It doesn't get much bigger in big pharma than Merck (MRK -0.29%), Pfizer (PFE 0.22%) or Johnson & Johnson (JNJ 0.43%). All three are packing pipelines to offset patent expirations. But, is one a better buy than another?

Debating earnings

One of my favorite ways to evaluate whether big companies will continue to reward investors with buybacks and dividends is to consider operating margins. The ability to translate revenue into profit is critical to long-term success. In addition to funding future dividends and buybacks, a strong operating margin provides fuel for drug research, development, acquisitions too.

Among these three, operating margins have turned up for J&J and are showing early signs of improvement at Pfizer. However, they remain depressed at Merck, which suggests sluggish net income growth. The fact that J&J's operating margin is highest positions it nicely for future growth.

Source: Operating Margin data by YCharts.

Of the three, net income is greatest at Pfizer, where the rate increase has accelerated this year. J&J's net income has also improved, while Merck's has been heading lower.

Source: Net income data by YCharts.

While operating margins and net income give some insight, you get a clearer picture when you consider each companies history of underpromising and overdelivering on quarterly earnings. Management teams that understand how Wall Street rewards and punishes companies know that keeping analyst expectations in check is important.

Merck and J&J both get high marks in this regard, both outpacing analyst earnings projections in each of the past four quarters. Pfizer has also done a nice job, beating in three of the last four quarters.

EPS Surprise %

|

Company |

Dec. 2012 |

March 2013 |

June 2013 |

Sept. 2013 |

|---|---|---|---|---|

|

Merck |

2.50% |

7.60% |

1.20% |

4.50% |

|

Pfizer |

6.80% |

(8.90)% |

1.80% |

3.60% |

|

Johnson & Johnson |

1.70% |

2.90% |

6.50% |

3.00% |

Source: Yahoo! Finance.

But those beats aren't translating into analyst euphoria. Over the past 90 days, analysts have taken Merck's forward earnings expectation down by 5% as they model for lower Singulair sales. That drug lost patent protection last year.

Pfizer is also wrestling to offset the threat of generics. The company lost protection for its blockbuster Lipitor in November 2011, and sales of the drug were 27% lower year over year in the third quarter. Pfizer also lost protection for Viagra in Europe this past summer. That caused Viagra's third-quarter sales to slump 11% compared to last year.

Johnson & Johnson isn't immune to the patent cliff, either. The company faces patent expiration for its high-profile blockbuster Remicade as early as 2015, and generic drug maker Hospira has already won approval in Europe for its biosimilar version of the drug. However, despite that threat, analysts have bumped up their earnings outlook on sales strength of J&J's prostate cancer drug Zytiga and hopes for a successful launch of its hepatitis C drug simeprevir.

EPS Trends

|

Merck |

Pfizer |

Johnson & Johnson | |

|---|---|---|---|

|

Next Year |

Next Year |

Next Year |

|

|

Dec 2014 |

Dec 2014 |

Dec 2014 |

|

|

Current Estimate |

3.49 |

2.29 |

5.85 |

|

7 Days Ago |

3.49 |

2.29 |

5.84 |

|

30 Days Ago |

3.56 |

2.31 |

5.83 |

|

60 Days Ago |

3.68 |

2.3 |

5.82 |

|

90 Days Ago |

3.68 |

2.3 |

5.82 |

|

% Change from 90 Days Ago |

(5.16)% |

(0.43)% |

0.52% |

Source: Yahoo! Finance.

Debating valuation

Switching over to valuation, investors are paying more for each dollar of Pfizer and J&J sales than they have in five years. Merck's price-to-sales ratio is similarly high relative to historical levels.

Source: P/S data by YCharts.

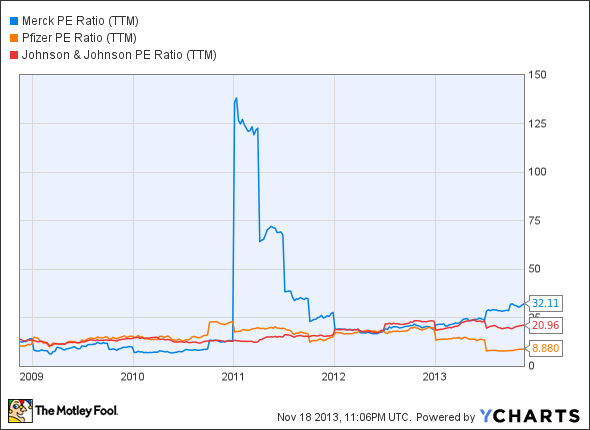

Investors are paying a lot for trailing 12 month earnings per share at Merck and J&J too. If we discount the spike in Merck, we see P/E ratios for each are near five year highs. Pfizer is a different story. Investors are paying near the low end for future earnings ahead of generic threats.

Source: P/E data by YCharts.

If we compare the companies forward P/E to the five-year P/E low, Merck is more expensive than its large cap health care peers, while Pfizer and J&J are less expensive than those peers.

Source: Yahoo! Finance.

If we assume investors will pay closer to the historical norm for earnings at Merck, applying a P/E ratio target of 15.5 to forward earnings estimates gets a back-of-napkin target price of $54.10, which is 12.67% higher than its trading currently.

If we assume Pfizer will trade in the middle of its trailing and forward P/E ratio over the coming year, it appears overvalued by as much as 18%. However, if we use the five-year average P/E ratio for Pfizer, it could be 9.5% undervalued. That's a fairly wide spread and should make you cautious.

Over at Johnson & Johnson, taking the midpoint between its trailing and forward P/E gets us a potential 15% return. Of course, whenever you make such assumptions, you take a leap of faith. Any number of things can occur causing investor enthusiasm to rise or fall, and that could drastically change target P/Es. After all, past performance never guarantees future returns.

|

Metrics |

Merck |

Pfizer |

Johnson & Johnson |

|---|---|---|---|

|

Trailing P/E |

32.26 |

8.84 |

21.03 |

|

Forward P/E |

13.76 |

13.98 |

16.12 |

|

Current Share Price |

$48.01 |

$32.01 |

$94.30 |

|

Forward EPS Estimate |

$3.49 |

$2.29 |

$5.85 |

|

Target P/E |

15.50 |

11.41 |

18.58 |

|

Target Price Forward EPS * Target P/E |

$54.10 |

$26.13 |

$108.66 |

|

Potential Return |

12.67% |

(18.37)% |

15.23% |

Sources: Yahoo! Finance and author's calculations.

Foolish final thoughts

Johnson & Johnson offers peer-leading operating margins, rising net income, and the best history of beating analyst expectations. J&J is also the only one of the three where analysts are increasing, rather than decreasing, next year earnings estimates.

And, while J&J investors are paying near historical highs for sales and earnings, it may offer the biggest potential for upside based on my target P/E estimates. As a result, J&J appears to have the edge when compared to both Merck and Pfizer. But, that assumes investors remain enthusiastic about Zytiga and simeprevir, two drugs targeting very competitive markets.