Xcel Energy (XEL 1.05%) reported earnings this week, missing on sales estimates but beating on the bottom line. With promises of a bigger dividend down the road, let's see whether Xcel Energy can accelerate your own portfolio's profits.

Number crunching

Third quarter sales clocked in at $2.8 billion, a 3.6% increase over last year's third quarter, but $1.6 billion short of analyst estimates. As one of the first utilities to report earnings this quarter, we'll have to wait and see whether lackluster sales are a common trend.

But where Xcel Energy failed on the top line, it made up for in profits. Operating earnings clocked in at $0.77 per share, exceeding analyst expectations by a penny for the sixth straight quarter of earnings beats.

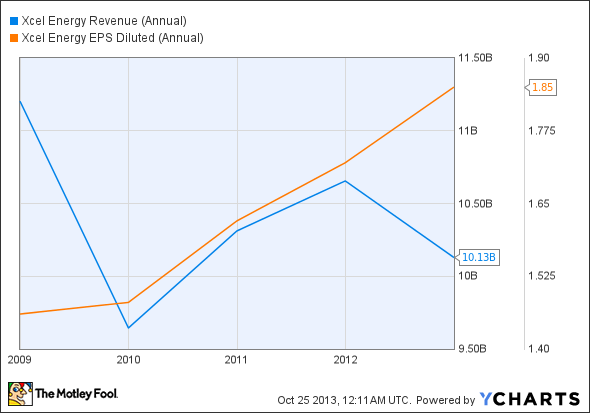

For a peck of perspective, here's how Xcel Energy's sales and earnings have held up over the past five years.

XEL Revenue (Annual) data by YCharts

Fundamentals

When it comes to sustainable earnings, Xcel is a step ahead of many diversified utilities. The corporation's operations are entirely regulated, with 3.4 million electricity customers and 1.9 million natural gas customers spread across 8 states in the West and Midwest. Over the last few years, regulated utilities have had the last laugh as low demand and volatile energy prices have kept competitive utilities guessing.

Competitive energy economics has meant major profits for utilities heavy on natural gas like Dominion Resources (D -1.02%), but disaster for other companies stuck in less competitive fuels like Exelon (EXC 2.40%) and TECO Energy (NYSE: TE). Dominion's regulated unit has been doing well, but its unregulated business has soared on news that it has been approved to export LNG to non-free trade agreement Countries. With around 20% of the nation's entire nuclear supply, Exelon's earnings and share price have struggled to keep up as stubbornly cheap natural gas continues to keep power prices low. Likewise, TECO Energy has historically relied on vertically integrated coal to keep costs low, but just like nuclear, coal hasn't cut it. The utility is making moves to switch to natural gas through acquisitions, but its core business is still tied tight to coal. Here's how these companies' share prices have fared over the last year:

With Xcel's earnings originating from regulated earnings, the utility doesn't have to worry about gas prices – but it does have to worry about regulators. This quarter's earnings took a $0.04 per share hit due to a customer refund mandated by the Federal Energy Regulatory Commission (FERC). FERC added Xcel to its naughty list after it found that the utility had mixed fuel costs with its base rate – two numbers that need to be kept separate.

But with fines behind it, Xcel thinks things are looking up. The company expects its 2013 ongoing EPS to be in the upper half of its reiterated $1.85 to $1.95 guidance range, and revealed its 2014 range as a slightly high $1.90 to $2.05.

Dividend diva

For income investors, this latest report included an extra treat: Xcel Energy promises to keep its dividend increases at 4% to 6% annually, in line with its long-term estimated annual EPS growth of 4% to 6%. Xcel has a long history of boosting its dividend, something that can't be said for Exelon or TECO Energy.

XEL Dividend data by YCharts

While Xcel's performance relies primarily on steady regulated sales, the company hasn't had the best track record. FERC fines and lower-than-expected rate increases have kept its solid business model on rocky ground, but the company's below-average valuation and 3.9% dividend yield continue to make it a solid long-run income investment. With another earnings beat behind it, Xcel has proven its profitable position once again.