Breakfast News: Apple Launches Liquid Glass

June 10, 2025

| Monday's Markets |

|---|

| S&P 500 6,006 (+0.09%) |

| Nasdaq 19,591 (+0.31%) |

| Dow 42,762 (-0%) |

| Bitcoin $108,632 (+2.17%) |

Source: Image Created by Jester AI.

1. Apple Goes Large on Changes, Light on AI

Apple (AAPL +0.87%) revealed the most sweeping software design in its history, but lacked the kind of AI breakthroughs investors had been hoping for at its Worldwide Developer Conference. History indicates the resulting stock movements might come over the following week. For example, 2017 saw a muted one-day move, but a 5.7% drop in the following week. In 2019, the stock moved 3.7% higher in one day but in excess of 10% in the week after WWDC.

- "Expressive. Delightful. But still instantly familiar": CEO Tim Cook introduced Liquid Glass, the new design language for iOS26, designed to freshen up app icons and widgets. The short-term reaction from users has been mixed, with some calling it impressive while others cite the interface being hard to read.

- "This work needed more time to reach our high quality bar": Craig Federighi, SVP of software engineering, spoke about the absence of a more AI-powered Siri product, stating more news on other AI functions would be released in the coming year.

2. Meta Pushes for New Superintelligence Group

Meta Platforms (META 1.31%) CEO Mark Zuckerberg is prioritizing recruiting a new team of AI experts focused on artificial general intelligence (AGI), believing machines can perform as well as humans at many tasks.

- 50-person team to sit near to Zuckerberg: After falling behind rivals in the first stage of the AI race, Zuckerberg has been personally recruiting for the new team. The CEO's reported goal is to beat other tech companies to reach AGI, weaving it into the full Meta suite of products.

- Tying in Meta's largest external investment to date: Scale AI founder Alexander Wang is expected to join the team, as part of the mutli-billion dollar investment Meta are part of, with one of the largest private company funding events of all time.

3. AI Capex Spend Highlights Amazon's Priority

Amazon (AMZN 5.49%) announced a $20 billion investment in data center infrastructure in Pennsylvania, underscoring a continued commitment to support demand for generative AI technology.

- 1,250 high-skilled tech jobs created: One of the two data center complexes is being constructed alongside a nuclear power plant, in a move highlighting the importance of accessing such output for powering the servers and equipment.

- "We don't think that there's going to be one model to rule them all": Dave Brown, VP of compute and networking at Amazon Web Services, said he isn't betting on one AI model winning the race. Rather, Amazon's aiming to offer customers a buffet of models to choose from.

4. CASY and PLUG Move +10% Higher in Early Trading

Stock Advisor recommendation Casey's General Stores (CASY +1.25%) rocketed over 10% higher after the closing bell thanks to double-digit percentage growth in both revenue and earnings per share versus last year.

- "Another great example of how our differentiated business model coupled with a great team leads to outstanding results": CEO Dan Rebellas noted the benefit from rising same-store sales, as well as the fuel division growing market share. It expects to open a further 80 stores in the year ahead.

- New facility backed by the local Government: Plug Power (PLUG +11.56%) closed 25.88% higher in regular trading, and up almost 15% more following the market close after announcing a strategic collaboration with an Australian company for a new $5.5 billion hydrogen fuel electrolyzer plant in Uzbekistan.

5. Your Take

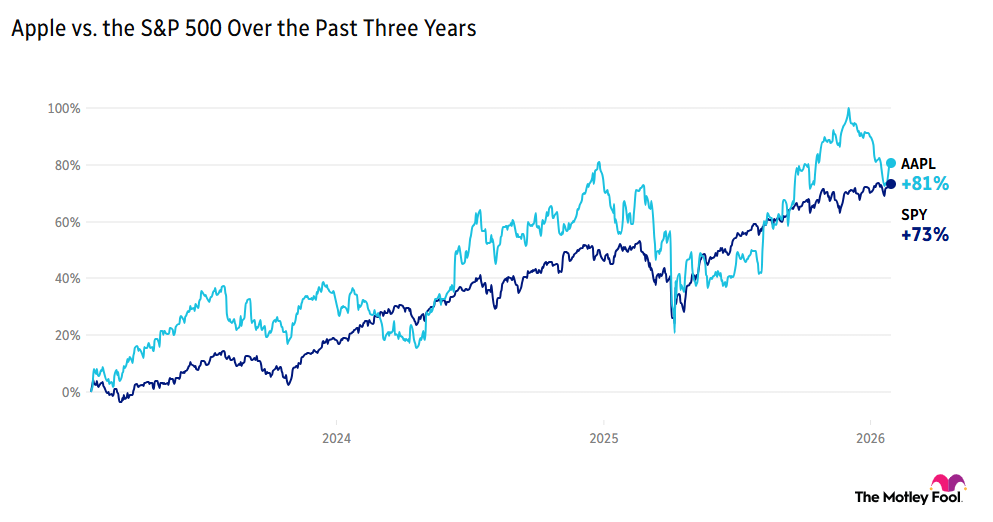

Apple has beaten the S&P 500 by over 3,500% since it was first recommended in Stock Advisor in 2008. Will Tim Cook's philosophy of being not first, but best, prove true for its forays into AI? Debate with friends and family, or become a member to hear what your fellow Fools are saying.