Artificial intelligence (AI) is a computing-intensive technology, and with demand for high-performance data centers outstripping supply, a host of players in the cloud sector are rapidly expanding their footprints.

The persistent gap between the volume of computing capacity the big AI players can supply in-house and what is needed has created an opening for a new class of cloud computing infrastructure companies: neoclouds. These businesses are focused solely on providing the high-end computational power and hardware resources required to train and run AI models. One such neocloud is CoreWeave (CRWV 2.56%). It rents some space from Applied Digital (APLD 3.61%), which also owns and operates data centers.

Neoclouds are a subset of the AI infrastructure market, which Fortune Business Insights forecasts will grow from $59 billion in 2025 to $356 billion by 2032. And investors interested in capitalizing on this expected massive expansion may find that buying shares of CoreWeave or Applied Digital makes sense to them. But which looks like a better investment today?

Image source: Getty Images.

A look into Applied Digital

Applied Digital was up by nearly 500% over the past 12 months through Jan. 28, when it hit a 52-week high of $42.27. That hot performance was all thanks to AI.

The AI-related demand for more computing power helped lift its revenue by a whopping 250% year over year to $126.6 million in its fiscal 2026 second quarter, which ended Nov. 30. That top-line growth is poised to continue. In the quarter, the data center landlord signed new leases that will be worth $16 billion over the term of the agreements.

Although the company is enjoying sales growth, its business model does have downsides. One of these is that it needs to construct more data centers to continue growing revenue. The buildout of data centers is costly, and Applied Digital has taken on tremendous debt to fund construction. It exited its fiscal Q2 with debt in excess of $2.6 billion. That said, its cash position was solid with cash and equivalents of $1.9 billion.

Moreover, Applied Digital is not profitable. Its fiscal Q2 operating expenses were $157.5 million, triple the prior-year period's $49 million. As a result, it booked an operating loss of $31 million.

NASDAQ: APLD

Key Data Points

CoreWeave's neocloud business

CoreWeave is one of Applied Digital's largest customers, having signed an $11 billion lease for data center space. Like its landlord, CoreWeave is seeing spectacular sales growth as customers flock to it for AI cloud computing services. In Q3, it booked record revenue of $1.4 billion, up from $583.9 million in the prior-year period.

CoreWeave also benefits from the backing of AI chip leader Nvidia. The two entered into a partnership worth $6.3 billion last year. According to a filing with the Securities and Exchange Commission, if the neocloud provider has excess data center capacity, "Nvidia is obligated to purchase the residual unsold capacity through April 13, 2032." This is significant because it cushions CoreWeave against the risk of a decline in demand for its infrastructure.

In addition, Nvidia invested $2 billion in CoreWeave, buying its stock at $87.20 per share. This suggests Nvidia is bullish on CoreWeave's business prospects, which makes sense given the expected growth in the AI infrastructure industry.

However, like Applied Digital, CoreWeave has amassed high debt to fund the expensive computing hardware and cooling systems required for AI. The company ended Q3 with debt of more than $14 billion.

NASDAQ: CRWV

Key Data Points

Making a choice between Applied Digital and CoreWeave stocks

The strong sales growth experienced by Applied Digital and CoreWeave shows that both are successfully capturing market share in the AI infrastructure space. Yet a deeper look into their financials shows Applied Digital's costs are so high, even its gross profits are slim.

In its fiscal Q2, the company's sales of $126.6 million yielded a gross profit of $26 million, as its cost of revenue was $100.6 million. By contrast, in Q3, CoreWeave booked a gross profit of nearly $1 billion after subtracting its $368.8 million cost of revenue.

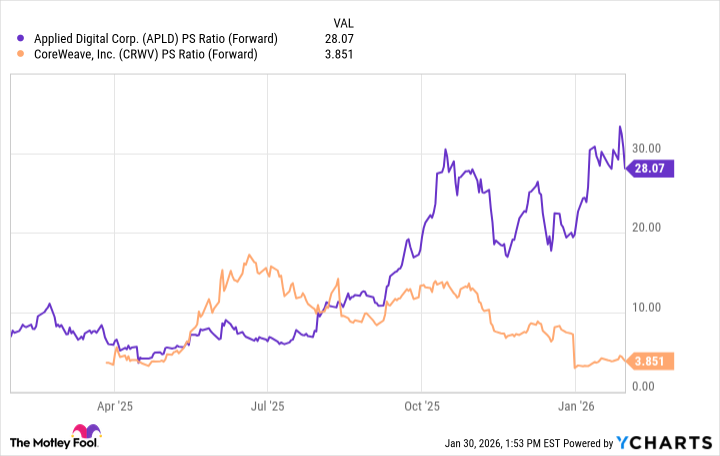

Nvidia's backing also enhances the attractiveness of CoreWeave as an investment compared to Applied Digital. But in deciding which is the better investment now, there's another factor that must be considered: share price valuation. As neither is profitable, one of the best metrics to use to compare them is the forward price-to-sales ratio (P/S), which indicates how much investors are paying today for every dollar of projected revenue over the next 12 months.

Data by YCharts.

CoreWeave has a significantly lower forward sales multiple than Applied Digital, indicating it's the better value. In fact, CoreWeave's P/S ratio is trading near its 52-week low, while the opposite is true for Applied Digital.

Based on its higher sales, higher gross profits, and superior valuation, CoreWeave is the better investment choice between these two AI infrastructure companies.