Breakfast News: MELI Falls on Margin Miss

August 5, 2025

| S&P 500 6,330 (+1.47%) |

|

| Nasdaq 21,054 (+1.95%) |

|

| Dow 44,174 (+1.34%) |

|

| Bitcoin $114,747 (+0.48%) |

|

Source: Image Created by Jester AI.

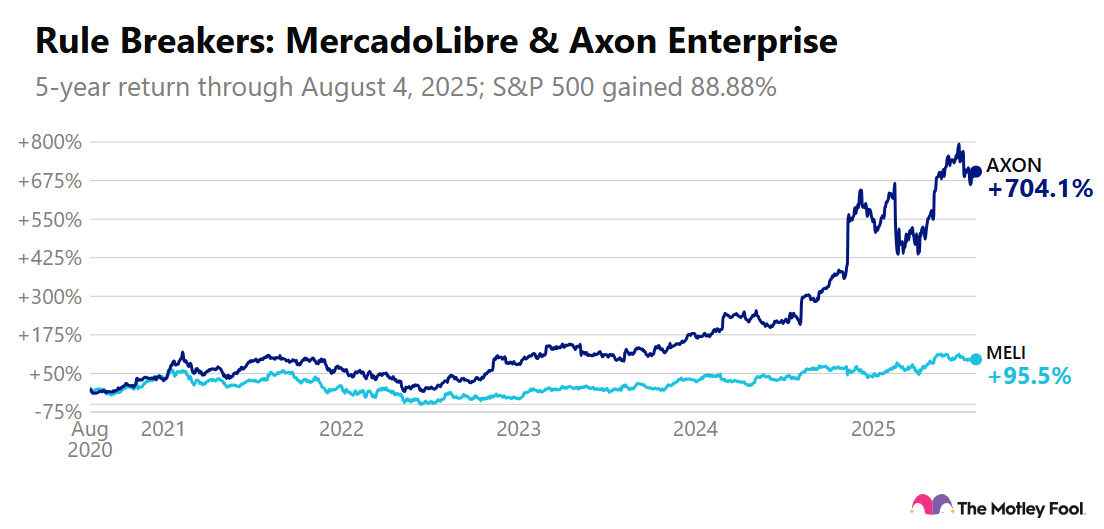

1. Mixed Results for Rule Breakers Pair

MercadoLibre (MELI 3.34%) and Axon Enterprise (AXON 1.25%), both introduced to the Fooliverse as Rule Breakers recommendations, posted second-quarter results after yesterday's closing bell. Axon stock gained over 6% pre-market, with MercadoLibre down more than 5%.

- Biggest in Latin America by market cap: MercadoLibre missed analyst expectations for net income, down 1.5% year over year to $523 million, as more generous free shipping led to a lower EBIT margin of 12.2%, from 14.3% a year prior.

- FY revenue guidance lifted to $2.65 billion to $2.73 billion: Axon, meanwhile, posted a 33% year-over-year rise in Q2 revenue to $669 million, thanks to growing demand for software services, TASER, and body camera technology.

2. Wall Street Warning

Concern is growing among market commentators we could be in for a correction, as stocks have soared in 2025 despite souring economic indicators – the latest inflation and job growth prints both disappointed amid trade war concerns.

- S&P 500 14-day relative strength index touches 76: On that metric, stocks are more expensive than they've been since just before last summer's peak. Over 70 is often seen as overheated.

- "We're buyers of dips": Mike Wilson, strategist at Morgan Stanley (MS -1.03%), said he expects a "modest pullback in the third quarter" of up to 10%, but is still upbeat on long-term earnings strength. Evercore's (EVR 0.94%) Julian Emanuel fears a dip of up to 15%.

3. VRTX, KD, HIMS in Big Swings After Earnings

Vertex Pharmaceuticals (VRTX 1.18%) posted adjusted Q2 earnings of $4.52 per share yesterday, ahead of estimates. But the stock fell 14% overnight as the biotech company reported disappointing Phase 2 results for pain drug VX-993 and will not move it further.

- Down 12% after hours: Hidden Gems rec Kyndryl Holdings (KD 1.67%) posted $3.74 billion Q2 revenue after market close, short of analysts' estimated $3.80 billion with sales for the IT services company flat year over year.

- Superscore of 76 in Moneyball database: Hims & Hers (HIMS 2.84%) missed on revenue, even with a 73% year-over-year rise to $544.8 million. EBITDA of $82.2 million soared above $39.3 million this time last year, but the stock fell 15% after hours.

4. Q2 Updates From AMD, ANET, AMGN After Close

Advanced Micro Devices (AMD 3.45%) stock is up 46% year to date following Q1 revenue and earnings beats. Watch for news on the latest Instinct MI350 series of AI chips, designed to compete with Nvidia (NVDA 0.88%).

- Optimized for hyperscale cloud networks: Arista Networks (ANET -3.15%) is a preferred network switch supplier for AI giants like Microsoft (MSFT -0.77%) and Meta Platforms (META 1.30%). The company expects a 24% revenue rise year over year in the quarter.

- Beaten earnings estimates in the past four quarters: Chronic disease management specialist Amgen (AMGN -0.32%) saw a performance upturn in Q1 on the back of strong global demand, with Wall Street expecting $5.28 per share from $8.91 billion revenue this time.

5. Your Take

Which of the following Foolish stocks, all down over 30% since being recommended in Stock Advisor over the past 2 years, has the best chance of recovering and beating the market over the next 5 years: Lululemon (LULU 0.35%), Novo Nordisk (NVO -0.73%), Atlassian (TEAM 0.92%), or e.l.f. Beauty (ELF 0.53%)? Debate with friends and family, or become a member to hear what your fellow Fools are saying.