Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Cabela's (CAB) fit the bill? Let's take a look at what its recent results tell us about its potential for future gains.

What we're looking for

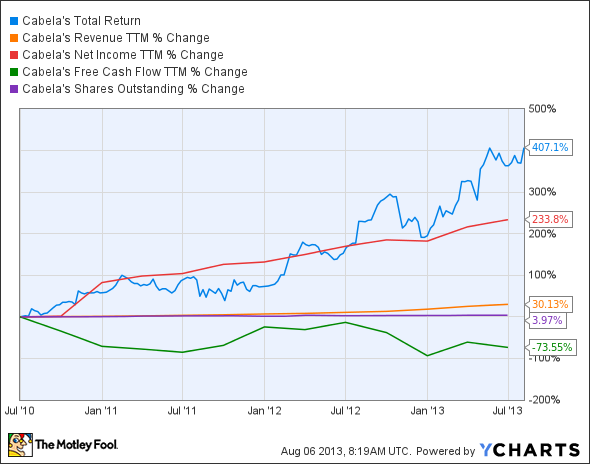

The graphs you're about to see tell Cabela's story, and we'll be grading the quality of that story in several ways:

- Growth: Are profits, margins, and free cash flow all increasing?

- Valuation: Is share price growing in line with earnings per share?

- Opportunities: Is return on equity increasing while debt to equity declines?

- Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's take a look at Cabela's key statistics:

CAB Total Return Price data by YCharts.

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Revenue growth >30% |

30.1% |

Pass |

|

Improving profit margin |

156.5% |

Pass |

|

Free cash flow growth > Net income growth |

(73.6%) vs. 233.8% |

Fail |

|

Improving EPS |

214.9% |

Pass |

|

Stock growth (+ 15%) < EPS growth |

407.1% vs. 214.9% |

Fail |

Source: YCharts. * Period begins at end of Q2 2010.

CAB Return on Equity data by YCharts.

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Improving return on equity |

126.5% |

Pass |

|

Declining debt to equity |

(36.2%) |

Pass |

Source: YCharts. * Period begins at end of Q2 2010.

How we got here and where we're going

Cabela's comes through with flying colors, earning five out of seven possible passing grades, but it tripped on its free cash flow test in a pretty serious way. Despite this weakness, Cabela's shares have surged over the past three years and have hit new peaks since emerging from the global economic crisis. Is this growth sustainable without an uptick in free cash flow? Let's dig a little deeper to find out.

Cabela's beat analyst expectations in its latest quarter, putting further wind in its sails. Revenue and earnings per share both soared by double-digit percentages -- the top line was up 20.7% year over year, and EPS rose 31.9%. The company has been producing strong same-store sales growth, which also grew at a rather ridiculous 24% in the first quarter. Much of Cabela's gains have been on the back of firearms enthusiasts, and there's little reason to expect any serious legislative impediments to such sales in the foreseeable future.

Fool contributor Steve Symington notes that a mild fright regarding the potential for restrictions on gun and ammunition purchases has helped spur demand at Cabela's stores. Consequently, firearms and ammunition prices have bounced abruptly over the past few months. Cabela's supplier Olin (OLN 0.79%), a manufacturer of ammunition, has had a difficult time keeping up with the demand -- but the unexpected smackdown of a new background-check bill calmed the herd enough for Olin's CEO to anticipate a future drop-off in ammo demand, which could easily hit Cabela's bottom line as well.

Cabela's has recently made two separate announcements to open new stores across the U.S. and Canada, adding up to 16 new stores slated for opening over the next two years. Fool contributor Rich Smith notes that two of the stores slated for a 2014 opening will have massive footprints, which will add some heft to the bottom line of this relatively small chain (even after all the openings, it will only have 60 locations). It can be assumed that the company's aggressive expansion will ensure sustainable revenue growth in the near future. On the other hand, it's likely to hinder any gains in free cash flow as it continues to spend on constructing and kitting out new locations.

Putting the pieces together

Today, Cabela's has many of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.