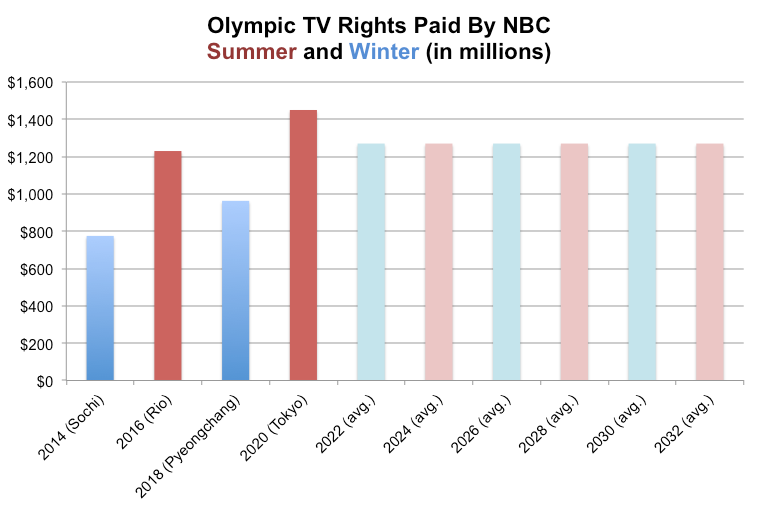

With its latest contract, NBC has placed a valuation of $1.27 billion on each of the six Olympic Games between 2022 and 2032. That's up from the $1.09 billion average it agreed to pay the IOC for the 2014, 2016, 2018, and 2020 Games. And over a longer time horizon, it's about 50% more than it paid for the seven events that preceded Sochi.

Data via NBC, and graph compiled by author. Years 2022 through 2032 are averages. First image (above initial text) via David Holt, Flickr.

They [NBC] have been doing this a long time and know the economics. IOC got long-term security. One may ask: Why did the IOC do this in isolation, and not tender a bid? It was because in the previous two or three tenders, Fox and ESPN/ABC basically phoned in their bids, and CBS was not interested. Why not take the money while the money is good?

Steve Smith, of Bryan Cave, says that while the $7.75 billion figure is enormous, "the Olympics are an incredibly valuable property." As I wrote earlier this year, the event has the rare ability to capture over a billion viewers, and to say ad space is hot would be putting it lightly. Havas Sports & Entertainment, for example, finds that in the last Summer Games, consumers were 50% more likely to find Olympic sponsors "trustworthy" and "inspiring" than prior to the event.

There's also its prestige, and the fact that it's had a relationship with NBC since 1964. "The Olympic Games have consistently delivered high ratings and high ad revenues to the broadcaster," IEG's Jim Andrews told me. This, he says, makes "them both profitable and a major promotional platform for the network's other programming."

There are still risks

But that doesn't mean no risks remain. Andrews, for one, says, "the element of the deal that carries the most risk is its length. No one can predict the state of the Olympics, or of network television, in 2030 and 2032." While the agreement should allow NBC to make amendments depending on the availability of new technology, there's still no guarantee viewers will tune in.

Still, given recent history, the network has shown it can innovate when it needs to. In Sochi, for example, average primetime viewership was 21.4 million, according to the New York Times. That's between what Turin and Vancouver registered in 2006 and 2010, respectively. But as the Times points out, digital streaming viewership surpassed 60 million, a Winter Olympics record.

The bottom line

At the end of the day, NBC's latest deal with the IOC is a smart one. There's uncertainty, sure. But given the network's Olympic history and the sheer enormity of the Games, it would've been foolish to allow a competitor to take its place. The greatest risk going forward -- technological change -- also represents NBC's biggest opportunity. Assuming it continues to innovate like it did in Sochi, the future looks very bright.