Did Caterpillar (CAT +0.00%) just signal that things are about to turn for the worst?

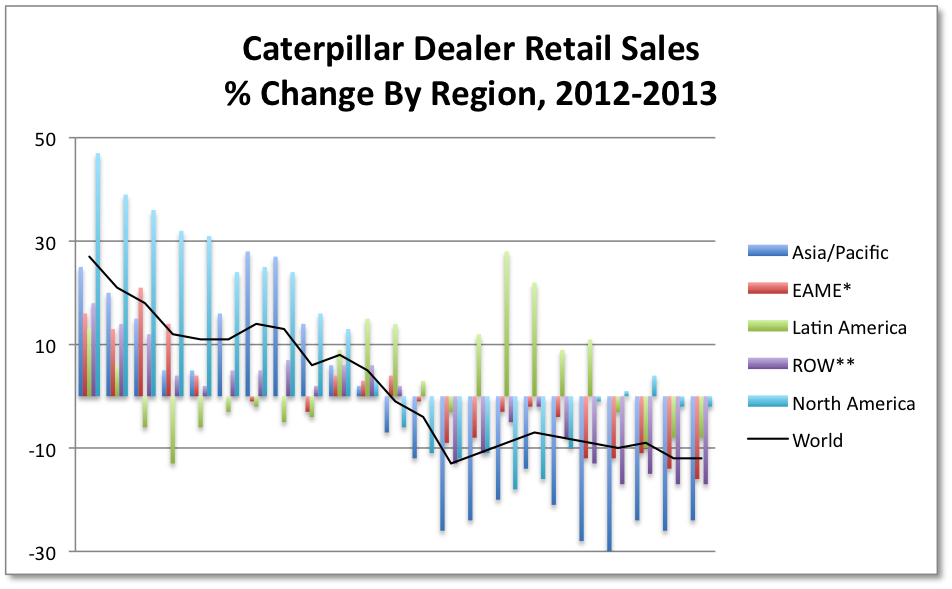

The heavy-equipment manufacturer reported last week the 12th straight monthly decline in its worldwide retail sales, which fell 12% in November, matching the drop experienced in October and marking the worst performance since February. You'd have to go all the way back to early 2010 to find the last time the company offered up an equally dismal report. Despite the talk of a dogged global recovery stumbling along, their may not be much hope left for it to pick up its pace.

Source: Caterpillar

Every region in Caterpillar's book reported falling sales for two consecutive months. Despite increases in global mining activity, the industry remains depressed. U.S. coal consumption is expected to rise 4.4% this year, but low prices for coal itself haven't been able to offset the competitively low price seen in natural gas. As a result, the Energy Information Administration says that through October, domestic coal production has fallen nearly 2%. Moreover, as Europe remains mired in economic malaise and international markets, particularly China, produce more of their own supplies, exports are down more than 8%. Overall, global coal demand will grow at an average rate of just 2.3% per year through 2018, but that's not likely to help many miners advance.

In addition to the collapse experienced by Caterpillar, industry peer Joy Global (JOY +0.00%) witnessed a 36% dissipation of new-order bookings due to coal's problems as nearly two-thirds of the heavy-equipment maker's revenues are derived from the industry, in both thermal and metallurgical markets. Yet it's not any better in iron ore either as it confronts a similarly weak demand environment despite low pricing.

Miners everywhere are curtailing investments heeding the call by Glencore Xstrata to initiate a new "age of austerity" in the words of one analyst. BHP Billiton, Rio Tinto, and Vale have all cut capital expenditures, sold non-core projects, and are focusing only on those assets that play to their strengths. In such a world, it becomes increasingly difficult for Caterpillar or anyone else for that matter to sell much new equipment.

Although Cat's power systems and construction segments may blunt the worst of the mining sector's collapse -- they're only expected to decline 5% this year compared to 40% in resources -- the economic malaise behind the decline belies the hope there's a global U-turn on the horizon, which the latest monthly sales numbers serves to underscore.

Cat's still counting on recovery in U.S. construction markets to underpin its own reversal of fortunes and with Deere (DE +0.00%) actually recording somewhat better results for November, Big Yellow may yet pull it off. Deere said its "first in the dirt" and settlement sales of construction and forestry equipment were higher by single digits, but Caterpillar's big bet on mining with its purchase of Bucyrus International in 2011 may make that a moot point.

It's not a pretty picture for the heavy-equipment maker, indicating that it still has a long way to go before it can plow its way out of this hole. Fourth-quarter dealer inventories are expected to decline significantly more. Investors ought to consider that if Caterpillar's business is bad and is going to get worse, how long will it be before we see global economic indices follow suit?

Caterpillar can still be a good, long-term play because mining is cyclical and when it does come back it will be well positioned. But that doesn't mean the picture won't darken more before it gets lighter