Imagine staying in a hotel room where you walk out onto a balcony to find a babbling brook paralleled by a quiet walking path. The air is so clean and crisp that it heightens your senses and makes you feel truly alive. If you desire a bite to eat or an ice cream, you can walk to the nearby village (where cars aren't allowed), satisfy your palate, and shop for apparel, toys, antiques, or jewelry. If that's not satisfying enough, you can hop on the gondola and try your feet at downhill skiing. If it's summertime, you can hike up the mountain and capture some of the most picturesque scenes found in the continental United States.

Many people refer to Vail as paradise, and rightfully so. This is only one of the reasons why Vail Resorts (MTN -1.15%) has been a winning investment over the past several years.

A Broader Look at Vail Resorts

Vail Resorts owns eight ski resort properties, which can be found in Vail and Breckenridge, Colo.; Park City, Utah; Lake Tahoe, Calif./Nev.; in the Afton Alps area in Minnesota; and in the Mount Brighton area in Michigan. Vail Resorts operates in three segments: Mountain (77% of revenue), Lodging (19% of revenue), and Real Estate (4% of revenue). Since Mountain is the most important segment, that will be the focus here.

In FY 2013, total net revenue for the Mountain segment jumped 13.2% over the previous year. Lift revenue is the biggest driver for the segment, and lift revenue jumped 14.1% year over year. Excluding acquisitions, net revenue still improved 9.3%. Net income skyrocketed 129.4% to $37.7 million, which the company attributed to higher visitation, improved pricing, and increased average guest spend.

Vail Resorts recently acquired Canyon's Resort in Park City, Utah; Afton Alps in Minnesota; and Mount Brighton in Michigan. Vail Resorts clearly aims for top-line growth.

Vail Resorts has cited strong performances in the stock market, improved consumer confidence, a recovering housing market, and lower unemployment as part of the reasons for its recent performance. However, it also has several concerns going forward, including federal budget cuts, higher taxes, monetary policy uncertainties, and slow growth in the global economy. The latter is especially important since 56% of Vail Resorts' guests are out-of-state, which can also mean out-of-country. These guests tend to spend more than in-state guests, simply because they're on vacation and they want the full experience.

Vail Resorts sells season passes as a way offsetting future economic headwinds or unfavorable weather. Since these passes are sold prior to the ski season, it's a good way for Vail Resorts to lock in sales. For the upcoming season, season passes saw a 19% increase in units and a 23% increase in sales dollars year over year. Vail Resorts is also looking to add more summer plans to attract more visitors across all resorts.

All of this is impressive, but Vail Resorts isn't the only way to play leisure.

Different Experiences

When you think of leisure and accommodations, there's a pretty good chance Marriott International (MAR 3.17%) comes to mind. After all, it's the second-largest domestic hotel operator by hotel rooms. It has also increased its hotel size (by rooms) in North America 12% since 2009. It also has a strong international presence. The bad news for Marriott is that it recently lowered its revenue-per-available-room expectation for fiscal-year 2013, primarily due to weakness in Europe (no surprise there) as well as parts of Asia-Pacific. The good news is that Marriott is looking to asset sales in order to improve its financial position.

If you're looking for a more unique investment opportunity, then you might be tempted to consider The Marcus Corporation (MCS 0.44%), owner of 20 hotels and 70 movie screens. In the first quarter, revenue increased 9.38% to $129 million year over year, beating the average analyst expectation of $128.3 million. The Marcus Corporation also beat on the bottom line, reporting adjusted earnings-per-share of $0.50 versus an expectation of $0.46. The Marcus Corporation cited a strong demand at its hotels and resorts, as well as a strong summer movie slate at its theaters.

On the surface, it looks as though all three companies offer good potential going forward. But consider top-line performances for these three companies over the past five years:

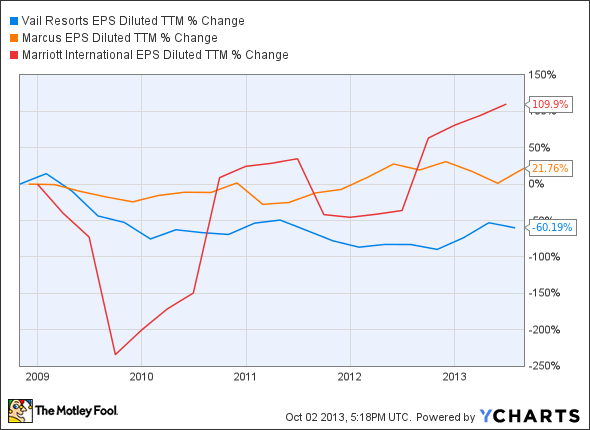

And bottom-line performance:

MTN EPS Diluted TTM data by YCharts

Vail Resorts has performed well on the top line, but it has lagged on the bottom line. The Marcus Corporation has underperformed on the top line. Marriott is the only company of the three that has delivered consistent performances on both the top and bottom lines, indicating the strongest management. Marriott should remain a long-term winner, but it's not for the faint of heart. It's highly sensitive to consumer health, which leads to volatility.

Climbing a Peak and Skiing Downhill

Vail Resorts is growing on the top line thanks to high demand and recent acquisitions. The bottom line hasn't been as impressive, but that's to be expected considering recent acquisitions. Vail Resorts has remained profitable annually, but two of the past four quarters have been in the red. Now that Vail Resorts has taken on more property, it will need demand to remain high. Considering the status of the economy, this might be difficult to achieve. Vail Resorts should be a long-term winner, but short to medium-term risks exist, which could lead to extreme volatility.