Last year wasn't a huge year for initial public offerings (IPOs), but one of the more anticipated ones came from design company Figma (FIG +0.37%). Its IPO price was $33 per share on July 31, and by the next day, it had skyrocketed to $122. Unfortunately, the stock has fallen about 80% and trades at about $24 (as of Feb. 2).

Considering the hype surrounding Figma, should investors take the opportunity to invest now that it's so far below its all-time high? Or is this a situation where excitement obscured the actual business? Let's take a look.

Image source: Getty Images.

What exactly does Figma do?

Think about how Google Docs made collaborating on documents in real time much more efficient than older software. Now, imagine that for user interface (UI) and user experience (UX) design.

Instead of sending designs back and forth, Figma lets teams build together in real time, in the cloud. It seems simple on the surface, but even legacy companies like Adobe didn't perfect this approach.

Much of Figma's hype has come from becoming the go-to platform to bridge the gap between designers and developers.

A growing customer base

The test of Figma's business model is the number of customers it can attract and retain. People and businesses often try a product, but retention matters for stability and long-term growth.

Figma ended its last-reported quarter (ended Sept. 30) with 1,262 customers with an annual recurring revenue (ARR) of at least $100,000, and 12,910 customers with an ARR of at least $10,000. These were up 385 and 3,148 year over year, respectively.

Any new customers are worth celebrating, but the increase in customers spending more than $100,000 is noteworthy because those companies usually stick around longer and would have Figma more ingrained in their design infrastructure. It's also a good sign that about 30% of them were creating on Figma Make (Figma's AI tool) weekly.

NYSE: FIG

Key Data Points

Financial takeaways from its recent performance

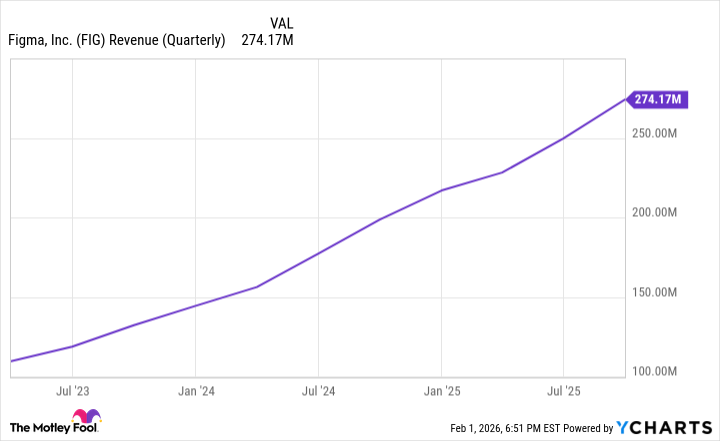

The growing customer base was reflected in Figma's financials in its latest quarter. Revenue rose 38% from a year earlier to $274.2 million. Its annual revenue run rate -- which is current quarterly revenue multiplied by four -- crossed the billion-dollar mark for the first time.

It had an operating loss of about $1.1 billion in the quarter, but most of that was due to the $975.7 million it spent on one-time stock-based compensation. This is expected with newly public companies because executives and early employees tend to vest their equity or receive payouts shortly after the company goes public.

Figma is continuing to reinvest heavily in its business, so profitability isn't the immediate priority. What matters more right now is that Figma's cash flow remains positive.

FIG Revenue (Quarterly) data by YCharts

Should you buy the dip on Figma right now?

To start February, Figma is trading at almost 70 times its projected earnings for the next 12 months. It's far below the 329 it traded at in its 2025 peak, but it's still expensive. That's much more than Nvidia's 25, Amazon's 29, and Meta Platforms' 24.

We've seen popular software stocks trade at premiums in recent years (Zoom, Snowflake, to cite a couple), and in most cases, they've experienced sharp and long-running declines. Being down 80% could mean that Figma has already gone through its great reset, but there could also be more downside. You don't want to invest simply because an expensive stock is cheaper than before.

Figma definitely has a good product; the proof is in its growing high-dollar customers and retention. However, given that Figma's stock remains richly valued, it falls in the wait-and-see category for me.