It's not surprising that investors look at Peter Thiel's latest buys and sells with interest. The billionaire has been involved in the launch and growth of many major businesses and knows how to spot a great company and get in on it early. Thiel is a co-founder of both PayPal and Palantir Technologies, and he also became Facebook's (now Meta Platforms) first outside investor.

At the helm of hedge fund Thiel Macro, the billionaire oversees more than $74 million in 13F securities -- managers of more than $100 million in securities must report their trades on a quarterly basis on Form 13F to the Securities and Exchange Commission. This is positive for us as it offers us a glimpse of their latest investing activities.

Just recently, Thiel made a major move. He unloaded all of his shares of Nvidia (NVDA 0.72%), an artificial intelligence (AI) giant, and opened positions in two tech industry stalwarts. Let's take a closer look at this shift in Thiel's AI bet.

Image source: Getty Images.

Nvidia's role in AI

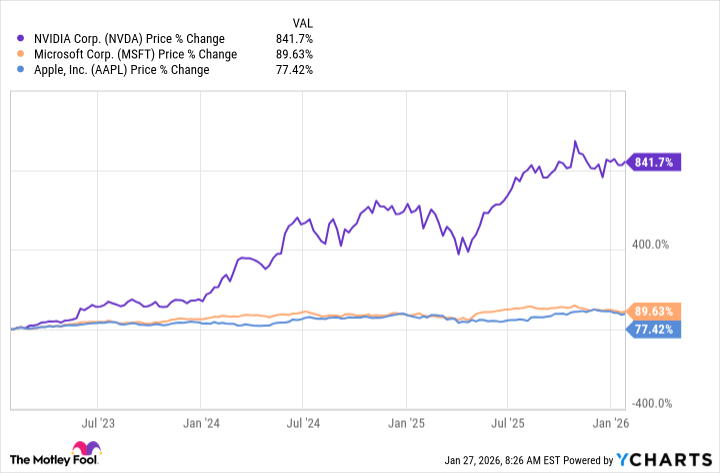

So, first of all: Why am I calling this a shift in the billionaire's bet? This is because Nvidia has been considered the company driving the AI revolution. The tech giant is the leading seller of graphics processing units (GPUs), the principal chips needed to fuel the development and use of AI. Its GPUs continue to outperform those of rivals, and this has resulted in explosive earnings growth and stock performance. For example, in the last fiscal year, revenue reached a record of more than $130 billion. And Nvidia stock has climbed in the quadruple digits over five years.

NASDAQ: NVDA

Key Data Points

On top of this, Nvidia's promise to update its chips on an annual basis may secure its leadership over time. And analysts' forecasts for an AI market of more than $2 trillion by the start of the next decade suggest there's plenty of growth ahead for AI powerhouses like Nvidia.

All of this has driven investors to buy Nvidia stock as a bet on the AI boom. Yet, Thiel, who initially purchased Nvidia stock in the fourth quarter of 2024, sold his entire position in the third quarter of 2025. That was 537,742 shares, which made up 40% of Thiel's portfolio.

Thiel's latest moves

And at the same time, he opened new positions in the following two tech heavyweights:

- Thiel bought 49,000 shares of Microsoft (MSFT 0.83%), and that company now makes up 34% of his portfolio.

- Thiel bought 79,181 shares of Apple (AAPL +0.62%), and that stock now accounts for 27% of the investor's portfolio.

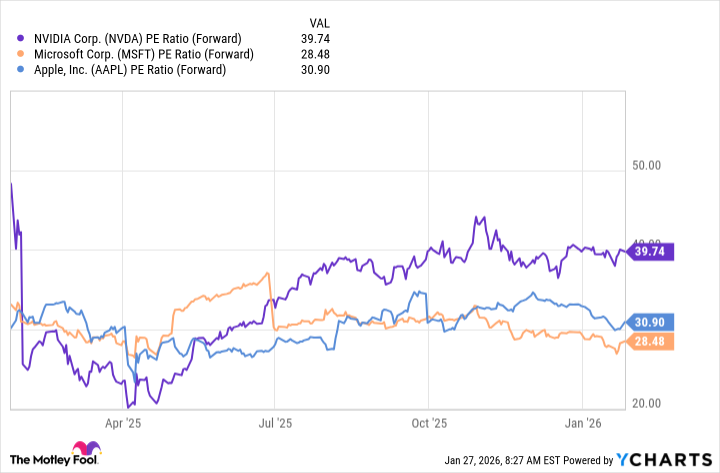

Thiel hasn't said why he made the following moves, but we may interpret this as a rotation out of a stock that has soared in the early stages of the AI boom and seen its valuation climb -- and a shift into stocks that haven't seen such enormous gains and today trade for lower valuations.

NVDA PE Ratio (Forward) data by YCharts

Nvidia's dependence on AI

It's also important to note that Nvidia is much more dependent on AI for growth than Microsoft and Apple -- this has been a positive point for Nvidia over the past couple of years, and has driven up the share price as investors saw it as a clear bet on AI. And Nvidia's AI strengths have also produced concrete results, with earnings climbing as I mentioned above.

But Nvidia may also be seen as a riskier AI buy than Microsoft and Apple. Microsoft generates revenue from a variety of businesses, from software to cloud computing -- businesses that have delivered growth well before the AI boom. And Apple has been a smaller AI player, just recently rolling out AI features across its devices, so while Apple may benefit from AI, the company isn't heavily relying on it for growth. This means they are less likely to suffer if there's any slowdown or headwinds in the AI story.

So, Thiel's shift broadens his exposure to companies that are active in the AI space -- but aren't as tightly linked to it as Nvidia. Now the question is: Should you follow Thiel's moves?

This depends on your investment strategy. If you're a cautious investor or worried about the formation of an AI bubble, Microsoft and Apple make excellent choices today. But if you're an aggressive investor who aims to maximize your potential for AI growth, you might want to stick with Nvidia -- this AI giant still could have room to run.