Sears Holdings (SHLD +0.00%) continued its habit of spinning off subsidiaries when Lands' End (LE +0.71%) began trading under its own symbol on Monday. Sears bought the catalog merchant in 2002 for $1.86 billion. Lands' End's stock opened on Monday at around $29.50 per share but has since fallen 7% to $27.45. At that price, the company is valued at just $878 million. Even after accounting for a $500 million dividend to Sears when the transaction was consummated, Lands' End turned out to be a terrible investment.

Lands' End is a classic brand with a loyal base, but it has struggled to keep up with a savvier consumer who is more aware of fashion trends. As the company transitions to the public stage, it faces more competition than ever from the likes of L.L. Bean, ANN's (NYSE: ANN) Ann Taylor and LOFT, Talbots, and Eddie Bauer. However, even after generating the same amount of revenue in 2012 as it did in 2001, investors may soon discover that Lands' End's future is bright.

A closer look at Lands' End

Lands' End sells casual clothing and home furnishings primarily through online and direct-mail catalogs. It also maintains a small retail presence, with 18% of its 2012 revenue coming from merchandise sold through stores. The majority of Lands' End customers are women.

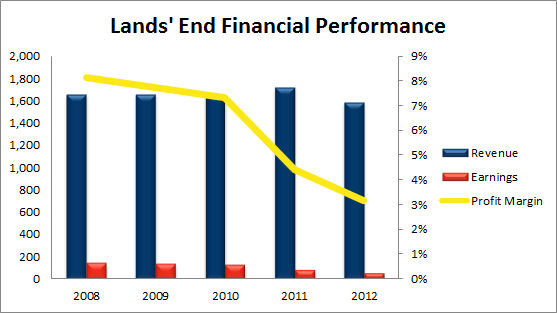

The company earned $50 million on $1.6 billion in revenue in fiscal 2012. By comparison, Sears lost $838 million on nearly $40 billion in revenue in 2012. Even though Lands' End was a bright spot in Sears' struggling retail portfolio, its profit margin declined as revenue stagnated, causing earnings to decline in each of the last five years.

The company is attempting to rectify its profitability problem by adapting to a changing consumer. For instance, the company is now updating its merchandise more frequently. Marla Ryan, Lands' End senior VP of merchandising, told Madison magazine:

When we started we largely had two product deliveries a year: spring and fall. And we recognized that if we wanted to be market-paced and relevant, we needed to deliver more each year. So now we're up to four deliveries ... we are bringing awareness to our customers at a faster pace. Even just four to five years ago, [our customer] probably wasn't as well informed as she is today. She's aware of key trends. One of the things we found in testing new product is that some of our most 'traditional' customers were our biggest fans of our new concepts.

Instead of inventing new styles, the company is updating and changing its traditional styles. Products that Lands' End would not have dreamed of stocking just five years ago -- like leopard-print smoking slippers -- are gaining traction with core customers.

Ryan says the company is trying to create products that "[our customer] trusts and knows that work for her, and give her updates instead of reinventing the wheel every season."

How Lands' End can beat the competition

Updating classics that loyal customers already buy is a shrewd way to stay on top of trends without betting an entire season's worth of inventory on a completely new style. Talbots took the riskier route and failed; after years of declining sales, the company tried to appeal to trendy, younger shoppers but ended up alienating its core base of middle-aged women.

Compared to many clothing retailers, Lands' End has stellar prospects. While Ann Taylor and LOFT maintain a robust online presence, both concepts rely on a heavy brick-and-mortar presence to drive sales. As a result, ANN has to make large investments to build, maintain, and update its stores. Lands' End's catalog-based business does not require significant capital to expand.

|

Company |

Biggest Sales Source |

No. of Stores |

Avg. Store Sq. Ft |

|---|---|---|---|

|

Lands' End |

Catalog |

14 plus 280 Sears stores-within-a-store |

8,600 |

|

Ann Taylor/LOFT |

Stores |

376/649 |

5,000/5,700 |

|

Talbots |

Stores |

495 plus 70 outlet |

Not available |

|

L.L. Bean |

Catalog |

22 plus 10 outlet |

Not available |

|

Eddie Bauer |

Catalog |

Not available |

Not available |

Lands' End faces its toughest competition from other catalog merchants, like Eddie Bauer and L.L. Bean. The latter mails more than 200 million catalogs per year to customers in more than 160 countries but managed only $1.5 billion in sales in 2013 -- that's $100 million less than Lands' End. Eddie Bauer is also smaller than Lands' End; the company is expected to earn less than $10 million in 2013, up from a $32 million loss in 2012. Lands' End has traditionally generated more than $100 million in annual profits.

While L.L. Bean and Eddie Bauer sell everything from men's and women's apparel to hunting and fishing gear, Lands' End remains focused on women's casual clothing and swimwear. Its devotion to a core base of loyal customers, in addition to its strategy of updating classic apparel to capitalize on current trends, gives Lands' End as much of a competitive advantage as a retailer can have in the 21st century.

Bottom line

Lands' End is embarking on a path that it has never taken before. Its first week as a public company has been a disappointment for Sears shareholders, who received Lands' End shares as part of the spinoff.

Regardless of what happens to the stock price in the next few months, Lands' End has a bright future. Its measured approach to following fashion trends promises to save it from Talbots' fate by retaining its core customer. Moreover, the company's catalog-based business model enables it to expand its reach much more quickly and efficiently than brick-and-mortar competitors like Ann Taylor and LOFT.

Finally, Lands' End will forever be locked in a battle with fellow catalog merchants L.L. Bean and Eddie Bauer. However, Lands' End's focus on a narrow customer base gives it an edge over its broad-based rivals. As a result, investors may want to scoop up Lands' End shares before its earnings recover.