In February 2025, Sandisk (SNDK +4.55%) spun off from Western Digital, becoming a stand-alone, public company for the second time. Since then, it has been the hottest stock in the S&P 500, up 1,500% through the end of January 2026.

For investors who bought Sandisk shares early, it's been a lucrative ride that has made a lot of people a lot of money. For investors considering buying shares now, the decision gets a bit trickier after such a huge run in a short period. If you find yourself in the latter category, is now the time to get in? Well, let's take a look.

Image source: Getty Images.

Right place at the right time

Sandisk's recent surge comes down to its role in the AI ecosystem. Sandisk builds advanced storage devices, which you can think of as digital filing cabinets to hold the data that artificial intelligence (AI) needs. These are important because they let you save and quickly access large amounts of data, and without them, it would be impossible to train AI on the scale it is today.

As one of the leading makers of these storage devices, Sandisk is well positioned to capitalize on the increased demand. In fact, because demand is beginning to outpace supply, Sandisk has been able to raise its prices significantly. And that combo always attracts investors' attention.

NASDAQ: SNDK

Key Data Points

You can't deny the cash flow

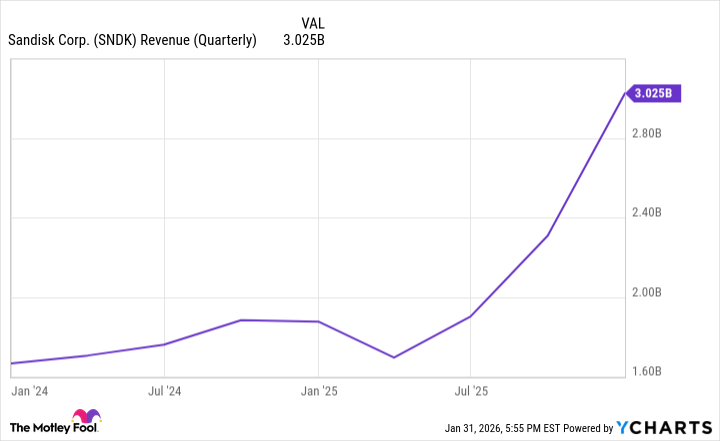

Sandisk put up impressive numbers in its second-quarter fiscal year 2026 (ended Jan. 2). Its revenue increased 61% year over year to $3.03 billion, around $360 million more than estimates. Its earnings per share (EPS) increased by 404% to $6.20, well above the estimated $3.54.

Sandisk noted that a lot of its growth is coming from companies building out AI infrastructure and deploying AI at scale.

Sandisk projects its current quarter's revenue to be between $4.4 billion and $4.8 billion, which would be up between about 160% and 183% year over year. It projects its EPS to be between $12 and $14, up from a loss of $0.30 last year.

SNDK Revenue (Quarterly) data by YCharts.

Should you buy Sandisk right now?

As of the beginning of February, my answer is no. But it's much less about Sandisk's business and much more about how expensive the stock is right now.

At its current valuation, a lot of growth is already priced into Sandisk's stock, suggesting investors have very high expectations. Whenever this is the case, anything short of near-perfect results could cause sharp drops.

Yes, Sandisk's business is booming. But investing in good companies at unreasonable prices can lead to disappointing long-term returns. That doesn't mean its momentum will stop. I just believe there are better-valued alternatives on the market right now.