To Verizon Communications (VZ -0.36%), 2012 was a year for the record books. The stock set all-time highs again, backed by the richest cash flows the telecom king has ever seen:

VZ Total Return Price data by YCharts.

The telecom sector is booming in general. Verizon and AT&T (T 0.28%) crushed their Dow Jones (^DJI 0.64%) peers this year. Smaller rival Sprint Nextel (S) skyrocketed even higher thanks to a turnaround story based on smartphones and high-speed data connections. Verizon's story is similar, except the company didn't have a near-death experience in 2011, as Sprint did. Instead, the company is building a long-term success story, brick by boring brick. Sprint might be exciting, but Verizon is the kind of reliable performer that builds wealth while helping you sleep at night.

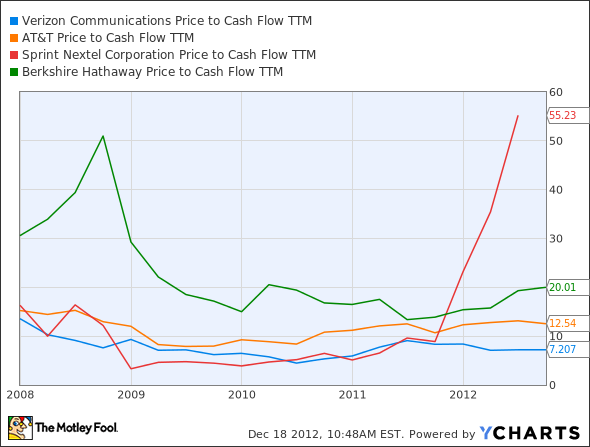

These gains still leave plenty of room for further growth. You pay just $7.20 for every dollar of Verizon's free cash flow. That's the kind of deep discount that makes value investors reach for their wallets. Let's put the ratio in the context of telecom rivals and a familiar value-hound favorite:

VZ Price to Cash Flow TTM data by YCharts.

The wireless industry is not without challenges, of course. The tablet and smartphone gold rush is reaching a more mature stage now, leaving less low-hanging fruit for Verizon and friends. And it's a sector in constant flux. AT&T recently tried and failed to buy out T-Mobile USA. Sprint appears well on its way to a major cash infusion from Japanese peer Softbank -- and a subsequent merger with data network operator Clearwire (NASDAQ: CLWR). T-Mobile found another partner in MetroPCS (TMUS -0.85%). The pack of smaller networks chasing Ma Bell and Big Red just isn't going away.