Apollo Global Management (APO 5.13%) is a leading asset manager and retirement services provider. It's the largest alternative credit manager and a leader in U.S. annuity sales. These businesses have driven robust earnings growth over the past few years.

The alternative investments leader expects to report its fourth-quarter and full-year financial results on Feb. 9. Here's a look at whether you should buy the financial stock before that date.

Image source: Getty Images.

What happened the last time Apollo reported earnings?

Apollo Global Management reported its third-quarter earnings on Nov. 4. The company reported $1.7 billion, or $2.82 per share, of net income. That was up from $787 million, or $1.30 per share, in the year-ago period.

The company posted record quarterly fee-related earnings (FRE) of $652 million, driven by strong growth in third-party management fees and capital solution fees. The company also delivered near-record quarterly spread-related earnings (SRE) of $871 million, driven by strong organic growth.

NYSE: APO

Key Data Points

Apollo also delivered a record quarter of origination activity at $75 billion. Meanwhile, its global wealth platform had a strong quarter, driven by the momentum of its signature semi-liquid and fixed income replacement-focused products.

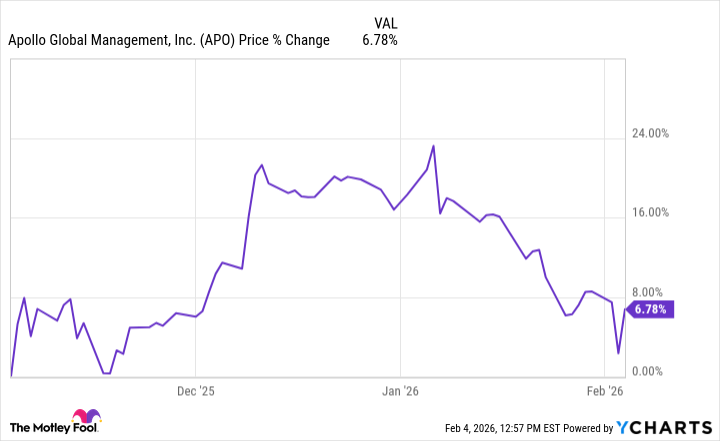

That strong showing initially drove up shares of Apollo:

As the chart shows, the company's stock popped 8% after it reported earnings. However, it has proven volatile since then, initially giving back those gains before rallying even higher, only to give most of those gains back as well.

What to expect this quarter?

Apollo's management team provided some guidance for the fourth quarter on its third-quarter conference call. Co-founder and CEO Marc Rowan estimated that the company's SRE will be around $880 million in the fourth quarter. That would increase its full-year total to nearly $3.5 billion, up 8% year-over-year and above the mid-single digit target it previously provided.

Meanwhile, the company provided a very optimistic initial outlook for 2026. It expects to deliver 20%+ growth in fee-related earnings. Additionally, it anticipates delivering 10% SRE growth in the coming year. Apollo Global expects to deliver similar average annual growth rates through 2029.

The company has strong confidence in its outlook, driven by embedded growth from previously closed investment funds and its strong business momentum. That diminishes the likelihood that the company will miss expectations and sell-off following its earnings.

It might be wise to buy before Feb. 9

Apollo Global Management will likely report strong fourth-quarter results on Feb. 9. The last time that happened, the stock spiked. While shares have been volatile since then, they're still above where they were when the company last reported earnings. Given its recent trading history and the strong growth the company sees ahead, buying shares before Apollo reports earnings might be a smart move.