On Wednesday, the Federal Reserve released minutes from its June meeting. While much was discussed it can be summarized fairly quickly: The economy is improving slowly, the Fed will end its bond buying program in October, and they discussed -- though coming to no clear conclusion -- when to raise interest rates.

All of which is in line with what Annaly Capital Management (NLY +1.19%) and American Capital Agency (AGNC +1.49%) investors have been hearing for the last several months. We know what's happening now, what will happen soon, and what will likely happen a year or so down the road.

What seems to be missing is the most important question of all: What happens after that?

mREITs aren't new

Eventually, there will be an increase in both short and long-term interest rates. Because rising rates puts pressure on Annaly and American Capital Agency's borrowing costs, as well as lowering the market value of their currently held securities, it creates a less-than-ideal investing scenario.

The problem is we don't know how long the rising rate environment will persist, or how sharp the incline will be. Moreover, considering at just 17 years old Annaly is the oldest of the more popular mREITs it's unclear how they could perform in a prolonged rising rate environment.

Luckily, today's mREITs aren't the first. In fact, they've been around since 1969, rising and falling in a fairly predictable manner for the last 45 years.

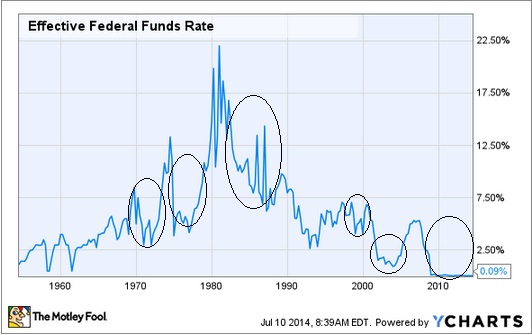

The chart below shows mREIT "hot spots." Throughout mREIT's history, the industry's collective market cap has risen when the federal funds rate -- short-term interest rates set by the Federal Reserve -- has been low or falling, and declined as rates increased. This cycle often starts with the creation of new companies, only for several to eventually fall on their sword, and the cycle starts over again.

mREIT's saving grace

While that sounds pretty bleak, I believe where the mREITs of old may have perished, Annaly and American Capital Agency have a few distinct advantages:

- Hedging techniques

- More aware of risk

- Communication with the Federal Reserve

In 1981, the first interest rate swap – allowing two counter-parties to exchange interest rate payments -- was completed between IBM and the World Bank. Therefore, any mREIT before that point was unable to trade their floating-rate payment for a fixed-rate. By doing so, today's mREITs aren't as susceptible to rising rates increasing borrowing costs at they once were.

However, that doesn't explain why many of the mREITs from the late 1980s and 1990s never made it to today. My belief is, first, that hedging tools were either misused or underutilized. Second, the failing of mREITs during the financial crisis was, in part, due to making heavy bets on risky assets, such as subprime mortgages.

Since the vast majority of Annaly and American Capital Agency's securities are protected against defaults, the risk of failing assets is almost zero. Though, it should be mentioned that Annaly is creating a net lease position – or owning physical real estate. While these assets are not protected against default, equity REITs over the last 40 plus years have been much more consistent than their mREIT brethren.

Finally, today's Federal Reserve has been extremely forthright as to the the inevitability of increasing interest rates. Unlike in the past when rates were increase with less warning, Annaly and American Capital Agency have had time to prepare their portfolios.

The last word

Annaly and American Capital Agency, along with the rest of today's mREITs, may have an advantage over mREITs of old, however, despite this leg-up the future looks far from advantageous.

While I believe that both companies have done what is necessary to navigate this environment, that doesn't mean long-term returns will be attractive. Therefore, I would suggest investors proceed with caution.