Shares of The Wendy's Company (WEN +4.48%) have done amazingly well this year with a 50% rise since January, which outperformed the share price appreciation of McDonald's(MCD 0.13%) and Burger King Worldwide (BKW +0.00%) by a great margin.

With 6,000 locations worldwide, Wendy's is still far away from reaching McDonald's huge scale of operations. However, constant menu improvements, quick drive-thru service, engaging marketing campaigns on Facebook and Twitter, and several other strategic initiatives are causing Wendy's top line to increase rapidly. The company, which just last year edged out Burger King for the first time ever as America's second largest hamburger chain, seems like it has decided to win the war against McDonald's for the burger market. Will Wendy's strategy work?

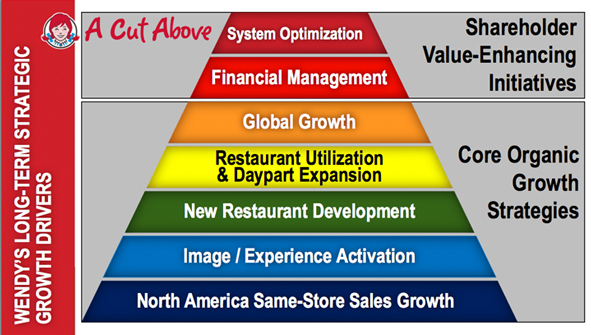

The plan

Wendy's management is implementing a long-term growth strategy where menu innovation plays an essential role. Basically, the company is trying to differentiate its menu from other competitors by insisting on premium, healthier, top-quality products such as Wendy's Garden Sensation Salads and Bacon Portabella Melt on Brioche. In Japan, the company went as far as selling lobster and caviar burgers with price points ranging from $16 to $20 per item.

Although these products have higher margins, they are also more difficult to sell. However, in the long run the company's emphasis on higher quality, combined with a quick economic recovery and the fact that Americans are becoming increasingly aware of their health, should help it capture market share from McDonald's. Wendy's management also plans to remodel most of its stores with modern designs and use social marketing to actively drive customer traffic.

Controlling expenses

Although turnaround plans and long-term strategies tend to be expensive, Wendy's plans to reduce its capital expenditures in order to maintain its profitability. This involves divesting more than 400 company-owned locations to franchisees in 2014. The firm is also reducing its beverage and paper expenses. Overall, cost reductions should help Wendy's stabilize its cash flow. Long term, the introduction of high-margin products should improve the firm's product mix and overall profitability.

McDonald's and Burger King won't be quiet

So far, Wendy's strategic plan seems to be working well. The company's same-store sales for the third quarter of 2013 outpaced both McDonald's and Burger King. In terms of the top line, third-quarter sales for the latest quarter came in at $641 million. This was slightly below consensus, yet higher than the year-ago period. The company managed to widen its restaurant margin by 170 basis points, which helped it beat the earnings per share consensus.

However, it's worth noting that because the fast-food industry is extremely competitive, Wendy's may not deliver excellent results every quarter because a price war could lead to a strong decrease in margin.

As the world's largest burger chain, McDonald's is also well aware of the importance of offering a premium menu to improve its product mix. That's why McDonald's introduced its premium line in the early 2000's. As Forbes contributor Scott Gamm notes, McDonald's is still struggling to balance both sides of the consumer equation: maintaining growth among cheaper food offerings, while attracting affluent customers to its premium items.

Burger King, on the other hand, is emphasizing a healthier menu. This year, the company started selling low-fat french fries, which are said to contain 40% less fat than a similar-sized serving of McDonald's fries.

Final Foolish takeaway

Wendy's long-term plan to improve its top line does sound promising. The company's focus on menu innovation combined with cost reductions through the divestment of company-owned locations should stabilize its cash flow in the medium run and improve its top line and margins in the long run.

However, because the fast food industry is extremely competitive it's hard to forecast the final outcome of Wendy's strategy. One thing is certain: to win the war for the burger market, balancing the consumer equation remains a key factor. That is, menu innovations should be balanced with initiatives to retain traditional customers in order to protect the company's brand.