Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Halliburton (HAL -0.33%) fit the bill? Let's look at what its recent results tell us about its potential for future gains.

What we're looking for

The graphs you're about to see tell Halliburton's story, and we'll be grading the quality of that story in several ways:

- Growth: Are profits, margins, and free cash flow all increasing?

- Valuation: Is share price growing in line with earnings per share?

- Opportunities: Is return on equity increasing while debt to equity declines?

- Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's look at Halliburton's key statistics:

HAL Total Return Price data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Revenue growth > 30% |

76.1% |

Pass |

|

Improving profit margin |

(22.9%) |

Fail |

|

Free cash flow growth > Net income growth |

363.5% vs. 35.9% |

Pass |

|

Improving EPS |

33.8% |

Pass |

|

Stock growth (+ 15%) < EPS growth |

69.6% vs. 33.8% |

Fail |

Source: YCharts.

*Period begins at end of Q3 2010.

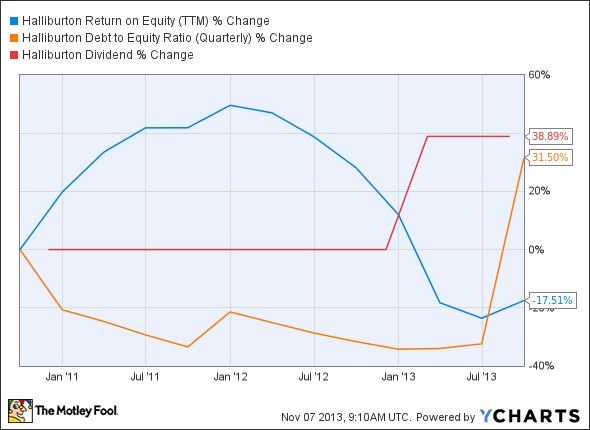

HAL Return on Equity (TTM) data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Improving return on equity |

(17.5%) |

Fail |

|

Declining debt to equity |

31.5% |

Fail |

|

Dividend growth > 25% |

38.9% |

Pass |

|

Free cash flow payout ratio < 50% |

36% |

Pass |

Source: YCharts.

*Period begins at end of Q3 2010.

How we got here and where we're going

Halliburton doesn't quite come through with flying colors, as it only mustered five out of nine possible passing grades in its second assessment. That's the same score the company picked up last year, which seems to indicate a holding pattern in Halliburton's progress. However, Halliburton's stock growth has outpaced the gains in its net income, and the company's falling profit margins have weighed it down as well, despite the EPS boost provided by a major share repurchase plan. Unfortunately, Halliburton took on more debt to fund the share repurchases. Can Halliburton improve more of its key financial metrics in 2014? Let's take a deeper look.

U.S. oil production recently surpassed oil imports for the first time in decades, and that's thanks in large part to the hydraulic fracturing techniques Halliburton pioneered. However, hydraulic fracturing has been embroiled in several environmental controversies, which stem from injecting injurious chemicals into the ground and the need to pump millions of gallons of water during the drilling process.

In an effort to surmount these criticisms, Halliburton has recently teamed up with Nuverra Environmental Solutions (NESC) for its H2O Forward water-recycling initiative, which eliminates the need for massive amounts of water in fracking wells. The company is currently offering the H2O Forward service to oil and gas firms in the Bakken Shale, enabling them to recycle produced water on site. Halliburton also plans to reduce fresh water consumption in the fracking process by 25% by the end of next year. However, GASFRAC Energy Services has devised a liquefied petroleum gas, or LPG-based fracking method, which may blunt the progress of Halliburton's water-recycling partnership with Nuverra.

Halliburton is exploring its own alternatives to water as well, and has been aggressively promoting its "Frac of the Future" program, which could save substantial amounts of diesel by using natural gas to fuel drilling equipment. Fool contributor Matthew DiLallo notes that Noble Energy (NBL) has been working with Halliburton to curb its emissions by fueling its fleets with natural gas in Colorado. This will also result in substantial cost savings due to the long-running discrepancy between natural gas and traditional liquid petroleum fuels. Halliburton's even begun a new initiative to create a fracking fluid made up of the food industry's waste products.

Fool analyst Joel South notes that Mexican President Enrique Pena Nieto may soon end the 75-year-old Pemex monopoly on Mexican oil production by permitting foreign companies such as ExxonMobil and Halliburton to work with the state-owned company. This could eventually improve the amount of proven reserves in Mexico as superior technology pushes exploration further beneath Mexican soils. Halliburton's H2O Forward service may also help China by freeing up scarce water for drilling purposes, thereby enabling the country to unlock its large oil and gas reserves.

Putting the pieces together

Today, Halliburton has some of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.