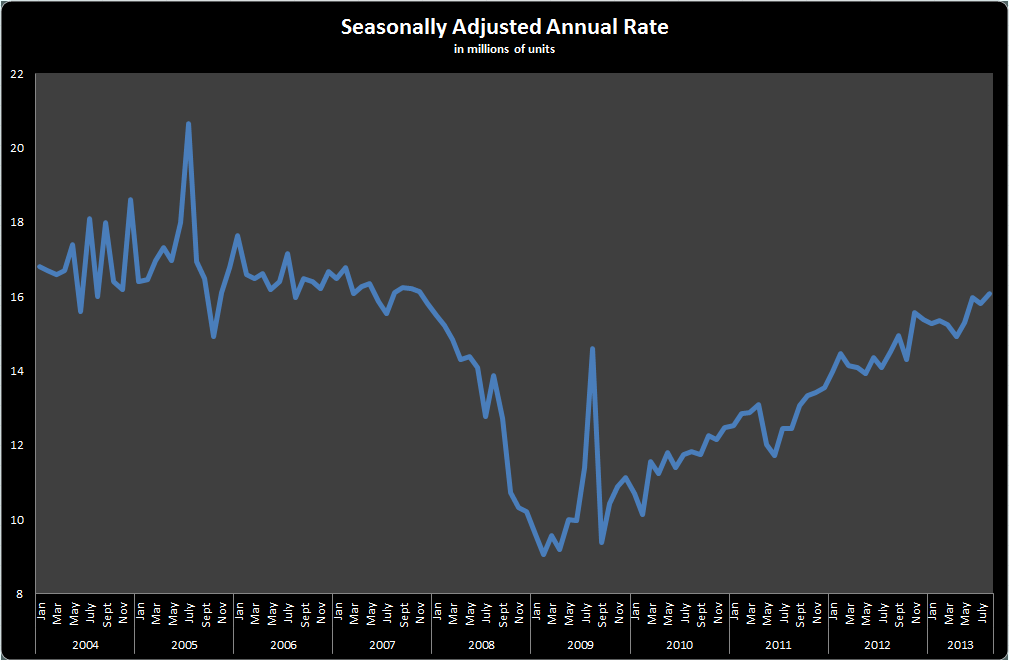

Many investors avoid owning shares in automakers such as Ford (F +0.84%), General Motors (GM 0.45%), Toyota (NYSE: TM), and Honda (HMC 0.27%) because they're in a very cyclical industry; when the good times roll, it's great. When the bad times drop by to party, it hurts, it really hurts. Seasonally Adjusted Annual Rates of vehicle sales, or SAAR, are surging higher, which has some investors wondering if we're approaching unsustainable sales levels similar to what we saw before the recession. I don't believe that to be the case at all; here are two reasons why:

Graph by author. Information from Automotive News DataCenter.

Average vehicle age hasn't budged

Before the recession SAAR topped 17 million; some investors identify that as an unsustainable level given the subsequent market crash. As the SAAR has crept up to 16.1 million this summer, some worry we could be reaching unsustainable levels already, but they shouldn't be. During the recession people put off large automobile purchases as long as possible, and we're still working through that pent-up demand. So many consumers delaying purchases caused the average age of vehicles to rise, and we can't near an unsustainable level of sales until the average age drops and finds equilibrium with SAAR. The increasing SAAR level of sales hasn't put a dent in the average age of vehicles on the road – in fact the age recently increased to 11.4 years, a record high.

Moreover, it wasn't necessarily the high SAAR before the recession that was unsustainable. It had more to do with Detroit automakers having an excess of production capacity, or too many plants and workers to operate efficiently and profitably. Analysts estimate that for automakers to remain profitable factories must run near 80% capacity. Ford, GM, and Chrysler could only sustain that level of production capacity by pumping out tons of extra vehicles that no one wanted to buy, forcing the automakers to sell them at heavy discounts to fleets and rentals. That created a vicious cycle because it dropped the value of those vehicles substantially and created a poor quality stereotype that has proven difficult to unwind.

The recession forced major restructuring, plant closings, and strategy changes at Detroit's big three automakers, and today they are much more efficient. It's estimated that the three could now remain profitable at a SAAR of roughly 10 million; a night and day difference from being unprofitable at a SAAR of 17 million. In addition to being better run companies and having plenty of pent-up demand remaining, there's another revenue catalyst looming for automakers.

Scrap rates

Investors often think about the front end of the equation: how many more vehicles can the U.S. buy? But just as important is the back end: when does the supply disappear? Itay Michaeli, director of U.S. autos for Citigroup Investment Research and Analysis, offers a fair answer.

Using R.L. Polk data, he studied the makeup of 11.8 million vehicles that were scrapped last year, and found that the rate of vehicles being scrapped rises dramatically at 13 years of age, according to Automotive News. That makes the average vehicle about 20 months away from being completely scrapped. That situation should spur new vehicle sales and support a high-level SAAR; it should also support higher transaction prices on both new and used vehicles because supply will decrease.

"No later than 2015, we should see an incredibly strong scrap recovery in this cycle, and it hasn't even begun," Michaeli said the 2013 CAR Management Briefing Seminars, according to Automotive News. "In 2014 and 2015, the rate of vehicle designs and refreshes with tremendous new technology is going to come right at the time when we think the vehicle age will start to hit that ideal range when scrap rates tend to balloon," the Citigroup economist said.

Final word

I believe it's a great time to buy into automakers. Europe's vehicle sales are still in the dumps and costing automakers billions per year. Ford and GM, though, both plan to break even in Europe by 2015, which will instantly add those billions back into pretax profits – a huge positive development for earnings per share. Analysts also predict that China's annual vehicle sales could jump from 19 million last year, to as much as 30 million by the end of the decade – enormous growth for automakers to grab. Also consider that Ford and GM's most profitable segment is full-size trucks that continue to see very strong sales as the housing and construction industry rebound. Combine those factors with the two above that show the U.S. can sustain higher SAAR levels and it equals a bright future for automakers and their investors.