For the first time in what seems an eternity, international stocks outpaced domestic rivals in 2025, with many ex-U.S. exchange-traded funds (ETFs) trouncing the S&P 500. That trend is carrying over to 2026, as the iShares Core MSCI Total International Stock ETF (IXUS 1.63%) is up 7.5% year to date, compared with a 1.9% gain for the S&P 500.

The resurgence of international stocks isn't confined to large caps. Smaller stocks contributed to that theme in 2025 and are showing signs of doing more of the same this year, underscoring why I've got the Avantis International Small Cap Value ETF (AVDV 2.72%) atop my 2026 ETF shopping list.

Winning small caps are found outside the U.S., and this ETF has them. Image source: Getty Images.

The allure of this international ETF is easy to explain. If small caps and global stocks are expected to be leadership groups this year, why not embrace both under a single umbrella?

Maybe a better small-cap value mousetrap

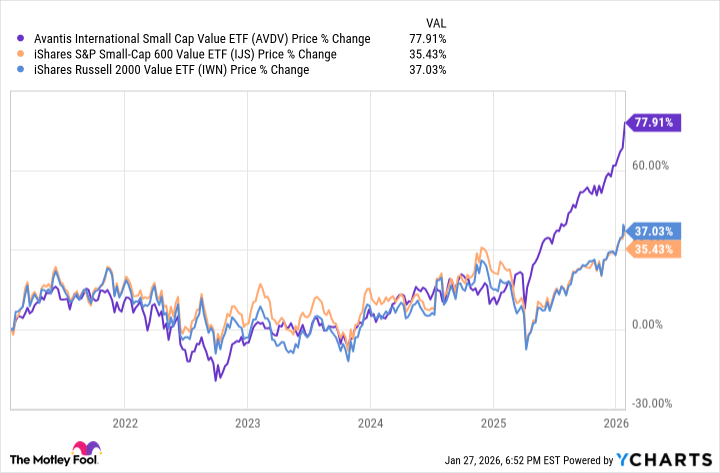

Over the long term -- close to a century -- small-cap value has worked, but more recently some of the value funds addressing domestic smaller stocks lagged. That disappointment doesn't apply to this Avantis ETF, which easily outpaced U.S. small-cap value gauges over the past five years.

Past performance isn't a guarantee of future gains, but this ETF has some perks worth considering.

First, it's actively managed. The small-cap space is seen as less efficient than large-caps, meaning some are mispriced, opening the door to opportunity for active managers. That's even more pronounced with international small caps, which don't get much attention from U.S. investors.

NYSEMKT: AVDV

Key Data Points

Second, this fund has a compelling geographic mix, which is essential when evaluating any international fund. The Avantis ETF allocates 32% of its portfolio to Japanese small caps. Some market observers view Japanese small caps as inexpensive and as beneficiaries of Prime Minister Sanae Takaichi's economic agenda.

Put it all together, and the $17 billion Avantis ETF has a lot to like. Its annual expense ratio is 0.36%, or $36 on a $10,000 stake.