Breakfast News: DUOL Misses The Mark

November 6, 2025

| Wednesday's Markets |

|---|

| S&P 500 6,796 (+0.37%) |

| Nasdaq 23,500 (+0.65%) |

| Dow 47,311 (+0.48%) |

| Bitcoin $103,670 (+4.51%) |

1. Mixed Results for Rule Breakers Recs

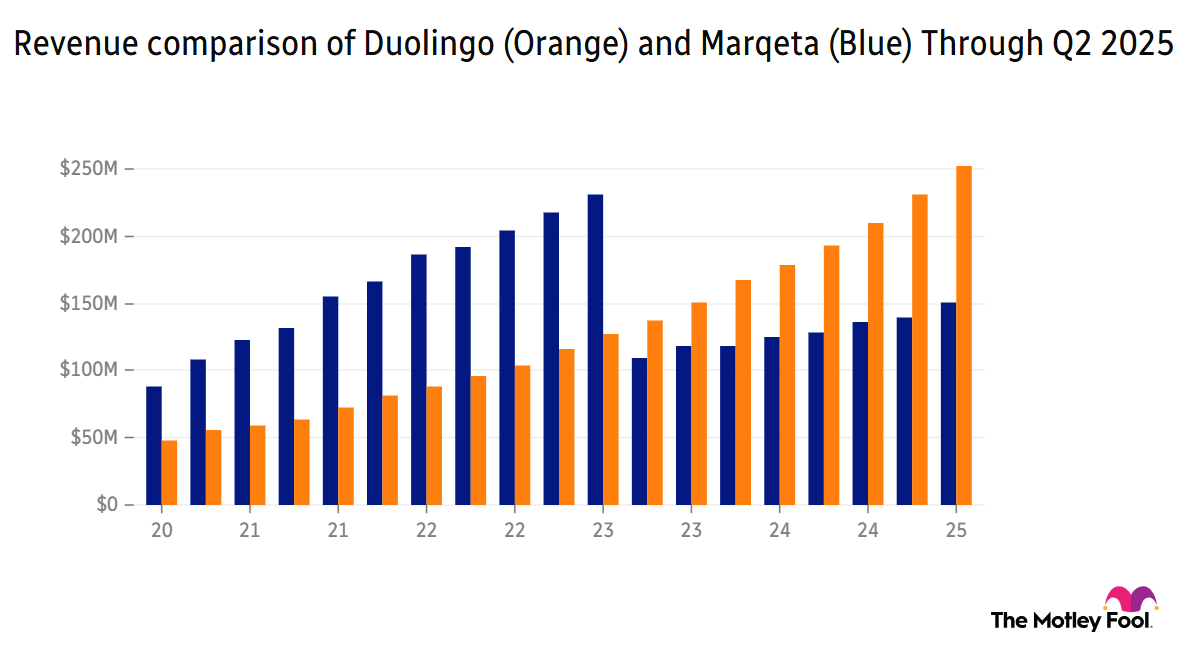

Duolingo (DUOL +6.98%) fell over 20% after the closing bell despite growing quarterly revenue 41%, as investors' high bar of expectations fell short of being met, with daily active users missing expectations along with underwhelming forecasts for the coming quarter.

- "One of the core theses for investing in Duolingo – its go-to-market efficiency – remains alive and well": Fool analyst Tim Beyers said "I'd be more concerned if revenue growth had fallen short", adding "monthly active users grew 20% over the same period. Daily actives grew 36%, and paid subscribers grew 34%. This is a healthy business."

- "By far, the most significant factor driving our outperformance is the underlying business growth": Marqeta (MQ +0.00%) popped over 7% when the market closed thanks to quarterly results revealing a 28% jump in revenue, with CEO Mike Milotich crediting this to increased demand from growing clients.

2. DASH and PAYC Drop While SEZL Soars

DoorDash (DASH +0.31%) is down over 9% in pre-market trading with results showing the recent acquisition of Deliveroo won't deliver as strong profits as expected. The original Stock Advisor recommendation in 2023 is beating the market by 112%, with 2024's rerec ahead of the S&P 500 by 48%.

- Double-digit organic recurring revenue growth not enough to impress: Hidden Gems rec Paycom (PAYC 2.17%) is also down close to 10% ahead of the market open, with adjusted earnings per share missing expectations and no upgrade to the full-year outlook.

- Gross merchandise volume (GMV) crossed the $1 billion mark for the first time: Sezzle (SEZL +4.68%) jumped over 9% after the market closed as the business saw quarterly gains in all major financial metrics, with management raising profit forecasts as a result.

3. PFE Reportedly Matches Novo Bid for Metsera

The FT reports Pfizer (PFE 0.04%) has matched Novo Nordisk's (NVO +3.59%) bid for Metsera (MTSR +0.00%) for up to $10 billion, as the battle for a key player in the weight-loss drug market heats up.

- Fighting over a forecasted $100 billion market by 2030: Novo Nordisk is already a dominant player in the obesity drug space, with Pfizer keen to buy Metsera as a way to play catch up in the growing market.

- Metsera stock up 13.6% in the past week: Novo Nordisk has no hard deadline to submit a counterbid, but if it does, Pfizer must either match the bid or pass on the deal within two days, setting up a tense few weeks ahead.

4. Next Up: Tech and Travel Earnings

The Trade Desk (TTD 0.06%) reports after the market closes, with customer retention in focus after the 95% figure last quarter, alongside keeping a lid on platform operating costs.

- Previous guidance called for slower growth and margin compression: Airbnb (ABNB 1.50%) should release earnings following the closing bell with more clarity expected on investment in international expansion.

- High-growth SaaS players in focus: Datadog (DDOG 0.36%) posted strong results before the market opened with revenue increasing 28%, while Doximity (DOCS 0.14%) reports after the trading day finishes, with both cloud-based platforms focused on growing recurring revenue.

5. Buy, Sell, or Hold?

e.l.f. Beauty (ELF +4.33%), HubSpot (HUBS 2.61%), and Fortinet (FTNT 0.36%) were down markedly in after-hours trading following results – over 20%, 13%, and 12%, respectively.

If your portfolio comprised just these three companies, and you bought each of them at the start of the year with the same amount of money, and had to buy more shares in one, completely close your position in another, and hold the final stock, what are you choosing to do and why? Become a member to hear what your fellow Fools are saying!