Breakfast News: BTC Enjoys Holiday Boost

November 28, 2025

| Wednesday's Markets |

|---|

| S&P 500 6,813 (+0.69%) |

| Nasdaq 23,215 (+0.82%) |

| Dow 47,427 (+0.67%) |

| Bitcoin $90,245 (+3.50%) |

1. Bitcoin Nears $92K on Risk Recovery

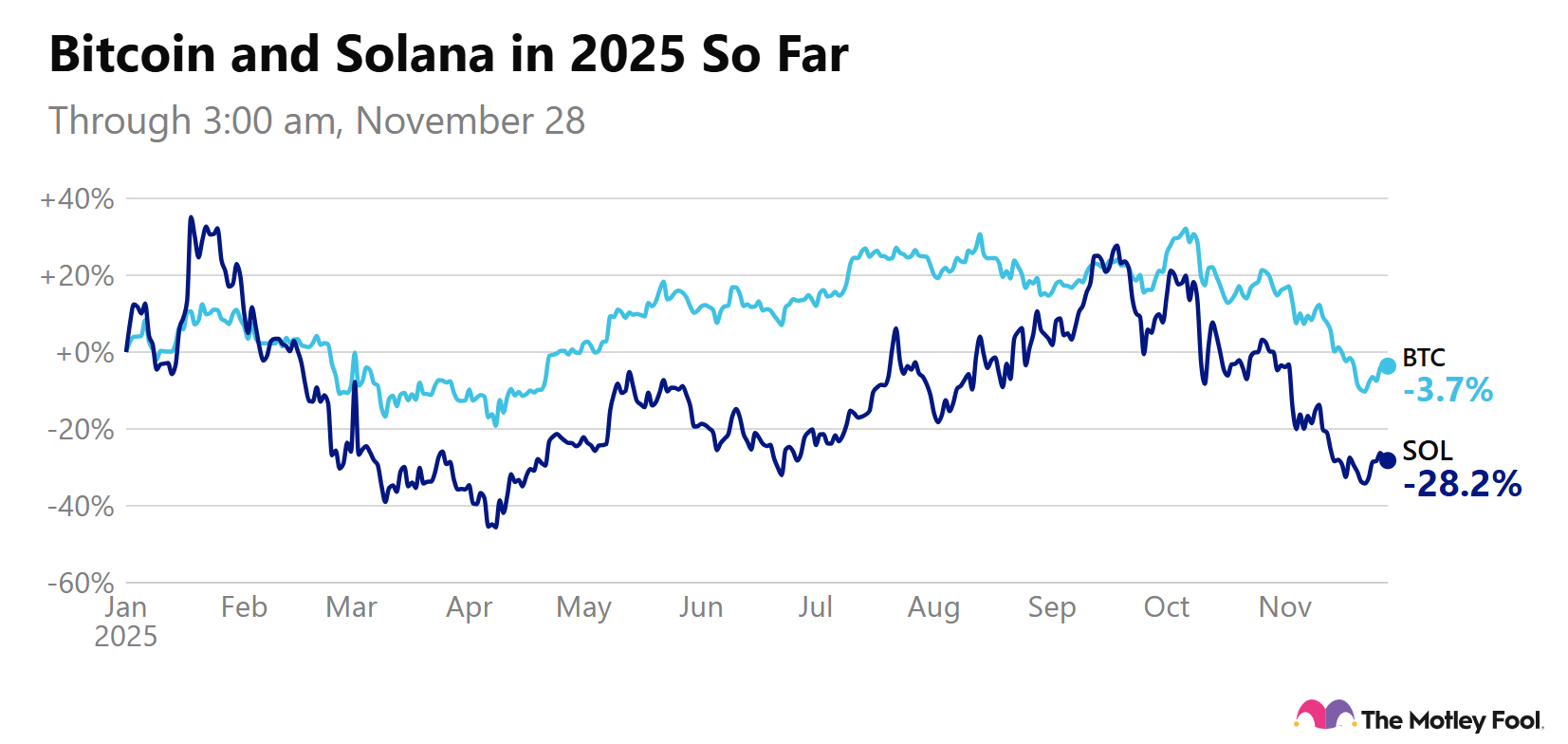

Bitcoin (BTC 0.66%) posted its fourth gain in five days to trade just shy of $92k, with the improved sentiment over Thanksgiving – when traditional markets are closed – offering a positive signal for stocks for the final trading day of November.

- Bitcoin is still down nearly 17% this month in the worst performance since February: Other coins including Ether (ETH 1.06%) and Solana (SOL 2.27%) jumped over 3.5% this week, but the size of the fall in November leaves room for a continued bounce. Ether currently has a Superscore of 83 in our Hidden Gems Cryptoball database.

- Nasdaq on track for best holiday week since 2008: The Nasdaq is more closely aligned with crypto markets due to its exposure to riskier stocks, with the index up more than 5% in the past four days.

2. CME Halts Trading on Data Center Fail

Stock Advisor recommendation CME Group (CME 0.33%) experienced a halt in trading on futures and options contracts for several hours on Friday morning due to a data center outage, in a wide range of markets ranging from stocks to oil. The stock fell over 2% in pre-market trading in response.

- "Due to a cooling issue at CyrusOne data centers, our markets are currently halted": Millions of contracts tracking the S&P 500, the Dow Jones and the Nasdaq trade every weekday on the CME, with the loss of a major liquidity source heightening the risk of a large move if a big event occurs.

- CME "has been a total-return beast when you add in that dividend for investors who have reinvested it": Back in July, Fool analyst Asit Sharma said he thinks the stock "can at least outperform the market over the next few years based on this very basic pattern of volume from trading and generating a lot of free cash flow."

3. Retailers Vie for K-Beauty Surge

Beauty retailers including Ulta Beauty (ULTA +0.57%) and Walmart (WMT 0.10%) are rushing to take advantage of rising interest in Korean cosmetics, known as K-beauty, with U.S. sales expected to exceed $2 billion in 2025 in a 37% increase versus last year.

- South Korea became the leading exporter of cosmetics to the U.S. in H1 2025: According to data from the South Korean government, shipment value came to $5.5 billion for the period, with facial skin care and hair care products most popular.

- Asian retailers already planning on opening stores in the U.S.: Incumbent companies such as Costco (COST +0.16%) are aiming to take market share from specialist shops and fend off new competition, with a recent expansion to include related products in store.

4. Your Take

This Black Friday, which stock in your portfolio will you actually be shopping at – and does your spending match your conviction as an investor? Discuss with friends and family, or become a member to hear what your fellow Fools are saying.