Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Hasbro (HAS 0.79%) fit the bill? Let's take a look at what its recent results tell us about its potential for future gains.

What we're looking for

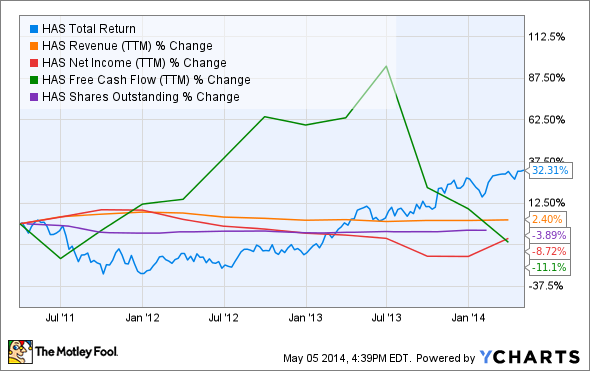

The graphs you're about to see tell Hasbro's story, and we'll be grading the quality of that story in several ways:

- Growth: Are profits, margins, and free cash flow all increasing?

- Valuation: Is share price growing in line with earnings per share?

- Opportunities: Is return on equity increasing while debt to equity declines?

- Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's take a look at Hasbro's key statistics:

HAS Total Return Price data by YCharts.

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Revenue growth > 30% |

2.4% |

Fail |

|

Improving profit margin |

(10.9%) |

Fail |

|

Free cash flow growth > Net income growth |

(11.1%) vs. (8.7%) |

Fail |

|

Improving EPS |

(0.8%) |

Fail |

|

Stock growth (+ 15%) < EPS growth |

32.3% vs. (0.8%) |

Fail |

Source: YCharts.*Period begins at end of Q1 2011.

HAS Return on Equity (TTM) data by YCharts.

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Improving return on equity |

(6.7%) |

Fail |

|

Declining debt to equity |

(6.4%) |

Pass |

|

Dividend growth > 25% |

43.3% |

Pass |

|

Free cash flow payout ratio < 50% |

88.5% |

Fail |

Source: YCharts. *Period begins at end of Q1 2011.

How we got here and where we're going

We first looked at Hasbro last year, and it has lost four passing grades in its second assessment to finish with a meager two out of nine possible passes today. Over the past three years, Hasbro's minuscule top line growth has not been surpassed by greater momentum on the bottom line, resulting in weaker profit margins and diminished free cash flow levels. However, the company remains committed to raising its dividend payments, which has spiked its free cash flow payout ratio to 88.5%, leaving very little room for error in the future. Will Hasbro be able to improve its mediocre metrics and produce stronger growth in the future, or will the toy maker be hampered by fundamental weaknesses in the end? Let's dig a little deeper to find out.

Hasbro recently reported better-than-expected revenue and earnings per share in its first-quarter earnings, an outperformance that rode strong performance in the girl-friendly My Little Pony brand and the Nerf Rebelle bow -- a line of soft-tip dart blasters for girls. Fool consumer goods specialist Rick Munarriz notes that Hasbro's new purple and pink weaponry has enjoyed positive momentum thanks to the massive popularity of arrow-slinging heroines in Brave and The Hunger Games. CEO Brian Goldner noted that the company's product and licensing initiatives continue to receive strong retailer support both in-store and online around the world, and Hasbro has a long history of executing on multiple levels to engage customers with tie-ins to movies and animated series. Hasbro's own licenses have already generated billions in worldwide revenue at the box office as well.

Over the past few years, Hasbro's partially owned Hub TV network has continued to showcase animated Transformers shows to sustain viewer interest during the downtime Michael Bay needs to add more explosions to the live-action Transformers films. The company has been pushing Transformers: Age of Extinction hard in advance of its June 27 release. Hasbro is also teaming up with 3-D printing leader 3D Systems to customize toys for children with 3-D printing.

Hasbro also appears to be a better investment than fellow toy maker Mattel, as the latter reported an unexpected loss for its first quarter due to lackluster holiday-season Barbie sales. Fool writer William Bias points out that Hasbro's strong portfolio of character-centered brands -- Transformers, Magic: The Gathering, and My Little Pony, among others -- provides a competitive advantage against Mattel, which has yet to leverage its properties at the box office with similar aplomb.

However, Mattel recently signed an agreement with Disney to produce toys based on the red-hot Marvel and Star Wars properties, which could be a major thorn in Hasbro's side -- Hasbro owns the licensing rights for toys and games based on Marvel characters until 2017. Mattel's also acquired Canadian toy maker MEGA Brands in a deal worth $460 million, which should help it tap the growing interest in build-it-yourself toys (although MEGA will probably never be as beloved as larger block-based rival Lego).

Putting the pieces together

Today, Hasbro has few of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.