Microsoft (MSFT 3.23%) kicked off big tech earnings this week and so far Wall Street isn't happy. Despite beating expectations across the top and bottom lines, investors are spooked about Microsoft's rising costs.

In my eyes, the hyperscaler's decision to double down on its artificial intelligence (AI) infrastructure road map is a no-brainer. While analysts continue to harp on Microsoft's capital expenditure (capex) profile, I'm looking at an entirely different metric.

Image source: Getty Images.

Microsoft's costs are soaring, but so is the future of its business

For the second quarter of fiscal 2026 (period ended Dec. 31), Microsoft reported $81.3 billion in revenue -- up 17% year over year. Perhaps most encouraging was growth from the company's cloud computing division, Azure. Sales in the intelligent cloud segment rose 29% year over year to $32.9 billion, while Azure services specifically increased 39% compared to last year.

Accelerating sales is not Microsoft's problem. The main drag on the stock revolves around the company's surging capex. During the quarter, Microsoft spent $37.5 billion on capex -- a 66% increase compared to last year. On the surface, increasing your costs to maintain your top-line growth might make sense.

Here's the issue: Microsoft's operating cash flow during the quarter was $35.8 billion -- less than what the company spent on capex. In addition, Microsoft's free cash flow declined as a result of rising infrastructure investments.

The question that has analysts worried is simple: Can Microsoft maintain its spending, or is the company getting ahead of itself? In my eyes, management gave us the answer, but no one seems to be paying attention.

During the earnings call, Microsoft CFO Amy Hood explained that the company's remaining performance obligations (RPO) grew 110% year over year to $625 billion. What's even more interesting is that 45% of the RPO backlog is tied to OpenAI.

NASDAQ: MSFT

Key Data Points

Why is OpenAI important for Microsoft?

There are two ways to look at OpenAI's position within Microsoft's backlog. Bearish investors will point out the obvious: customer concentration risk.

Given OpenAI is not yet a mature, profitable company, there are legitimate risks that its future commitments to Microsoft could be recognized slower than anticipated. In turn, this could decelerate Microsoft's revenue and put downward pressure on the company's margins.

From a macro standpoint, OpenAI's role within Microsoft's backlog suggests something far more strategic. To me, the growing RPO figure underscores that AI demand is not a function of transient, cyclical cloud spending.

Rather, the pace at which Microsoft's RPO is growing suggests that AI is becoming increasingly embedded in enterprise workflows -- making OpenAI's explosive usage a structural cornerstone for Microsoft as the multiyear infrastructure supercycle unfolds.

Should you buy the dip in Microsoft stock?

Following the earnings report, Microsoft stock plummeted more than 10%. In fact, the sell-off was so dramatic that Microsoft stock formed a rare death cross. This is finance jargon used to mean that technical analysis implies further selling could be in store in the short term.

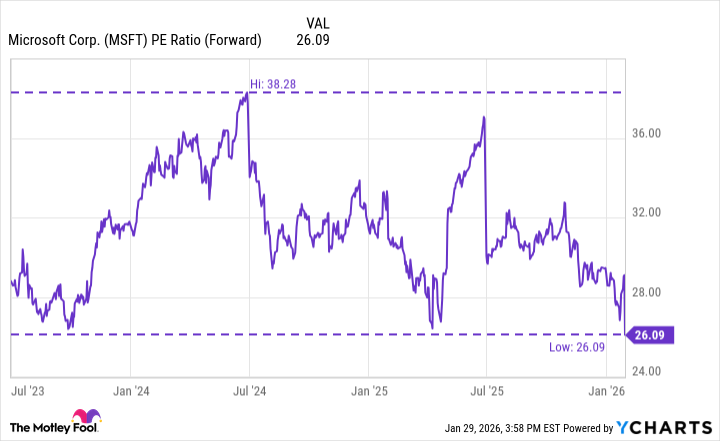

With shares falling off a cliff, Microsoft now trades at its cheapest valuation throughout the entire AI revolution based on forward price-to-earnings (P/E) trends: 26.

MSFT PE Ratio (Forward) data by YCharts

As a long-term investor, I can't name many other companies with over a half-trillion in future revenue booked and waiting to be recognized. While investors may continue to trim their exposure to big spenders like Microsoft, I'd use this as an opportunity to buy the dip.