Breakfast News: SBUX Eyes 2026 Revival

July 30, 2025

| S&P 500 6,371 (-0.3%) |

|

| Nasdaq 21,098 (-0.38%) |

|

| Dow 44,633 (-0.46%) |

|

| Bitcoin $117,393 (-0.36%) |

|

Source: Image created by Jester AI.

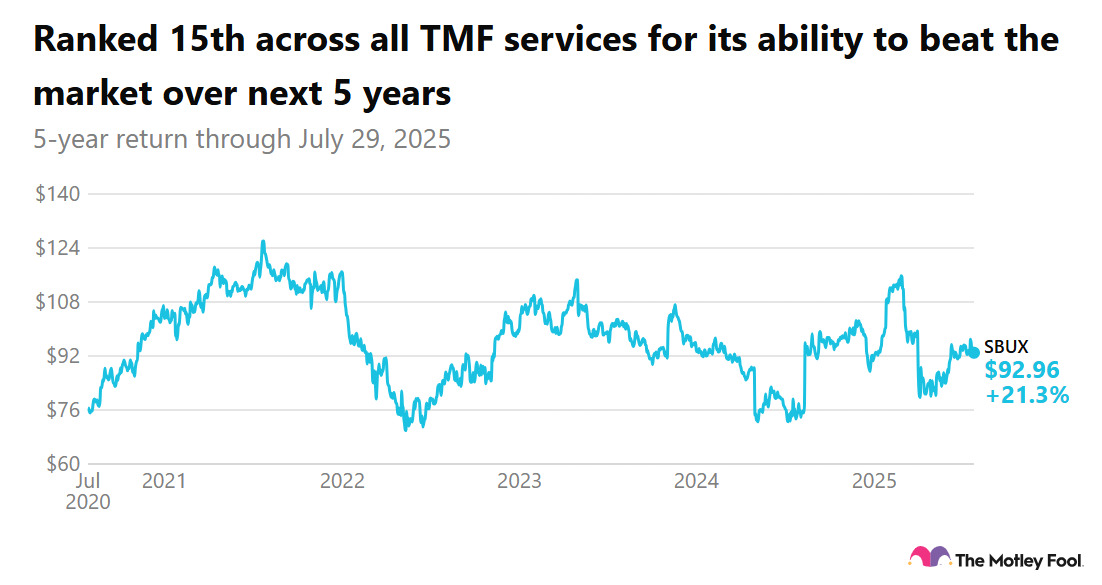

1. Starbucks Pops 4% Despite Sales Drop

Starbucks (SBUX -1.56%) moved higher in pre-market trading after Q3 revenue came in better than expected. Same-store sales fell for the sixth quarter in a row, but less than feared at 2%. CEO Brian Niccol warned we probably won't see real success until 2026.

- Recommended in Stock Advisor earlier this month: Starbucks will close or convert no-seating pickup-only outlets -- only around 90 in the U.S. -- saying they "lack warmth." Of the 1,000 U.S. stores marked for revamp by next year, some will replace seats previously removed.

- "Pricing will be a part of our business model": Niccol said he wants pricing changes used as little as possible, prioritizing "welcoming coffeehouses, and the human connection."

2. MSFT, META to Conclude Mag 7 Earnings

Microsoft (MSFT -0.85%) will post fourth-quarter earnings after the closing bell, along with a Q2 update from Meta Platforms (META -0.53%). Focus will be on AI growth, with both investing heavily this year.

- "Next phase of monetization on the AI front": Wedbush says Microsoft's Azure platform – developed in partnership with OpenAI – could help the stock to $600 (from $512.5 today). Azure and related cloud services revenue climbed 33% last quarter.

- "30% more advertisers are using AI creative tools": Meta CEO Mark Zuckerberg said AI-based advertising was already producing results as Q1 revenue and earnings climbed, and last week announced "hundreds of billions of dollars" spend on new multi-gigawatt data centers.

3. Novo Nordisk: What We Think Now

Emily Flippen

Novo Nordisk (NVO -0.89%) shares sank almost 22% yesterday after management updated guidance for the full year, lowering both sales and operating margin expectations, in large part due to increased competition for its GLP-1-based weight loss medication in the United States.

- The Stock Advisor team is not encouraging members to sell shares today: Despite these headwinds and operational missteps, Novo Nordisk remains an active buy recommendation on the scorecard.

- What the team is watching to ensure the investment thesis remains intact: Compounding litigation, expanding partnerships and DTC offerings, plus development of oral formulations.

4. Acquisition Rumors Drive Market Moves

The Wall Street Journal reports Rule Breakers recommendation Palo Alto Networks (PANW 1.58%) could finalize a deal to acquire cybersecurity specialist CyberArk (CYBR 1.65%) as early as this week, in its bid to strengthen defense against AI threats. Palo Alto is down 5% pre-market, with CyberArk up 13%.

- Moneyball Superscore of 57: Takeover speculation has spread to Okta (OKTA -0.04%), up a couple of percent since a Betaville "Uncooked" alert yesterday claimed a larger tech rival is planning an approach.

- Business travel merger back on: The Department of Justice, meanwhile, will not block a bid from Global Business Travel Group (GBTG -0.13%) for CWT. It had tried to stop the deal before President Trump took office, fearing it would eliminate competition.

5. Your Take

Pick a stock from your portfolio. Now, think about which company you think it could realistically acquire to improve your stock's chance of market-beating performance over the long term. Discuss with friends and family, or become a member to hear what your fellow Fools are saying.