In the quantum computing space, IonQ (IONQ 6.75%) has helped make a name for itself by developing one of the most accurate systems. Because quantum systems use less stable qubits, they tend to be error-prone. However, IonQ's trapped ion technology, which uses real atoms, has proven to be one of the most accurate, achieving 99.99% two-qubit gate fidelity (accuracy).

Becoming vertically integrated

Accuracy isn't the only issue quantum computing companies need to solve for the technology to become commercially viable. These companies also need to be able to scale the technology and have the networking and transmission systems in place, as well. Because of this, IonQ has been aggressive on the acquisition front, buying up companies that will both help it scale and control more of the quantum ecosystem.

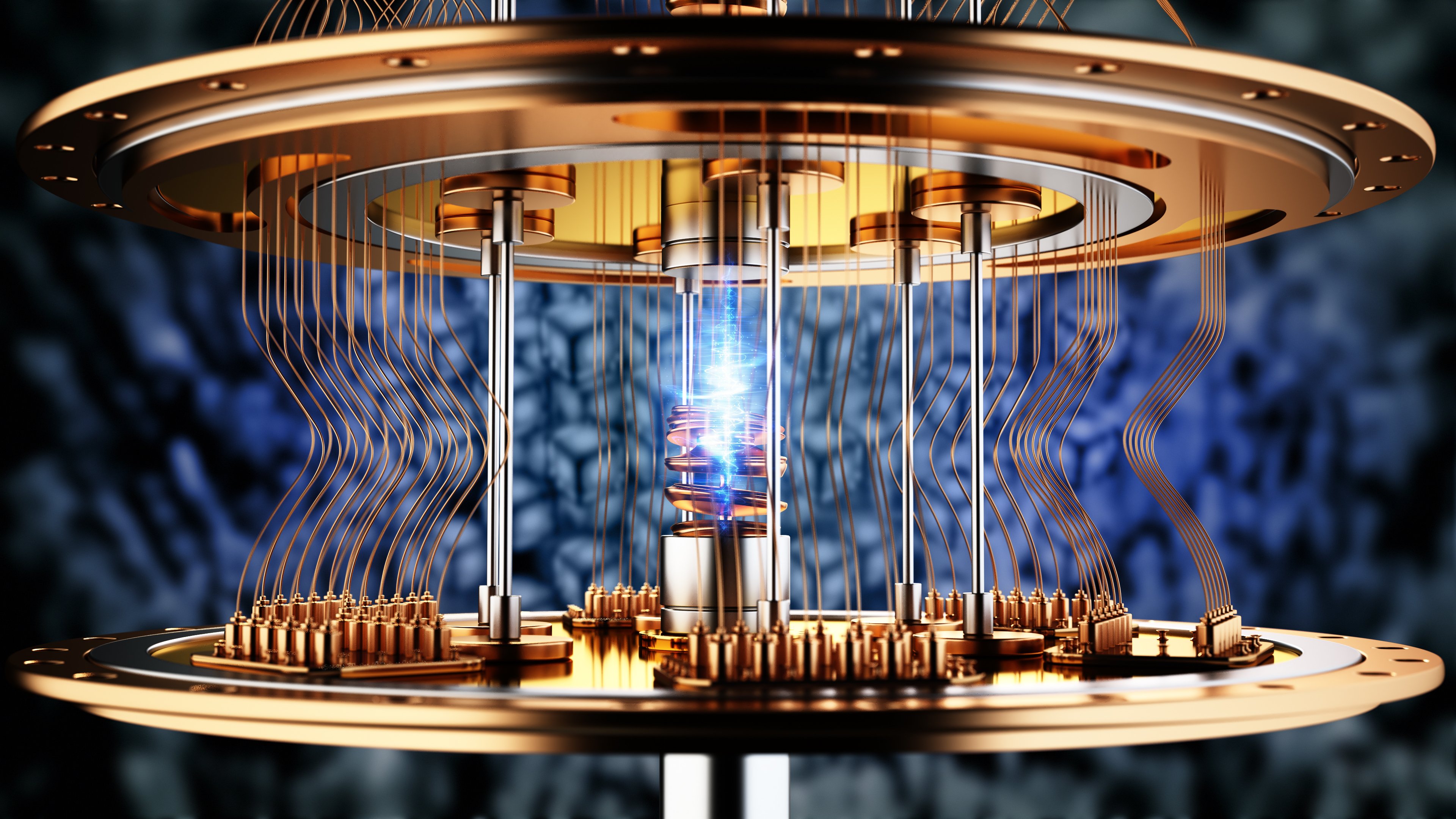

Image source: Getty Images.

Past big acquisition deals include Oxford Ionics to help it reduce the size of its quantum computers, and LightSynq, which brought it photonic interconnect technology that it needs to help scale its systems. Meanwhile, the acquisition of Capella gave it satellite-based distribution, and Vector Atomic brought with it quantum sensing technology.

However, IonQ's latest announced acquisition, SkyWater Technology (SKYT 3.20%), brings an entirely different element to the company. SkyWater is a semiconductor foundry focused on the quantum computing industry. With the deal, IonQ will become the only vertically integrated quantum computing company capable of manufacturing its own chips.

Today, most logic semiconductor companies use a fabless model and rely on third-party foundries like Taiwan Semiconductor Manufacturing. Building out fabs is costly, and running them profitably and advancing technology is difficult. However, in an emerging field like quantum computing, vertical integration makes a lot of sense.

While SkyWater will continue to serve its existing customers, IonQ now has priority that should help speed up its development roadmap. It will now be able to prototype chips more quickly, have access to the most advanced die and fabrication technology before others, and have more control over its supply chain. This is a big advantage.

SkyWater's fabs are also all located in the U.S., and the company is a trusted U.S. government partner with DMEA Category 1 Trusted Accreditation. This opens up the door for IonQ to be at the front of the line when it comes to winning government quantum computing contracts. Given that quantum computing is such an emerging technology, the U.S. government is generally a good revenue source.

NYSE: IONQ

Key Data Points

Is IonQ stock a buy?

IonQ remains a speculative stock. Quantum computing is still an unproven technology that is many years away from commercialization. However, right now it looks like IonQ could be the best-positioned company in this field, and the deal to acquire SkyWater only adds to its appeal.

Investors can consider taking small, speculative positions in the stock.