Apple (AAPL 1.06%) kicked off the tablet revolution with the iPad, but it's looking like Apple's position as top dog is under increasing pressure.

It's been well documented that Google's (GOOG 3.22%) Android mobile operating system has been slowly encroaching on Apple's lead in the booming market for some time. However, a growing body of evidence suggests that a changing of the guard may have already come and gone.

Pass the baton

The second quarter of this year marked a notable first in the tablet space. According to market researcher ABI Research, Google's Android surpassed Apple's iOS in terms of market share for the first time since the tablet market, well, started.

This is highly significant in and of itself. However, digging deeper into ABI's press release reveals another interesting -- and possibly alarming -- trend for Apple. ABI notes that in addition to usurping Apple in market share, Android and its hardware partners now evenly match iOS 50-50 in terms of overall sales generated from tablet sales.

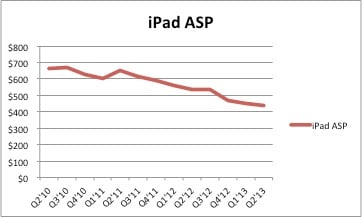

For longtime Apple observers, this only reiterates the negative trend in iPad average selling price, or ASP, that's been continuing in the last nine quarters. Take a look.

Source: Apple press releases.

Since hitting its second-highest mark ever at $654 in the calendar 2011 Q2, Apple's tablet ASPs have slowly but persistently fallen in each consecutive quarter, hitting a new all-time low of $436 during Apple's most recently reported quarter. ABI echoes this same trend, noting that IPad ASPs declined 17% year over year in the second quarter.

However, Android's matching Apple in terms of revenue in the tablet space isn't simply due to falling iPad prices. ABI also noted that the average price of an Android tablet has been on the upswing of late, rising 17% year over year in the second quarter of this year. It's this dual convergence that's driving this storyline, not one single data point.

This certainly highlights the direction that prices for tablets running on these respective operating systems are headed, but even this doesn't give the full picture of the revenue dynamics in the tablet market.

Who's really making it rain?

Android's rising prominence in the tablet market parallels the gradual dominance it's gained in the smartphone space, where it controlled a 75% share of the global market last quarter according to IDC.

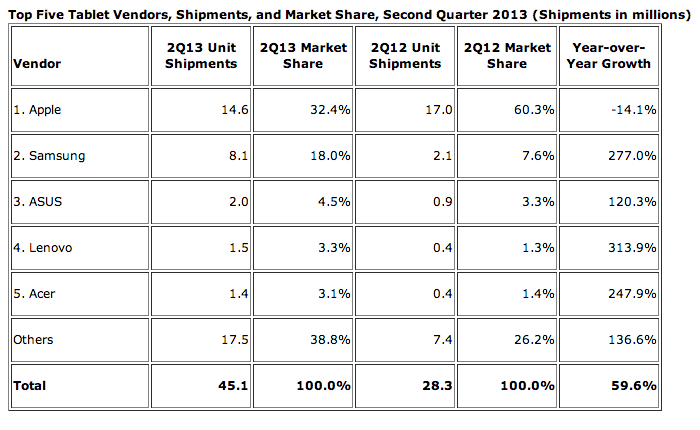

In the tablet space, Android's growth has been nothing short of explosive. In Q2, Android grew its share of the market 163% to steal a hefty 63% of the overall global market, which is nearly double iOS's 32.5% share. However, it becomes clear when you look at IDC's tablet market data when broken down by specific hardware vendor that growth is being driven largely by lower-cost Android-based OEMs.

Source: IDC.

As IDC points out, the difference in growth profiles between Apple's iOS at the top, which shrank year over year in Q2, versus the next four largest tablet vendors is stark. Two things stand out. First, each of these tablet makers is predominantly Android-based. Second, their tablet shipments have more than doubled year over year.

A big part of this is the explosion of smaller, lower-cost Android-based tablets that have flooded the market over the last several quarters. ABI's senior practice director Jeff Orr noted as much in the release, saying, "Smaller 7-inch class tablets are finally the majority of shipments."

However, the revenue generated from Android sales that ABI references doesn't necessarily equate to dollars flowing directly into Google's coffers. Remember that with a few notable exceptions, like Motorola or Google's own Nexus tablets, Google doesn't sell hardware, but instead licenses Android to original equipment manufacturers like Samsung, ASUS, Lenovo and many others. While many of these names grab much of their sales volumes from emerging markets where the business models are typically lower margin, Apple's strategy remains firmly rooted in the high-end, highly profitable portion of the tablet market.

In need of a winner

All this isn't meant to besmirch the iPad as one of the most important devices in the entire tablet market. It still outsells any other Android tablet OEM by a wide margin and profits handsomely in the process. In fact, Apple outsold second-place tablet vendor Samsung by 80% in the second quarter. Instead, the ABI research highlights how the playing field in the tablet space is shaking out in very much the same way the smartphone market has evolved over time.

This isn't necessarily a bad thing. Apple still commands a significant portion of the profits in the smartphone market, even as Android has overtaken the iEverything giant by revenue and shipment volumes. The key factor for Apple's continued success here, as in the smartphone space, is that it must keep producing winners with each product refresh.

Apple is widely expected to refresh its iPads at some point in the coming weeks. The rumor mill is already revving trying to predict what new features and upgrades will be included in the new set of iPads. However, as ABI and others have highlighted over the last few months, Apple will need to produce anther winner in order to keep consumers from handing over their iPads in favor of a growing field of serious competitors.