Consolidated Edison (ED 0.56%) reported earnings last week, missing on the top line but making up for it on the bottom line. The dividend stock has dropped off 5.7% in the past three months while Mr. Market has reached all-time highs. Let's take a closer look to see whether Consolidated Edison can still pull profits for your portfolio.

Number crunching

Consolidated Edison sales clocked in at $2.82 billion, 1.7% higher than Q2 2012 and just $30 million shy of analysts' expectations. While revenue didn't quite cut it, the utility pulled through with net profits. Analysts had expected adjusted EPS of $0.57, but the company added an extra two cents per share this past quarter. Unfortunately, the earnings beat still falls below 2012's second-quarter adjusted EPS of $0.61.

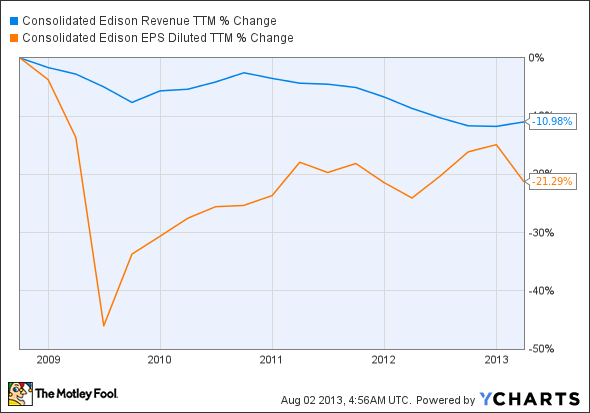

For a peck of perspective, here's how Consolidated Edison's trailing-12-month sales and adjusted EPS have fared over the past five years (essentially since the bottom of the Great Recession). Sales have slumped off 11%, while profit has fallen almost twice as much, down 21.3%.

ED Revenue TTM data by YCharts

Focusing on fundamentals

Although net income beat analyst expectations, Consolidated Edison saw earnings per share drop almost across the board compared with Q2 2012. The biggest dip came from a $0.09 drag on the company's competitive energy businesses. Looking back over the past six months, this generation division's losses are equal to the utility's overall $0.44 seasonally adjusted slump.

Consolidated Edison's unregulated division isn't alone in the dumps. Exelon's (EXC -0.23%) earnings took a dip because of lower-than-expected power prices, and the utility announced an extra $350 million and $400 million reduction off its 2014 and 2015 sales, respectively, as it expects cheap power to persist. Likewise, TECO Energy (NYSE: TE) missed on the bottom line because of cheap coal prices, an energy source that the vertically integrated company relies on along its entire supply chain. With the recent $950 million acquisition of a regulated natural gas utility, TECO seems to be taking its future diversification more seriously.

But unfortunately for Consolidated Edison stock, the trouble didn't stop with unregulated assets. The company's regulated utilities saw a $0.04 drop in EPS for Q2 2013 compared with the same quarter last year. Digging deeper, the numbers reveal that taxes took the largest toll on this division's earnings.

It seem Uncle Sam is through giving utilities a break. While Consolidated Edison had to absorb higher depreciation and property taxes this quarter, Entergy (ETR 0.81%) felt its own earnings squeezed by higher income taxes. Entergy has managed to maintain its 2013 earnings guidance, but tax losses are equivalent to around a third of the total value of its expected annual earnings.

Is the price right?

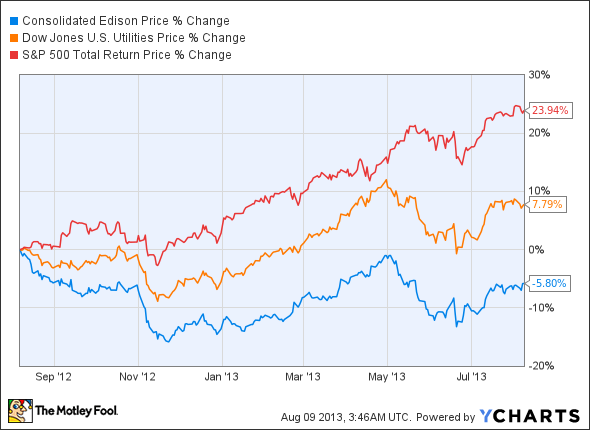

Over the past year, Consolidated Edison stock has lost 5.8% of its value, compared with a 7.8% gain for the Dow Jones U.S. Utilities Index and 23.9% gain for the S&P 500.

The utility currently offers income investors a 4.1% dividend yield with a long history of steadily increasing payouts. With Q2 solidly behind it, Consolidated Edison reaffirmed its full-year forecast range of $3.65 to $3.85 per share. This latest earnings report doesn't bring big news to Consolidated Edison investors, but it does reiterate what many shareholders love to hear: slow and steady. This stock is far from soaring, and it might not even be a market beater, but if you're in it for stable earnings and a dividend drip, Con Ed delivered again.