Breakfast News: ServiceNow Eyes $7B Deal

December 15, 2025

| Friday's Markets |

|---|

| S&P 500 6,827 (-1.07%) |

| Nasdaq 23,195 (-1.69%) |

| Dow 48,458 (-0.51%) |

| Bitcoin $90,212 (-2.98%) |

1. ServiceNow to Acquire Armis?

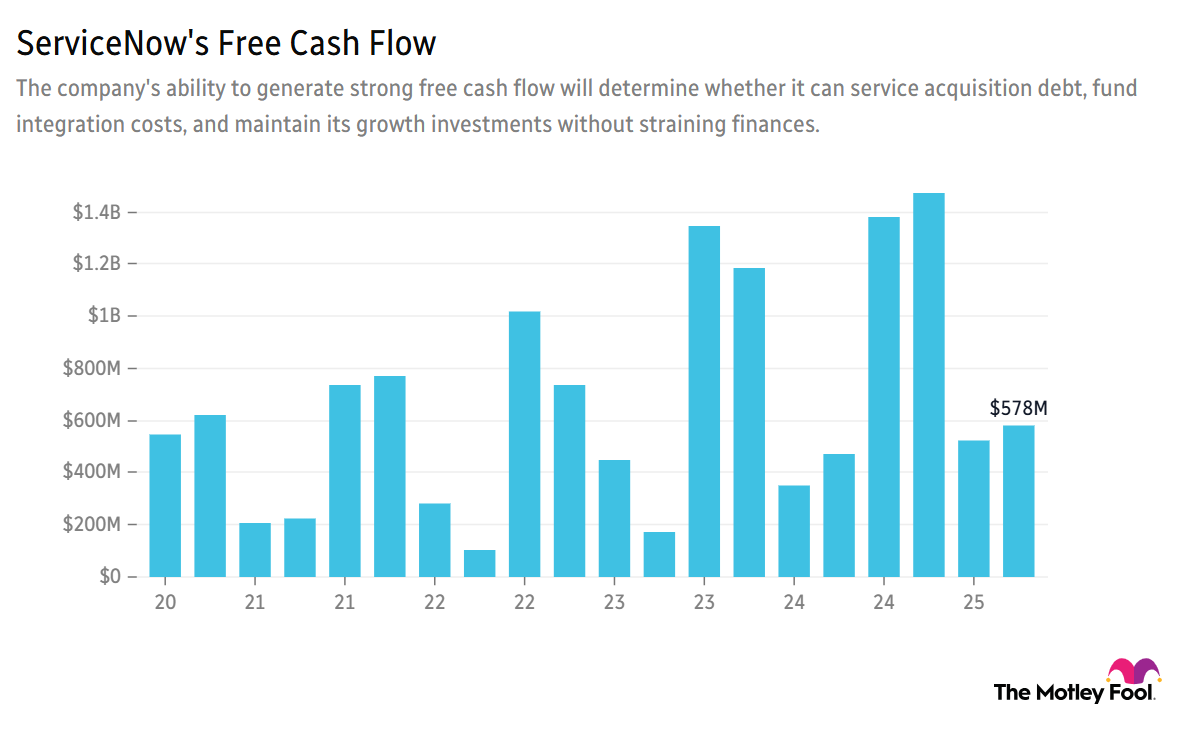

ServiceNow (NOW +3.43%) is poised to buy Armis, a San Francisco-based cybersecurity start-up founded by Israeli military veterans, reports Bloomberg. Potentially valued at up to $7 billion, it would mark the company's largest acquisition to date. It comes after ServiceNow agreed to buy agentic AI developer Moveworks in March for $2.85 billion.

- "Companies like ServiceNow are both talking the talk and seemingly walking the walk": In the summer, TMF chief investment officer Andy Cross said: "Companies that most effectively embrace AI to enhance client and employee experiences and drive efficiencies are likely to strengthen their long-term competitive positions. As we've seen over 30 years of Foolish investing, those kinds of forward-thinking investments have delivered long-term wins for shareholders."

- Heading off IPO plans: In August, Armis CEO Yevgeny Dibrov revealed $300 million in annual recurring revenue, and suggested a public listing was on the cards for 2026.

2. Key Earnings to Watch This Week

Micron Technology (MU +0.52%) will post first-quarter earnings after market close Wednesday, with the stock soaring 122% in the past 12 months. Q4 saw record quarterly revenue of $11.32 billion, boosted by cloud memory and AI data center demand. Management predicted $12.5 billion revenue for the current quarter.

- Superscore of 67 on our Hidden Gems Primary database: Accenture (ACN 1.41%) is due to report Q1 Thursday, following a 7% increase in full-year 2025 revenue. Watch for progress on AI staff training and expansion at the technology consulting specialist. Accenture is currently trailing the S&P 500 by 69% since HG's August 2023 recommendation.

- Year-over-year earnings expected to decline: Thursday's Q2 update from Nike (NKE 0.72%) should cast some light on the sportswear giant's turnaround strategy. The analyst consensus suggests revenue of around $12.2 billion, up modestly from the $11.7 billion reported in Q1.

3. Markets Await Jobs, Inflation Updates

The S&P 500 largely trod water last week, down 0.63%, though futures were up 0.35% this morning. The Nasdaq gave up 1.62%, but at least the Dow Jones gained with a 1.05% rise. Nasdaq futures rose 0.3% in early Monday trading.

- Unemployment rate to reach 4.5%?: The delayed November unemployment report hits the headlines Tuesday, with predictions suggesting 50,000 jobs added in the month – down from 119,000 in September. Economists expect unemployment to tick up from October's 4.4%.

- Watching for further tariff impacts: Thursday brings the latest consumer price index (CPI) print, combining limited October and full November data. CPI year over year is tipped to reach 3.1%, up from September's 3%. Core CPI – excluding volatile items like food and energy – looks set to remain steady at 3%.

4. Most Americans Bullish Despite AI Bubble

60% of Americans are confident AI-focused companies will deliver strong, long-term returns despite AI bubble chatter, according to The Motley Fool's 2026 AI Investor Outlook Report. What's more, 9 in 10 AI investors plan to hold or buy more AI stocks in the next 12 months. The report, which includes further AI data insights and how Motley Fool analyst Asit Sharma is thinking about the next wave of AI investment opportunities, can be found here.

5. Your Take

Elliott Hill has been Nike CEO for more than a year now, with the stock down 12.5% over 12 months, and trailing the S&P 500 by 2% since the May recommendation in Stock Advisor. Bearing in mind that we advise Fools to hold for 5 years or more, what adjective best characterizes your feelings about Hill's turnaround plans so far? Discuss with friends and family, or become a member to hear what your fellow Fools are saying.