Earlier this week, Microsoft (MSFT 0.45%) announced it was upping its quarterly dividend by 22%, and starting a new $40 billion share repurchase program. Buying back shares Microsoft is nothing new for Microsoft, but what's important for investors to consider is whether or not previous repurchase plans have significantly benefited company shareholders.

History repeats

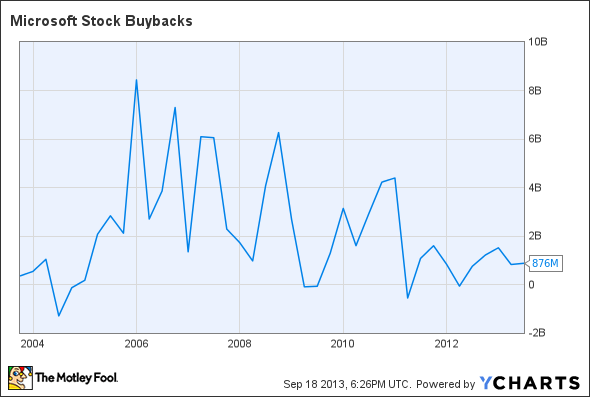

First, let's take a brief look at how much Microsoft has paid in share repurchasing over the past few years. You can see from the chart below that the recent 2008-2013 buyback followed some larger repurchasing that started in 2006.

Source: YCharts

In 2004, Microsoft announced it would buy back about $30 billion worth of shares. For the next two years, it did just that, but investors weren't rewarded with a higher stock price. From July 1, 2004 to July 31, 2006, Microsoft's stock fell about 8%.

In fiscal 2007, Microsoft authorized additional buybacks, first at $20 billion, and then upped the anti to $36 billion. Then, in 2008, the company issued the current round of share buybacks totaling $40 billion.

Here's how the amount of Microsoft shares outstanding changed over more than five years of buybacks.

Source: YCharts

Theoretically, decreasing the amount of shares has added value for current shareholders through earnings accretion. But, unfortunately for Microsoft, that may not necessarily translate into share performance because, after five years and tens of billions spent in buybacks, the stock price hasn't changed much.

Let's take a look at the same graph of buybacks overlaid with the company's stock price.

Source: YCharts

From the beginning of 2010 – when the amount of shares started to decline significantly -- to today, Microsoft's stock has only increased about 6%. So, while the amount of outstanding shares has plummeted, it hasn't added a huge amount of shareholder value.

For Microsoft investors, the better news this week came from the increased dividend. Dividends have comprised a large portion of the company's returns over the past five years, particularly when compared to returns without dividends. The total return over the past five years has been about 50%, compared to around 33% without dividends.

Source: YCharts

Assigning $40 billion to buybacks over an indefinite amount of time isn't detrimental to the company -- nor does it mean Microsoft necessarily has to go through with it -- but it does mean that whoever takes the helm after Steve Ballmer may have some set expectations for stock repurchases. And, as the data shows, it may not be the best way to benefit Microsoft's long-term investors.