Finding stocks that can double your money in a short time frame is a lofty goal for investors. The old saying goes, "If you shoot for the moon and miss, you'll end up among the stars," may resonate with investors, but the reality is, you could also end up crashing and burning if you're wrong on a stock. Balancing risk and reward is a skill investors must learn, and each investor's risk tolerance will vary greatly.

However, I've identified a stock that could be a strong candidate for doubling your money in 2026: The Trade Desk (TTD 9.58%). It's a rare combination of growth and value, and I think it could double your money by the end of 2026 if everything goes right.

Image source: Getty Images.

The market misunderstands The Trade Desk

Part of the reason why I think The Trade Desk could have a strong 2026 is because of how bad its 2025 was. The stock is down nearly 80% from its all-time high established in late 2024, and the stock consistently fell throughout 2025 and even into 2026.

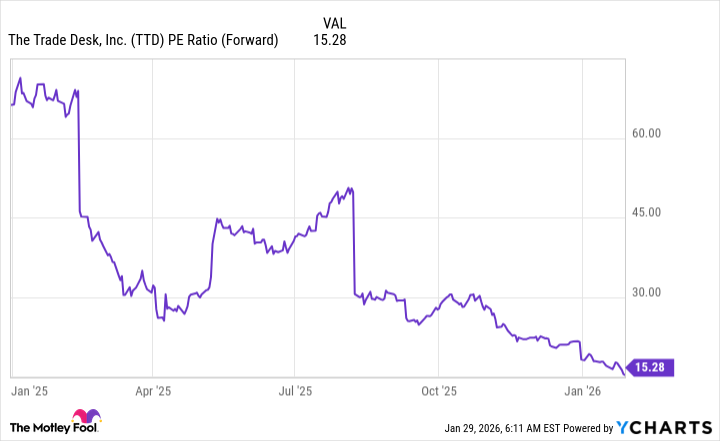

However, it has reached bargain-bin valuation levels that investors shouldn't ignore. At a mere 15 times forward earnings, it's an absolute steal.

TTD PE Ratio (Forward) data by YCharts

A valuation like that indicates a company that may be shrinking or stagnant at best, but The Trade Desk is still growing at a healthy rate.

In Q3 2025, its revenue rose 18%. That's not a sign of a failing company, and it was affected by a lack of political spending. The Trade Desk operates a buy-side ad platform, which helps advertisers find the best places to advertise on the internet. This makes it a huge beneficiary of political spending in election years, which was not a factor in Q3 2025 as it was during Q3 2024. That should help 2026's results, and this is reflected in Wall Street's analysis.

Wall Street analysts expect 16% growth next year, and earnings per share (EPS) to come in at $2.09. However, the high end of projections indicates $2.40 of EPS for The Trade Desk.

NASDAQ: TTD

Key Data Points

So, does this add up to a stock that can double?

Because The Trade Desk is growing faster than the market (as measured by the S&P 500), it should have at least the same valuation as it. The S&P 500 trades for 22.2 times forward earnings, so we'll use 23 times forward earnings as our base case. If we use the high end of the earnings projection for 2026 and project another year of 16% growth in 2027, that would indicate $2.78 in EPS during 2027.

A stock projected to generate $2.78 in EPS for 2027 trading at a 23 times forward earnings valuation yields a stock price of $64. The Trade Desk currently trades at $32 per share, so a double is entirely within reason for the stock.

None of these projections is outlandish, so even if it doesn't hit these goals, I still think The Trade Desk will be a great investment for 2026.