When one company is down on its luck, and a competitor is thriving, it is natural for investors to focus on the positives of the winner and the negatives of the "loser." This makes perfect sense, right? If earnings, sales, and the stock price are headed on up, then obviously the winner is doing something right. Conversely, if a company's earnings, sales, and stock price have been flat to down, then clearly something's wrong, right?

TSMC and Intel -- let's not get carried away

This situation applies perfectly to two semiconductor giants -- Intel (NASDAQ: INTC) and TSMC (NYSE: TSM). Intel, which designs and builds its own chips, owns the PC and server markets but has had difficulties getting the right products to market at the right time for smartphones and tablets (although it's getting much better). TSMC, on the other hand, as a pure-play foundry, has benefited from the fact that just about all leading-edge mobile silicon is baked at its factories.

Of course, it is well known within the industry that Intel's semiconductor technology is quite a bit ahead of TSMC's, and has been for generations. Intel, for example, introduced high-K metal gate into high-volume production in 2009 at its 32-nanometer node, while TSMC didn't really begin the high-volume ramp-up of this technology until 2012 for FPGAs/GPUs and 2013 for mobile SoCs at its 28-nanometer node. The FinFET story is similar -- with Intel having been in volume production since late 2011 while TSMC has yet to ship a single production FinFET.

Will TSMC close the gap? Not anytime soon

TSMC has been very vocal about its 20-nanometer manufacturing process (which is in high volume now) and has even gone so far as to talk up its 16-FinFET technology (and an enhanced version of this process known as 16-FinFET+). However, if you actually take the time to study the landscape, you'll observe the following:

- Not a single one of TSMC's customers has demonstrated a 20-nanometer system-on-chip product. All we've seen is a 20-nanometer cellular baseband from Qualcomm and 20-nanometer FPGAs from Xilinx.

- According to a report from SemiAccurate from Mobile World Congress, TSMC and ARM were showing off 16-nanometer "test chips" featuring a bunch of Cortex A57 cores. This is a strong hint that the process itself isn't finished, and it also means TSMC's customers are likely a long way from production.

- Intel has been shipping 22-nanometer FinFET-based CPUs since 2012, and a 22-nanometer low-power mobile SoCs since mid/late 2013. Intel has also demonstrated numerous smartphone platforms (Merrifield/Moorefield) built on this process.

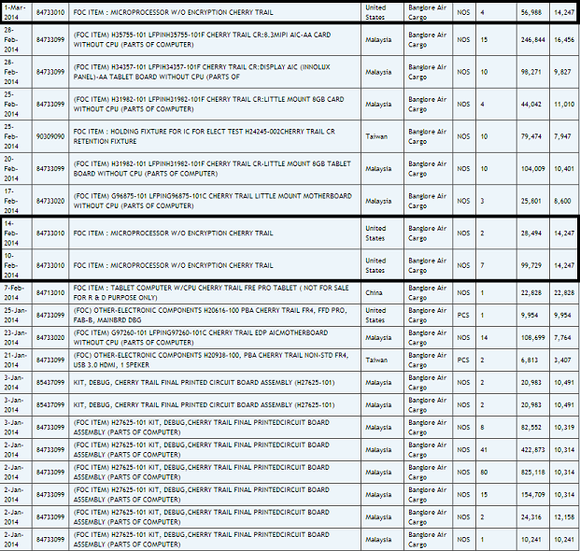

- Intel demonstrated its 14-nanometer (2nd generation FinFET) Broadwell SoC back in Sept. 2013, and according to Zauba, Intel has had samples of its first 14-nanometer low-power SoC code-named Cherry Trail since at least February 2014.

So, Intel has already completed the designs of its Broadwell chip for PC/Ultrabook as well as Cherry Trail for tablets. It is likely Intel will have samples of its next-generation Broxton (for phones and tablets) built on the 14-nanometer SoC process by mid-year. Further, at the Nov. 2013 Investor Meeting, Intel's William Holt stated that the company already had 10-nanometer test chips. Intel appears to be at roughly the same stage on 10-nanometers as TSMC is at 16-FinFET.

Foolish bottom line

While the foundries/fabless customers want to project the image that Intel's manufacturing lead is going to evaporate, the fact of the matter is, Intel's manufacturing dominance is very real and likely to continue (or even grow) over time. Intel's problems in mobile haven't been due to the manufacturing process, but instead due to design/time to market issues. However, Intel has gotten much better with its mobile SoCs, and by mid to late 2015, Intel could finally prove its doubters wrong.