Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Advanced Micro Devices (AMD 5.57%) fit the bill? Let's take a look at what its recent results tell us about its potential for future gains.

What we're looking for

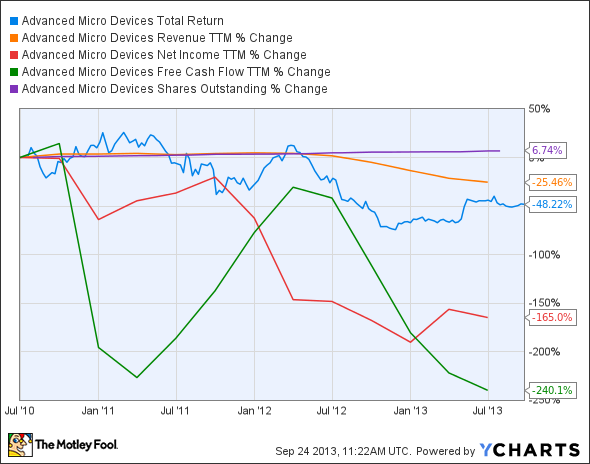

The graphs you're about to see tell AMD's story, and we'll be grading the quality of that story in several ways:

- Growth: Are profits, margins, and free cash flow all increasing?

- Valuation: Is share price growing in line with earnings per share?

- Opportunities: Is return on equity increasing while debt to equity declines?

What the numbers tell you

Now, let's take a look at AMD's key statistics:

AMD Total Return Price data by YCharts.

|

Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Revenue growth > 30% |

(25.5%) |

Fail |

|

Improving profit margin |

(187.2%) |

Fail |

|

Free cash flow growth > Net income growth |

(240.1%) vs. (165%) |

Fail |

|

Improving EPS |

(160.3%) |

Fail |

|

Stock growth (+ 15%) < EPS growth |

(48.2%) vs. (160.3%) |

Fail |

Source: YCharts. *Period begins at end of Q2 2010.

AMD Return on Equity data by YCharts.

|

Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Improving return on equity |

(122.1%) |

Fail |

|

Declining debt to equity |

No debt |

Pass |

Source: YCharts. *Period begins at end of Q2 2010.

How we got here and where we're going

AMD earns only one out of seven passing grades thanks to a miserable multiyear performance. It's never easy being a distant No. 2 in virtually all of your markets, and AMD has suffered from the shrinking PC market in many ways. None of its other segments have stepped in to fill the void, and without a major turnaround in PCs or a major surge in a new market, it's hard to see how AMD can reverse its slide and earn more passing grades and investor plaudits. But let's not write the chipmaker off just yet. What is AMD actually doing to put its problems in the past?

The continued weakness in the PC market has left AMD struggling to maintain revenue growth over the past few quarters. The company's attempt to diversify into mobile has also faced significant resistance from established smartphone chip champ Qualcomm and PC leader Intel (INTC 0.51%). Intel's recently launched Clover Trail dual-core x86 Atom chips is perhaps the best challenger to a crowded ARM-based (ARMH) mobile chip market, but even this effort may not be enough to penetrate the mature mobile space. My fellow Fool Sean Williams notes that Intel has an exclusive agreement with Microsoft to produce chips for its smartphones and tablets, but beyond this toehold, it's a very ARM world. Intel needs a smartphone beachhead more than AMD, as the decline in its flagship PC processor segment has led to a rare multiquarter decline in both revenue and net income, which both peaked in early 2012 and have yet to breach new highs.

Fool contributor Adam Weinberg points out that AMD has been trying to offset weakening PC sales with a greater presence in "embedded and semi-custom chip" markets. AMD's move into gaming consoles and cloud-based services might help to revive its sagging fortunes -- the company is already poised to benefit from Sony's and Microsoft's next-gen consoles, which both use AMD's processors. It has also won the design for Nintendo's next-generation game console, Wii U. The company expects to generate roughly half of its total revenue from embedded and semi-custom chips this year.

However, AMD's strategy may not work over the long term if gaming platforms shift toward mobile and cloud-based systems and away from all-in-one living room boxes. NVIDIA has already developed a cloud-based GPU platform that allows developers to offer gaming as a service. This new gaming platform could pose a potential threat to AMD, as it may discourage gamers from buying gaming consoles. To counteract this threat, AMD has partnered with ARM to build low-power server microprocessors, which could pose a potential threat to Intel's stranglehold in that segment, which could grow into a $240 billion-plus market by 2020. A recent Forbes report downplays any hope an AMD-ARM partnership may have of dislodging Intel from the server segment, as it quotes VMWare CEO Pat Gelsinger as saying, "Even if you reduced the power consumption of ARM CPUs to zero, x86 will still win." Since the primary advantage of ARM-based chips is their purported power savings, it seems like AMD might be stuck with its console focus for a while.

Putting the pieces together

Today, Advanced Micro Devices has few of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.