Halliburton's (HAL 1.60%) latest share buyback program could be a sign that the market has been discounting its stock for a long time. The oil services giant is buying back 68 million shares for $3.3 billion.

A justification at last

Last month, I wrote that Halliburton's valuations do not make much sense. The current buyback only reinforces my view. Before we proceed further, let's take a look at the valuation numbers for a few companies in the oilfield services industry:

|

Company |

Price/Earnings (TTM) |

Price/Book (TTM) |

Return on Assets (TTM) |

PEG Ratio (5 year expected) |

|---|---|---|---|---|

|

Halliburton |

23.6 |

2.9 |

9% |

0.67 |

|

Schlumberger (SLB 0.26%) |

17.7 |

2.9 |

8.2% |

0.98 |

|

National Oilwell Varco (NOV 0.16%) |

13.5 |

1.5 |

6.8% |

1.32 |

|

Nabors Industries (NBR 2.58%) |

23.1 |

0.8 |

3.1% |

2.25 |

|

Baker Hughes (BHI) |

20.7 |

1.2 |

4.4% |

0.93 |

Source: Yahoo! Finance; TTM=Trailing Twelve Months

We notice something funny about Halliburton's numbers. Despite having the most expensive valuation among its peers with a P/E of 23.6, its PEG ratio is the lowest at 0.67. The PEG ratio, which is price-to-earnings divided by expected growth rate, tries to quantify a company's valuation in terms of future expected growth. As we see here, for the PEG ratio to turn up the lowest among its competitors -- even as the P/E valuation is the highest -- suggests a solid expected growth rate far above its peers. It is from this perspective that Halliburton seems to be trading at a discounted price.

So why is Halliburton's trailing-twelve-month P/E so high? A dig into the company's financials gives us a clue. In the first quarter, Halliburton recognized a $1 billion loss contingency for the Macondo well incident under operating expenses. Due to this, the company reported an operating loss of $98 million, pulling down the EPS to a negative $0.02 per share in the first quarter.

A smart move

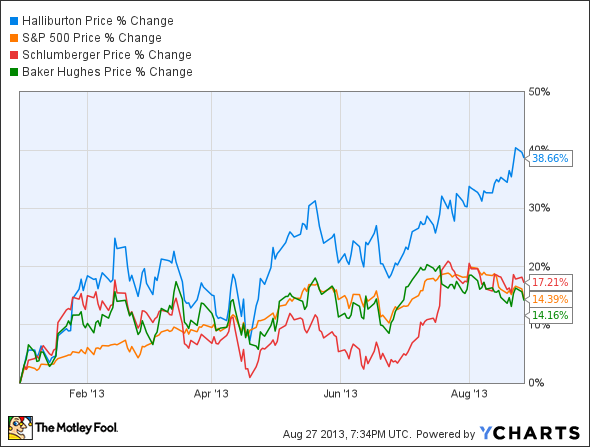

But in a sense, that was a smart move by management. By providing a rough estimate about Halliburton's potential costs from the disaster, Halliburton could limit Mr. Market's guessing game which would have likely affected its share price and valuations. On the contrary, the market rewarded the company's solid fundamentals with a year-to-date share price return of 40%.

Another metric that particularly interests me in this asset-heavy industry is the return on assets. Again, Halliburton trumps the rest with best in class figures of 9% during the last twelve-month period. While National Oilwell's P/E valuation looks the cheapest, its return on assets is yet to beat those of the Big Two. However, future growth remains attractive for National which makes it a solid buy.

A diversified approach

Halliburton's smart returns can be attributed to its geographically diversified portfolio of operations. The company's growing international operations look very attractive. The company is aiming to expand eastward to provide new manufacturing capacity and move closer to key markets. Its latest move comes in Malaysia where it opened a manufacturing and technology center that will manufacture "an extensive range of products from Halliburton's Completion Tools product line ". Not only are new markets tapped, costs come down as well.

Case in point, Nabors Industries suffered due to weakness in the North American pressure-pumping market, partly fueled to intense competition. Not surprisingly, Nabors is currently pulling out its rigs out of the U.S. for international operations. Schlumberger, on the other hand, has opened a reservoir laboratory in China last month to study exploration activity in unconventional shale plays. No prizes for guessing why the next shale revolution could be from China. Baker Hughes has also moved in the general direction of expanding international operations, with revenue from the Middle Eastern and Asia Pacific regions increasing 21% year on year.

The Foolish bottom line

Halliburton latest stock buyback program indicates that its stock is deeply discounted. With a solid expected growth rate, Foolish investors must keep a close eye on this stock.