The bullish case for oil stocks received a significant boost earlier this month when U.S. forces captured the now former Venezuelan President Nicolas Maduro, sparking hope that the petroleum-rich country will eventually be open to Western oil majors.

Count ConocoPhillips (COP +1.39%) among the domestic oil equities in rally mode to start 2026. January isn't over yet, but this stock is higher by more than 8%. How much, if any, of that move is attributable to Venezuela is up for debate.

Regime change is afoot in Venezuela, but that's not a primary catalyst for shares of ConocoPhillips. Image source: Getty Images.

Yes, there's been not-so-gentle cajoling from President Trump toward U.S. oil giants, including ConocoPhillips, to be prepared to invest in the South American country. Maybe they will. Perhaps they won't, but the point is that investors ought to be careful when considering this stock as a Venezuelan play, and that's not an indictment of the company.

ConocoPhillips has Venezuelan scores to settle

Investors who have been actively keeping up with the situation in Venezuela by now likely know that Chevron (CVX +3.33%) is the only domestic oil company operating there, but we're talking about ConocoPhillips here.

Like rival ExxonMobil (XOM +0.51%), Conoco was banished from the country in 2007 when then-President Hugo Chavez nationalized the nation's energy industry. So while access to any member of the Organization of Petroleum Exporting Countries (OPEC) is coveted, history alone could give Conoco pause about rushing back to Venezuela. Then there's the matter of derivatives of that history.

When accounting for interest, Conoco has legal claims against Venezuela totaling $12 billion. Exxon's amount to $20 billion, but that company is hoping to recoup $12 billion, too. At $12 billion apiece, Conoco and Exxon are two of Venezuela's biggest non-sovereign creditors. That's not chump change. In fact, $12 billion is nearly 10% of Conoco's market capitalization as of Jan. 28.

There's speculation that Exxon and Conoco would tie future investment in Venezuela to recouping those debts, but the White House views that as a long-term matter, not something to grapple with in the near term. Said another way, the Trump administration wants U.S. oil companies to invest in Venezuela, but it's not going to play debt collectors to make that happen.

Conoco keeps a low risk profile

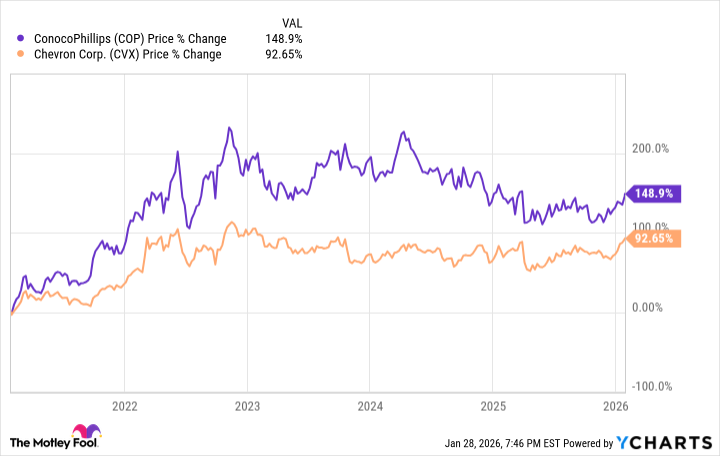

Investors experienced in the oil patch know this segment is ripe with idiosyncratic risk, or issues that are germane to a specific industry. It's difficult, perhaps impossible, to eliminate all idiosyncratic risk in the oil industry, but producers can take steps to minimize broader turbulence. Conoco does that, and not at the expense of shareholders, as the stock outpaced Chevron over the past five years.

For example, Conoco's largest production region is the lower 48 states. Its other significant regional exposures include Alaska, Canada, and Europe. While it does explore and produce in some potentially politically volatile corners of the globe, it's not biting off excessive risk on that front.

That may be a sign that Conoco's Venezuela story will be penned over years, not weeks or months, if it's written at all.