Visa (V 1.34%), MasterCard (MA 0.11%), and American Express (AXP 0.24%) have been on incredible runs over the last six years, but it turns out the growth has just begun.

Visa went public in March 2008 as the financial industry was crumbling around it. Even with initial difficulty, both it and MasterCard have resoundingly crushed the return of the S&P 500. And while American Express has trailed Visa and MasterCard over the last six years, it's difficult to suggest it has performed poorly, as it has more than doubled the S&P 500:

V Total Return Price data by YCharts

And with their combined market capitalization now standing at nearly $315 billion, it's easy to think their best days are now behind them. But there is still incredible opportunity and growth ahead for these powerful companies.

The amazing suggestion

In an interview with Fortune, the CEO of American Express, Ken Chenault, suggested there is "tremendous opportunity" in the payments industry across the world, saying:

We looked at where spending takes place. Outside of credit cards and charge cards, there's $25 trillion out there.

It's easy to think such a suggestion is simply a CEO attempting to talk up the power of the industry he finds himself in. But Chenault is exactly correct.

The remarkable growth

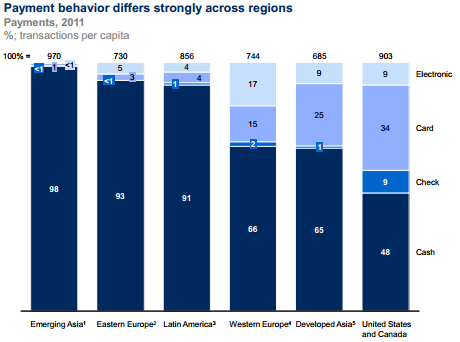

A recent publication by McKinsey & Company called "Global flows in a digital age" explores what the world's economy will look like in coming years in a variety of industries as a result of innovation and development. One of the most fascinating sections is the payments industry, where it reveals a staggering 90% of transactions in emerging markets are made using cash or checks.

This is a far cry from the developed nations, and in the U.S. and Canada that number stands at just 43%:

Source: McKinsey Global Payments Map; McKinsey Global Institute analysis

But McKinsey doesn't expect this to continue, as it projects China will see the number of card transactions made in a year increase by nearly five times, from just 6 billion in 2011 to 29 billion by 2016. And it's not simply China where growth is expected, but everywhere, as "emerging economies are set to experience significant growth in their use of electronic payment systems as financial inclusion grows."

The incredible opportunity

With all that in mind, one may think this means the biggest companies like Visa, MasterCard, and American Express in the payments industry will be threatened by new entrants and competitors. But simply, that isn't the case.

Although McKinsey notes there will be opportunities for smaller companies in these emerging markets, it notes:

We expect that the major payment companies such as Visa, MasterCard, and American Express will continue to have leading positions in the largest emerging markets because of the risk and expense involved in building a fully operational payment system.

The key takeaway

All too often we can think once a company hits a certain size the best days are simply behind it. And when you consider MasterCard is the "smallest" of the three mentioned with size of nearly $90 billion, the three biggest firms in the payments industry would easily fall into that space.

Yet the reality is, the payments industry has seen incredible growth, and it isn't poised to stop anytime soon.