Last year was a fantastic year for the S&P 500, but not all companies in the famous stock market index fared well. The Trade Desk (TTD 0.55%), one of the index's newest members, has been in a terrible slump. The stock declined by a whopping 67% in 2025 and kicked off this year by declining another 20%.

The Trade Desk is one of the world's leading adtech companies. Its software platform helps match advertisers with their ideal audience for advertising campaigns across digital media. The company has thrived as an alternative to Meta Platforms and Alphabet, industry juggernauts that dominate and tightly control advertising on social media and search.

Despite its downfall, the stock has still outperformed the broader market over its lifetime. Should you buy The Trade Desk? Or is this ongoing slump a flashing warning sign?

Image source: Getty Images.

Stocks don't typically decline this much for no reason

Unfortunately, The Trade Desk's decline isn't a fluke. The truth is that multiple factors have contributed to the stock's downfall.

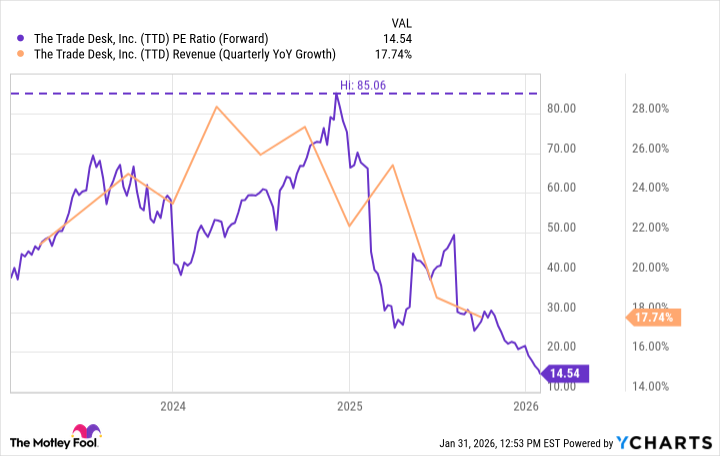

For starters, The Trade Desk was one of Wall Street's hottest stocks at one point, with a sky-high valuation that was difficult to sustain. At its peak in late 2024, The Trade Desk traded at 85 times its forward earnings estimates. If it weren't for that, the stock probably wouldn't have plummeted as it has.

TTD PE Ratio (Forward) data by YCharts. PE Ratio = price-to-earnings ratio. YoY = year over year.

Then, the competitive landscape heated up throughout 2025. Amazon has become an emerging heavyweight in digital advertising, launching a competing platform and partnering with Netflix for its ad-supported membership tier. The Trade Desk's revenue growth has slowed for several quarters now, an awful development for an expensive growth stock.

The Trade Desk is still struggling to regain Wall Street's confidence. It recently fired its new chief financial officer after just months on the job, which hasn't helped.

NASDAQ: TTD

Key Data Points

Sometimes, the pendulum swings too far in one direction

After the stock became too expensive, shares appear too cheap. The Trade Desk has a strong reputation as an industry leader and transitioned to Kokai, an improved, artificial intelligence-capable technology platform in 2023.

The business is also very profitable, and analysts estimate that The Trade Desk will grow earnings by 20% annually over the next three to five years. The stock trading at under 15 times forward earnings estimates resembles a company in an existential crisis, and it's hard to make that leap given the strong anticipated earnings growth ahead.

With one strong quarter, Wall Street could quickly reassess the stock's valuation favorably. That makes The Trade Desk a compelling rebound candidate worth considering.