of 8%, or more than 7 times the yield on the S&P MidCap 400 index. That's a relevant comparison because with a market capitalization of $8.4 billion, Conagra resides in mid-cap territory.

Conagra has a big yield, but it may not be underrated among dividend stocks. Image source: Getty Images.

Indeed, an 8% yield is eye-catching, especially when the Federal Reserve is expected to continue lowering interest rates, which in turn lowers yields on bonds and cash instruments. With Conagra, however, the dividend details matter. Let's explore why.

Underrated? Probably not.

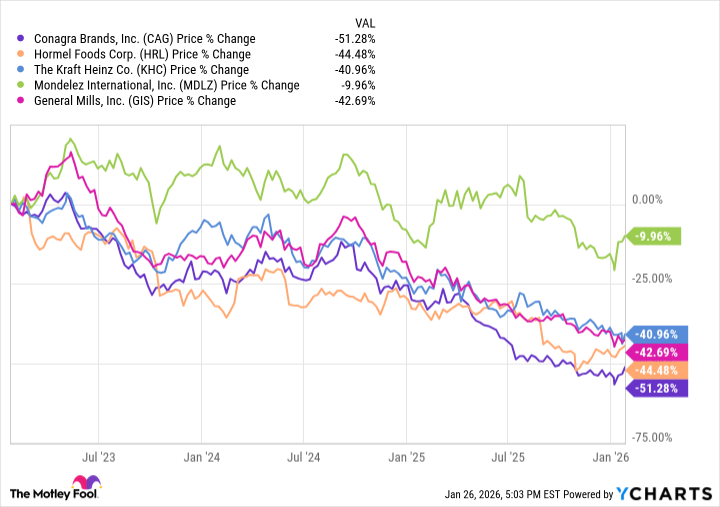

Conagra is a good reminder of something that experienced investors know, and newbies need to learn: Yields rise when the underlying security's price falls. Put simply, Conagra's elevated dividend is primarily the result of share price erosion. Making matters worse, while consumer-packaged goods stocks have struggled in recent years amid a shift to healthier eating, Conagra is one of the worst performers in its peer group.

Given those struggles, it's arguably a stretch to say that Conagra is an underrated dividend stock. The high payout might understandably be an attraction. Yet, dividend income investors may find some things to quibble about with this stock.

For example, it's neither a Dividend King, a stock with a dividend increase streak of a least 50 years. Nor is it a Dividend Aristocrat®, or a stock with a minimum 25-year payout increase streak (the term Dividend Aristocrats® is a registered trademark of Standard & Poor’s Financial Services LLC). In fact, Conagra has a couple of payout cuts to its name since the start of the 21st century although, to be fair, the payout has been trending in the right direction in recent years.

NYSE: CAG

Key Data Points

A lot needs to go right for Conagra to be underrated

"Underrated" implies that a company is doing something or several things right, and that execution isn't being fully appreciated by the investment. Think of it in college football terms. Say there's a team that's 7-0 and ranked 23rd in the nation or not ranked at all, while a bunch of 5-2 teams are in the top 10. The 7-0 team is, in fact, underrated.

Right now, Conagra isn't that team. It's not even a narrow-moat company, because some analysts say it doesn't have a moat at all. Compounding that situation is the point that in the frozen foods category, Conagra brands such as Healthy Choice and Marie Callender's don't command podium positions.

That's the result of Conagra's notoriously tight-fisted approach to advertising and research and development. Spending less than competitors hasn't benefited shareholders in recent years. Now, if Conagra changes its ways with investors buying into that story, it could become an underrated dividend stock -- but at this point, that could take a while.