Craft beers are enjoying ever growing popularity and brewers are enjoying growing share-price appreciation. But is it all just so much froth?

The craft-beer revolution

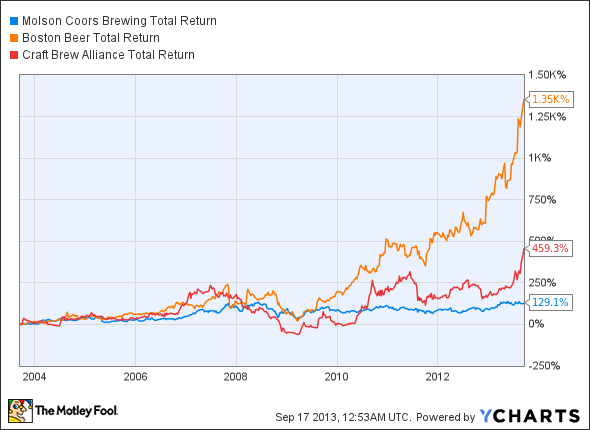

Boston Beer(SAM -2.33%), Craft Brewers Alliance (BREW), and Molson Coors Brewing (TAP -2.58%) are three brewers benefiting from this brewing revolution.

According to the Huffington Post, craft-beer sales (by value) could outstrip those of Anheuser-Busch InBev and Molson Coors by 2020 and in volume by 2033. Craft-beer sales in the US have doubled in the last five years from $5.7 billion to $12 billion last year.

The Brewers Association, a trade organization, saw craft-beer volumes sold up 15% and 17% in dollar sales compared to a 1% decline in the overall US beer market last year.

Molson Coors total return price data by YCharts

A small-cap brewer

Craft Brewers Alliance has the smallest market cap at $251 million. but a giant trailing earnings multiple of 664.5. Its earnings are spotty with several earnings misses and analysts' earnings growth estimates all over the map.

| Qtr (09/13) | Qtr (12/13) | FY (12/13) | FY (12/14) | |

|---|---|---|---|---|

| Average Estimate | $0.09 | $0.07 | $0.16 | $0.27 |

| Number of Analysts | 2 | 2 | 1 | 2 |

| High Estimate | $0.12 | $0.08 | $0.16 | $0.30 |

| Low Estimate | $0.06 | $0.06 | $0.16 | $0.24 |

| Prior Year | $0.05 | $0.01 | $0.13 | $0.16 |

| Growth Rate (year-over-year) | 80.00% | 600.00% | 23.08% | 68.75% |

Earnings per share (trailing-12 quarters)

Although second-quarter earnings of $0.06 per share doubled from the year ago period, year-to-date the company has a $0.04 loss per share. And while the gross margin expanded in the quarter by 40 basis points to 30.5%, again, year-to-date it contracted by 240 basis points for the same time frame in 2012.

Some things are going the company's way like a partnership with restaurant-chain Buffalo Wild Wings to push the Redhook Game Changer brand during football season and advertising support for its gluten-free Omission Beer. (Finally, a beer for Paleo dieters!)

The four main brands: Redhook, Omission, Kona, and Widmer Brothers, will see more competition in the coming years as the Brewers Association notes a new craft brewer starts up every day of the year and twice on Sunday. There are now 2,403 American craft brewers, the highest number since the 1880's.

Slow but sure

Molson Coors is a surer bar bet with its trailing earnings multiple of 15.8 much lower than the industry's 71.6. Molson Coors also offers a 2.6% yield at a five-year dividend growth rate of 12.8%. A gross margin at 67% is more than twice that of Craft Brewers Alliance and higher than an industry average of 62.5%.It must be noted a net profit margin at 8.5% is much lower than its five-year historical average of 14.6%.

Molson Coors, maker of mass-market beers like Miller Lite and Coors Lite, is also benefiting from the craft-beer movement with its own Blue Moon beverages (co-owned by SABMiller), which have seen market share triple since 2007 and now account for 15% of the US craft-beer market.

With only its Tenth and Blake Beer subsidiary's six brands including shandy, cider, ale, and lagers, Molson Coors is still America's largest craft brewer. Larger than rival Boston Beer despite its over 50 craft-beer brands under its belt, more if you count seasonal offerings.

At its New York analyst day in June, the company presented data including pre-tax income growth of 96% over seven years and 70% growth of free cash flow from $508 million five years ago to $865 million in 2012.

Despite its market cap of $9.1 billion, it is trading at a price/book of 1.1 and has under-performed the S&P 500 index this last year. Analysts predict a five-year EPS growth rate of 3.7% compared to 20% for Craft Brewers Alliance and 10% for Boston Beer.

Granddaddies of craft beer

James Koch, founder and chairman of Boston Beer, and CEO Martin Roper have an unusual mandate to help grow their craft beer competitors as part of their compensation plan. This arrangement earned Roper kudos as the Motley Fool CEO of the week back in April. The granddaddies of American craft beer both believe what helps one small brewer helps them all .

The stock has more than doubled from its 52-week low last October. There is a large short interest of 16%, much higher than the 3.4% for both Molson Coors and Craft Brewers Alliance. Part of that is valuation concerns after the astonishing share price appreciation of 1,355% over the last decade.

It is trading at 11.5 times book and has a trailing earnings multiple of 49.0. The stock hit a 52-week high of $234.82 on Sept. 16.

So what makes this a buy? Gross margin at 61%, earnings growth of 41% over the last five years, and a trailing return on investment of 25.3%, more than twice the industry average of 10.9%.

It's not all about numbers; the company has won the most international beer-tasting competition awards of any craft brewer. Chairman Koch noted in the second-quarter results that, "...for the fifth year in a row, our wholesalers ranked us the No.1 beer supplier in the industry, in the annual poll of beer wholesalers conducted by Tamarron Consulting."

Those results also included higher guidance for full year EPS to $5.10-$5.40 from a previous $4.70 and a 21% increase in core shipment volume.

Last call for craft beer

Boston Beer is getting a little foamy here but it is the craft beer pioneer with the most craft brands and best relationship with wholesalers and being very well managed to boot. Molson Coors is more of a sure thing with yield and a reasonable multiple but it's not going to grow as fast.

Craft Brewers Alliance is speculative with inconsistent earnings but has earnings catalysts ahead like its partnership with Buffalo Wild Wings.