Breakfast News: AI Boom Lifts ASML

October 15, 2025

| Tuesday's Markets |

|---|

| S&P 500 6,644 (-0.16%) |

| Nasdaq 22,522 (-0.76%) |

| Dow 46,270 (+0.44%) |

| Bitcoin $113,034 (-2.41%) |

1. ASML Pops, KARO Drops

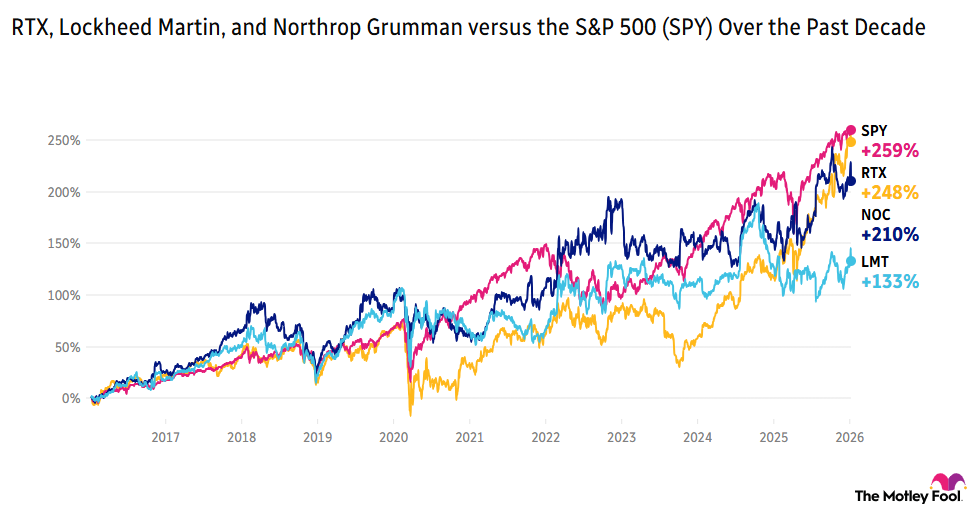

ASML Holding (ASML +5.38%) gained 4% in pre-market trading, on the back of mixed third-quarter results. Earnings beat expectations but revenue fell slightly short. The company predicted further strong growth from the booming AI sector, but warned of likely falls in Chinese demand next year.

- "I'm preparing for the pendulum swing back toward international outperformance": Motley Fool analyst Loren Horst noted "investors often miss out on key global companies because they're excluded from the major indexes," highlighting ASML as "the most valuable example on the Stock Advisor scorecard."

- Total subscribers up 15% to 2.5 million: Karooooo (KARO +1.52%), meanwhile, popped 7.4% by yesterday's close in anticipation of Q2 results, which saw the Singapore-based vehicle telematics specialist post a 20% rise in subscription revenue year over year. But that missed expectations as growth slows, and the stock fell 11% before the market opened today.

2. Stellantis Invests $13B in U.S.

Stellantis (STLA 1.48%) has announced a $13 billion investment in auto manufacturing in the U.S., after a raft of import tariffs have caused costs of importing from Mexico, Canada, and Europe to climb. The plan should raise U.S. production 50% over the next four years.

- "Accelerating growth in the U.S. has been a top priority since my first day": CEO Antonio Filosa spoke of "the single largest [investment] in the company's history," which will see new production coming to Illinois, Ohio, Michigan, and Indiana.

- Illinois facility to reopen: The Belvidere Assembly Plant closed in 2023 after the Jeep Cherokee was cancelled. But $600 million is earmarked for its reopening to manufacture a new Cherokee along with Jeep Compass SUVs.

3. Key Earnings to Watch Today

Dividend Investor rec Prologis (PLD +0.41%) is set to deliver Q3 earnings before today's opening bell. The real estate logistics company saw Q2 beat top- and bottom-line estimates and raised full-year guidance. Hopes for interest rate cuts could boost the real estate business.

- Superscore of 78 on our Moneyball database: Auto insurance specialist Progressive (PGR 0.96%) will also post Q3 results this morning, with analysts predicting a 15% revenue rise from the same quarter last year.

- Q2 earnings up 10.5% year over year: Abbott Laboratories (ABT 0.68%) reports Q3 before market open, after narrowly beating revenue expectations in Q2 with a 7.4% rise year over year. Full-year guidance suggested 7.5% to 8% organic sales growth (excluding Covid-related sales).

4. Your Take

Learning is a continuous journey. Think about a stock you sold too early, and the lessons you've learned since. Discuss with friends and family, or become a member to hear what your fellow Fools are saying.