Breakfast News: Netflix Sinks on Q3 Miss

October 22, 2025

| Tuesday's Markets |

|---|

| S&P 500 6,735 (+0%) |

| Nasdaq 22,954 (-0.16%) |

| Dow 46,925 (+0.47%) |

| Bitcoin $111,426 (+0.33%) |

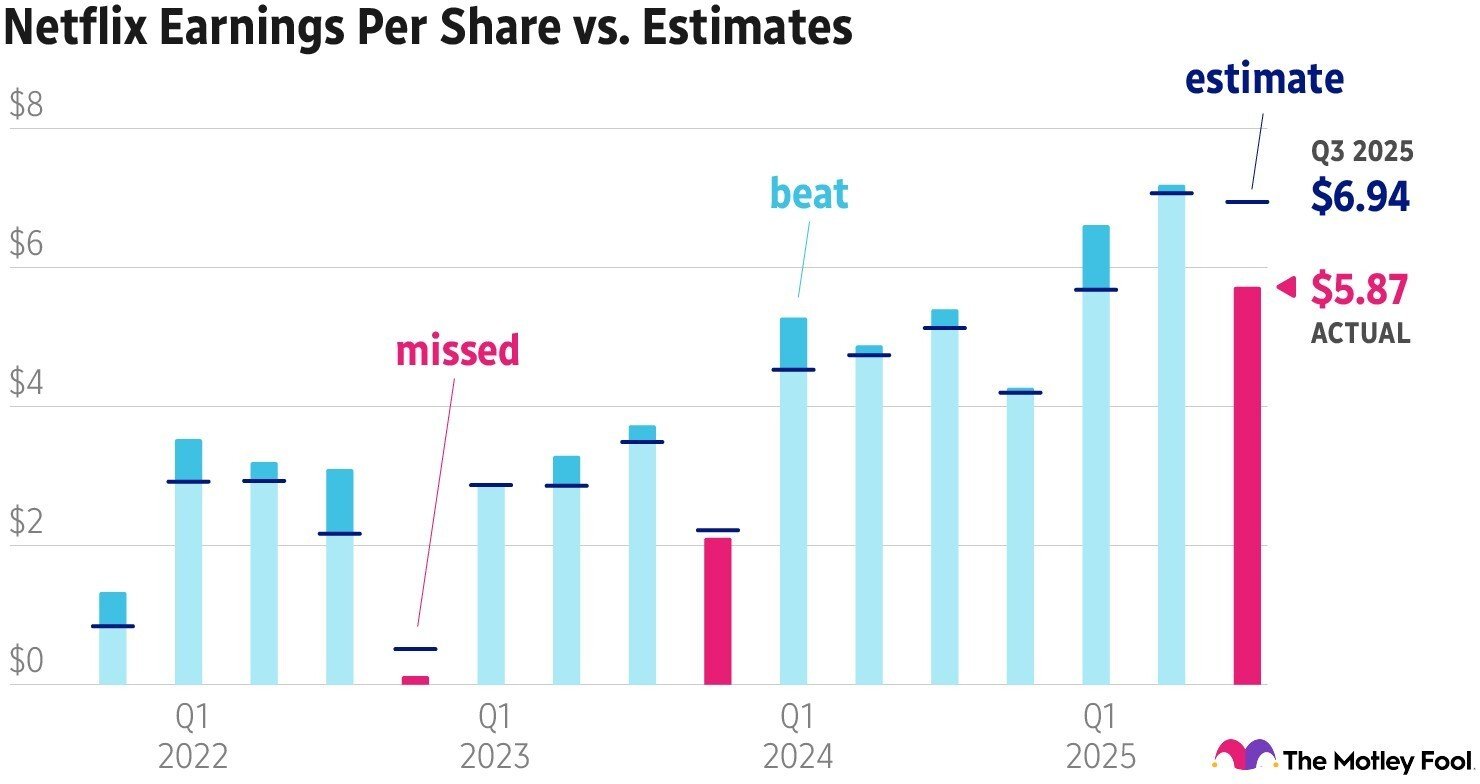

1. Netflix Earnings Fall Short

Longtime Stock Advisor recommendation Netflix (NFLX 3.36%) sank 6% overnight after posting third-quarter revenue and earnings misses after yesterday's close. The quarter's 28% operating margin fell below the expected 31.5%, due to an ongoing tax dispute with authorities in Brazil.

- "Last quarter, leadership noted they continue to expect to roughly double advertising revenue in 2025": Motley Fool analyst Jason Moser pointed to "the advertising opportunity and the company's foray into live content" as two of the key attractions. Netflix said it's "increasingly confident" in its full-year ads outlook.

- "Engagement remains healthy": Live content was boosted by September's Canelo vs. Crawford boxing match, which Netflix described as "the most-viewed men's championship fight this century" with over 41 million global viewers.

2. ISRG Pops, TXN and CME Drop

Rule Breakers rec Intuitive Surgical (ISRG 3.56%) popped 16% in early trading, on the back of a 30% rise in Q3 reported EPS year over year. Total worldwide procedures using the company's minimally invasive surgery techniques grew 20% – with Da Vinci procedures up 19% and Ion procedures growing 52%.

- Revenue up 14% year over year: Texas Instruments (TXN +0.09%) slipped 9% pre-market, even though Q3 came in ahead of expectations. The hit came from a disappointing Q4 earnings outlook, with an EPS range of $1.13 to $1.39 falling below Wall Street estimates.

- “We achieved our second-highest third-quarter ADV”: CME Group (CME +0.98%) reported a rise in Q3 average daily volume this morning, resulting in $1.5 billion revenue for the quarter, though CEO Terry Duffy spoke of “ongoing uncertainty in Q3.” The stock fell 1.25% in pre-market trading in response.

3. Anthropic in Google Talks

Anthropic – the artificial intelligence start-up behind the Claude chatbot – is in talks with Alphabet's (GOOG 1.22%) Google to provide cloud computing services valued "in the high tens of billions of dollars," Bloomberg reported.

- Machine-learning acceleration: The deal is expected to provide Anthropic with the use of Google's tensor processing units, which are designed to speed up the AI training workload.

- $26 billion revenue by 2026?: An earlier Reuters report claimed Anthropic is set to meet its goal of $9 billion annualized revenue by the end of this year, with a target range for 2026 starting at $20 billion.

4. Novo Board in Turmoil

Novo Nordisk (NVO 14.75%) – the company behind weight-loss drug Wegovy and diabetes treatment Ozempic – announced a board shakeup yesterday. All of the company's independent directors, including the chairman, will leave in November.

- "It was impossible to reach an agreement": Novo Nordisk Foundation chair Lars Rebien Sørensen said the foundation – which controls 70% of the stockholder vote – wanted a "comprehensive renewal" of the existing board, leading to the falling out.

- Stock down 60% since July 2024: Sørensen criticized the board's failure to respond to changes in the market as the company failed to meet demand – leading to the rise of legal Wegovy alternatives, and helping boost rival Eli Lilly's (LLY 3.90%) Zepbound.

5. Your Take

A little over a year ago, we asked the following question: What is your dumbest investment, and why?

Share with friends and family – even if your previous answer might have changed or stayed the same! – or become a member to hear what your fellow Fools are saying.