With the dust officially settled on big-bank earnings season, there was one stand out piece of data from Wells Fargo (WFC 0.42%) that was easily missed.

Of all the biggest banks, Warren Buffett's favorite, Wells Fargo, is often considered the safest and most reliable. It attempted to refuse bailout money during the financial crisis, and while it has had its fair share of settlements, it trails Bank of America (BAC +0.13%) by a wide margin. When you add in the tumultuous 2013 of JPMorgan Chase (JPM 0.34%), there is no denying that it has emerged as the clear winner of the big four.

As banks move ahead, Wells Fargo has been aggressively adding to one of its business lines in an impressive way.

Rapid expansion

In the latest earnings release, Wells Fargo revealed it had "strong loan growth," as it grew its total loans by 3% to $826 billion over the last year, and its "core loans," from $705 billion to $745 billion (roughly 6%).

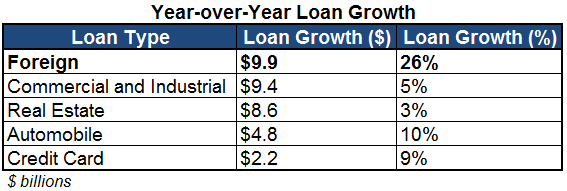

Yet if you had to guess where the biggest source of loan growth came from, you'd likely suspect since its Wells Fargo, it'd be some part of the American economy, and it would likely come from mortgages, commercial loans, or perhaps even one of its smaller buckets like automobile or credit card loans.

But in fact, its biggest source of loan growth on both a percentage and aggregate basis was foreign loans:

Source: Company Investor Relations.

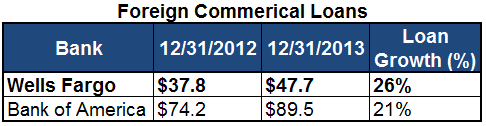

In fact, in its commercial loan portfolio, foreign loans went from being roughly 10.5% of loans at the end of 2012 to 12.5% at the end of 2013. And while Bank of America has a commanding lead in total loans and delivered strong growth, Wells Fargo actually outpaced it:

Source: Company Investor Relations.

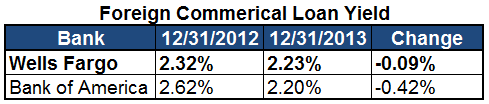

It is also rather interesting Wells Fargo went from trailing Bank of America in the yield earned from commercial loans in the fourth quarter of 2012 by a relatively wide margin, to actually being ahead of it at the end of 2013:

Source: Company Investor Relations.

Understanding the reason

There is no denying a big reason for this growth was the $6 billion worth of U.K. Commercial Real Estate acquired by Wells Fargo from Commerzbank in July of last year, but as quickly as headlines change, that reality can often be lost on investors.

When the transaction was announced, Mark Meyers, the head of Wells Fargo Commercial Real Estate noted, "Given Wells Fargo's position as the number one commercial real estate lender in the U.S. and our recent expansion of commercial real estate services in the U.K., this transaction is a significant investment in the future growth of our U.K. platform."

And Bill Vernon, who led the acquisition, said the move was "a great strategic expansion opportunity for Wells Fargo's U.K. Commercial Real Estate business."

While the foreign commercial loans are still a very small part of the overall portfolio of loans at Wells Fargo, such rapid growth and expansion in a particular line of business is always worth watching. Wells Fargo is often considered to be one of the only banks that is distinctly focused on the United States, moves like this show that may, in fact, be changing.