Skechers (SKX +0.00%) has is up 65% year-to-date, outperforming Brown Shoe (BWS 5.60%), Wolverine World Wide (WWW 6.28%), Deckers Outdoor (DECK 4.28%), and Nike (NKE 3.08%), which have appreciated 26%, 39%, 62%, and 43%, respectively. Skechers' upside move is justifiable based on the company's recent performance. At the same time, this doesn't mean Skechers will offer the best long-term investment opportunity in this group.

Halftime pep talk

In some cases, a company that's performing well will simply do nothing and expect that strong performance to continue. Fortunately, Skechers doesn't fall into that category. Prior to taking a gander at the company's strategies going forward, let's first take a quick look back at net sales performance by segment for the first half year-over-year:

|

% of Net Sales |

Net Sales | |

|---|---|---|

|

Domestic Wholesale |

44.3% |

up 22.6% |

|

International Wholesale |

22.9% |

up 16.4% |

|

Retail |

31.2% |

up 18% |

|

E-Commerce |

1.6% |

up 30.8% |

Domestic Wholesale is the company's most important segment. The biggest positive for the segment was a 24.2% jump in unit sales volume, which indicates increased demand. One negative was a decline in the average selling price to $20.62 from $20.89. But the positives greatly outweighed the negatives.

In the international wholesale segment, Skechers saw strength in France, Canada, Hong Kong, and China, especially in Women's Go, Twinkle Toes, Women's Sport, and Men's USA. Indonesia, South Korea, and Russia partially offset that strength due to weak economic and spending environments, but once again the positives greatly outweighed negatives.

Part of the reason retail performed well was due to a net increase of six new domestic stores and a net increase of five new international stores. However, the strong performance in retail wasn't just due to new stores. Actually, net products were the biggest driver. For instance, domestic comps jumped 14.1%, and international comps improved by an even more impressive 17.9%.

As you can see from the table above, e-commerce isn't a big part of the operation. Perhaps this will change in the future, but for the moment it shouldn't be a part of your investment decision-making process.

As far as that halftime adjustment goes, Skechers plans on continuing to offer new lifestyle and performance products at affordable prices, managing inventory and expenses to be inline with sales expectations, growing its international business, and expanding its retail distribution by opening another 35-40 stores. Overall, Skechers expects its current strong momentum to continue.

You can find many reasons to be optimistic about the company's future potential, and rightfully so, but let's take a look at those aforementioned peers as well.

A foot race

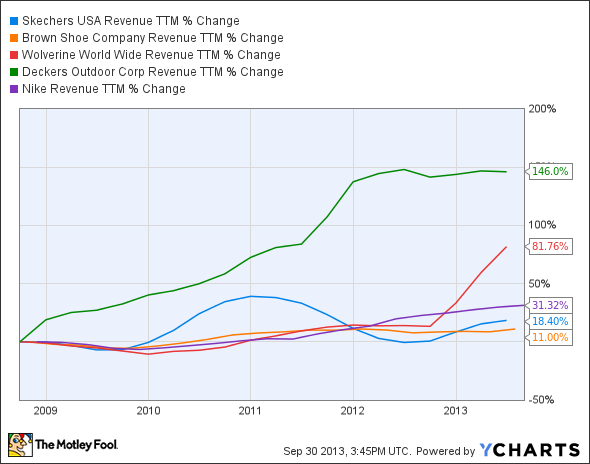

Since we're living in an economic environment where top-line growth is difficult to come by, let's see how these companies have performed on the top line for the past five years:

Skechers revenue trailing-12 months data by YCharts

Amazingly, all five companies have seen revenue growth over the past five years, with Deckers seeing the most impressive growth. The top-line growth across the board indicates heightened demand for footwear. All five companies have international operations, which helps a great deal. Now let's take a look at the bottom line:

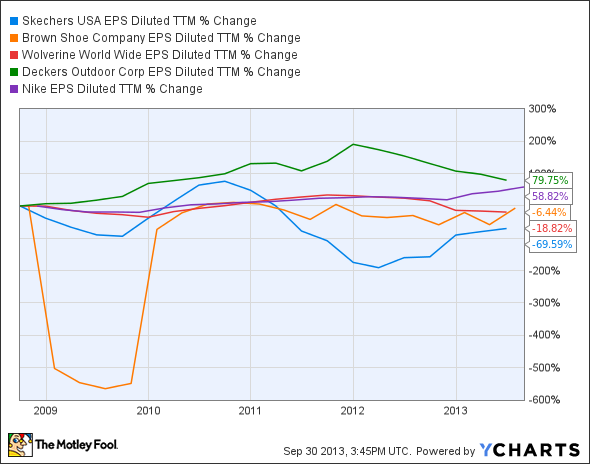

Skechers EPS diluted trailing-12 months data by YCharts

It can be difficult to make sense of this chart, but if you look closely you will see that Nike is the only company of the five that has delivered steady bottom-line growth (although Deckers beats it for overall growth).

In regards to key metrics, all five companies are strong. However, as usual, Nike steals the show:

|

Forward P/E |

Net Margin |

ROE |

Dividend Yield |

Debt-to-Equity Ratio | |

|---|---|---|---|---|---|

|

Skechers |

18 |

1.68% |

3.47% |

N/A |

0.15 |

|

Brown Shoe |

14 |

1.25% |

10.15% |

1.20% |

0.52 |

|

Wolverine World Wide |

17 |

3.43% |

11.58% |

0.40% |

1.68 |

|

Deckers |

15 |

7.91% |

15.69% |

N/A |

0.04 |

|

Nike |

21 |

10.45% |

24.93% |

1.10% |

0.12 |

If you look at a five-company comparison in any industry, it's going to be nearly impossible to find five fundamentally sound companies. But that is the case here. Therefore, all five companies offer long-term investment potential, including the focus of this article, Skechers.

At the same time, if you want the best possible long-term investment, you want the company that turns the most revenue and investor dollars into profit, and offers a somewhat generous yield, strong debt management, enormous international marketing power, excellent cost containment, consistent innovation, and broad product diversification; that company is Nike.

Invest at a sustainable pace

If you're looking for growth potential, then Skechers can definitely offer that, and there would be nothing wrong with this decision based on the company's products being in high demand. It would just be a little riskier than investing in Nike, which in addition to its previously mentioned advantages, has the capability of acquiring smaller companies to grow its top line, as well as the capability of buying back large amounts of shares to improve its bottom line, thanks to its strong balance sheet.