Since SolarCity's (SCTY +0.00%) IPO in December 2012, its stock has been on quite a run. GT Advanced Technologies' (NASDAQ: GTAT) shares have also skyrocketed over the same time period:

While these two stocks absolutely crushed the market for a long stretch, both have given up gains in recent months. Since mid-March, SolarCity's stock is down 30%, while GT Advanced Technologies shares are down 12%. Plus, short interest has actually increased sharply for both companies in 2014.

Why does short interest matter? Let's look at what it means, how it impacts your investment, and how it relates to the businesses behind the tickers.

What is short interest, and the other "short" mumbo jumbo?

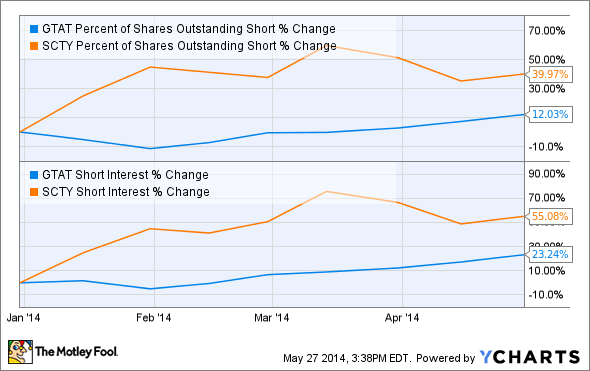

Short interest is essentially the number of shares that investors have sold short -- meaning they are set up to profit by the share price falling. Here's a look at two metrics used to measure short activity:

GTAT Percent of Shares Outstanding Short data by YCharts.

As you can see, short interest has gone up for both GT Advanced Technologies and SolarCity in 2014, as has the percentage of shares outstanding short. Here's another metric that is important to understand:

GTAT Percent of Float Short data by YCharts.

The percentage of "float" short is like percentage of shares outstanding short, except that it excludes shares held by insiders, such as directors and executives. This is important for SolarCity, where more than 30% of shares are held by a small handful of insiders, including co-founders Elon Musk and his cousins Lyndon and Peter Rive, as well as several directors who are part of early investor venture capital groups.

In short, "short float" is a better way to gauge the "real" short position in a stock with heavy insider ownership, but all of these metrics should be used within the context of one another, and the long-term trends.

Why does it matter?

If there's a lot of short action on a stock, it's a good bet that the share price is going to be volatile, and you must be ready to weather that volatility. The stock will often move up or down without any clear cause. This can also lead to bigger rises and falls around earnings announcements, when a lot of options investors are trying to "cover," or exit, their option positions.

What's the story with SolarCity?

Over short periods of time, short interest and other such measures can prepare us to expect volatility in the stock, but they don't really tell us anything about the company. Take SolarCity, for instance.

SolarCity shares have fallen 30% this year, partially because of how far and how fast the stock has run since its IPO. There are also concerns that solar technology and dropping prices for solar hardware will undermine SolarCity's $0-down business model. SolarCity has shown explosive growth, based on its ability to reduce or even eliminate the up-front cost of solar for residential customers via long-term contracts with a monthly payment that is often 20% less than utility payments.

However, SolarCity's management doesn't seem fazed by its falling stock value. The company does cash sales, as well as lease and PPA agreements. Add in the company's sheer scale, and it can be price-competitive with any kind of transaction and have wider gross margins than smaller competitors because of its buying power. The company is also growing its business at an insane rate -- management expects to install double the capacity in 2014 that it installed in 2013 -- while increasing investments in sales and marketing to accelerate growth even more. In short, there's a lot to like with SolarCity right now.

GT Advanced showing its roots

Before rebranding itself, GT Advanced was once known as GT Solar. The change was an important reflection of what the company does, which largely involves developing advanced technologies in materials that have applications far beyond just solar. The company's massive deal with Apple last year, to make sapphire material that will be used in an as-yet unnamed Apple device, illustrates this quite well.

GT's recent unveiling of several new technologies and advancements of prior systems is opening doors to markets worth potentially billions in sales tied to nonsolar and solar applications. As CEO Tom Gutierrez said on the company's most recent earnings call, GT Advanced's "entry into the sapphire materials business (the Apple deal) may enable us to expand into other materials segments." Management also reiterated its target of $1.50 in adjusted earnings per share by 2016, making today's roughly $16 share price look cheap.

Keep the long view, but know what shorts could do

Even if you don't ever plan to use options -- long or short -- it's worth knowing how they can cause significant rises or falls in share price. If you're holding or planning to open positions in either SolarCity or GT Advanced Technologies, be sure to know the difference between news and noise, and don't get caught up in buying or selling just because the stock price is moving. Keep an eye on the bright futures of both of these companies; make your investing decisions based on how the businesses execute.