Source: Flickr / Source: Flickr / JefferyTurner.

When General Electric (GE 2.71%) announced its earnings in the second quarter, one of the biggest pieces of news came when it revealed it would complete the spinoff of Synchrony Financial -- the retail arm of GE Capital -- through an IPO at the end of this month.

And while there is a lot to dive through in the updated SEC filing detailing exactly what Synchrony is and how well it has done, one sentence contains something investors should keep in mind.

Diving into the details

In the discussion of the broader business of Synchrony, one of the most interesting things came when it noted:

We are expanding our direct banking operations to increase our deposit base as a source of stable and diversified low cost funding for our credit activities.

Currently, Synchrony itself is principally -- and almost exclusively -- a company that provides private-label credit cards to retailers for their customers in its retail card business. For example, Amazon.com and Wal-Mart cards are provided by Synchrony.

It also has a payments solution group that allows stores to give their customers the ability to finance major purchases ranging from things like car tires, jewelry, and even televisions. And it has a CareCredit business, which provides financing for individuals getting elective health-care services, like dental, cosmetic, and other services.

Source: Company SEC Filings.

As a result of these relationships, GE noted at the end of March that it had more than $54 billion in total loans and that it is "the largest provider of private label credit cards in the United States based on purchase volume and receivables."

So what does all that have to do with the sentence I highlighted earlier? Well, it would seem as though it's positioning itself to only continue growing.

The bright spot of direct banking

When discussing the growth strategy of the business, one of the things Synchrony is seeking is to further expand its banking relationships. After all, in January of last year it acquired nearly $6.5 billion worth of deposits from MetLife.

But this isn't traditional banking relationships, but instead what is known as "direct banking," which lacks branches. And not only does this allow it to operate at lower costs and provide greater benefits to its customers, but it's also what customers prefer. The release stated:

According to 2012 and 2013 American Bankers Association surveys, the percentage of customers who prefer to do their banking via direct channels (i.e., Internet, mail, phone, and mobile) increased from 53% to 61% between 2010 and 2013, while those who prefer branch banking declined from 25% to 18% over the same period.

Put simply, like other successful banking operations, Synchrony is seeking to capitalize on customer preferences.

But this won't only be beneficial to its top line in expanding its revenue possibilities by enabling it to issue more cards, write loans, and other banking services. It will also grow its bottom line as a way to cut its cost of funding its operations.

At their core, banks make their money by borrowing -- often in the form of deposits -- and in turn combine that money and issue it out in the form of loans. If it borrows at 1%, and collects 4% on the loans it issues, it has what is known as a net interest margin of 3%. All else being equal, to boost its profitability, it can either issue loans at higher rates -- which are often riskier -- or cut its borrowing costs.

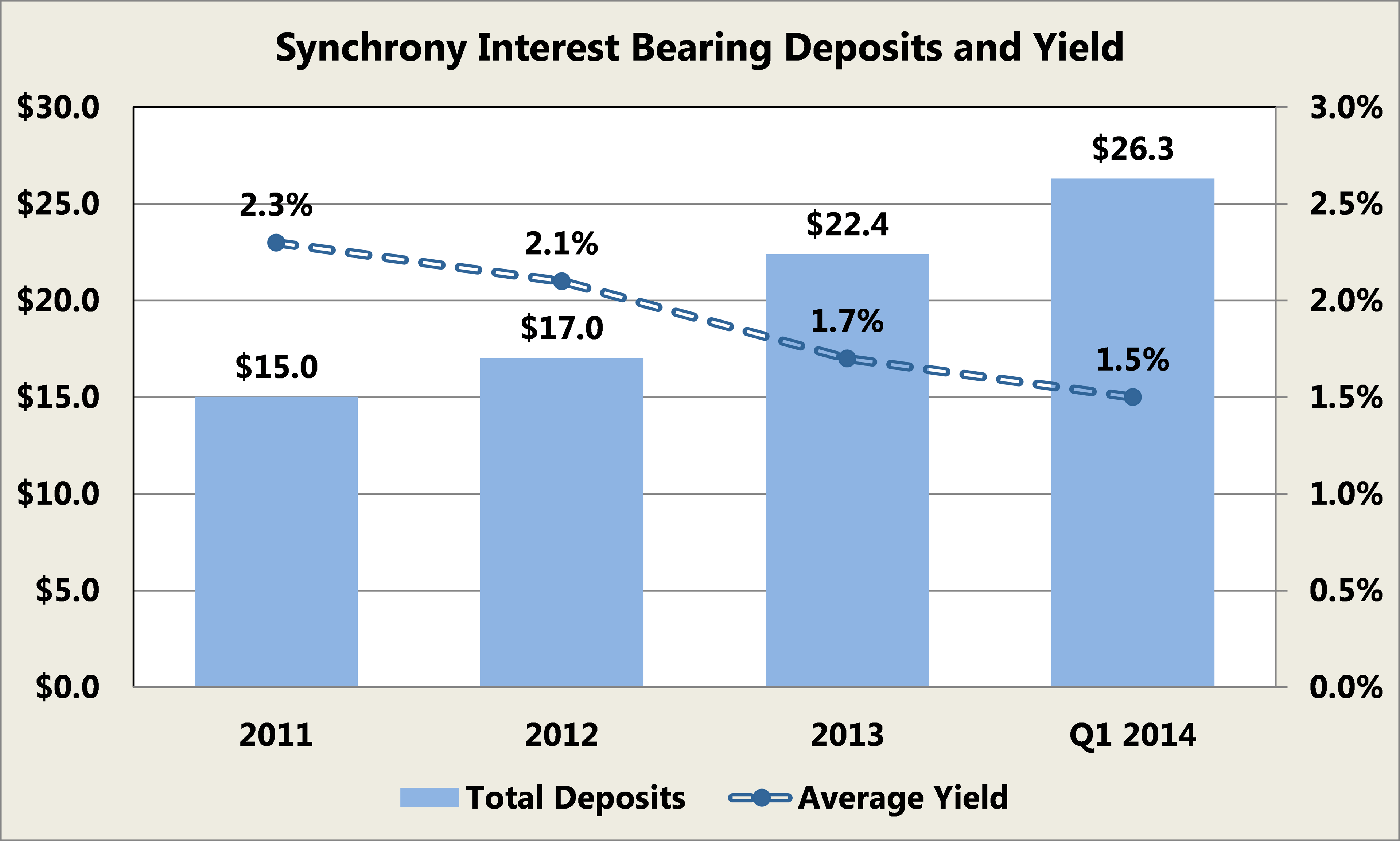

With the expanding deposit footprint into lower cost options, Synchrony has done an incredible job at borrowing more, but at a lower cost. And any further expansion of its deposits in the future will only continue this trend:

Source: Company SEC filings.

And as a result, its profitability will only continue to rise as its cost to borrow continues to fall.

The Foolish bottom line

There is a lot to parse as investors gauge whether an investment in General Electric's retail finance arm is an intelligent one. But the thought of a plan that will increase its revenues and cut its expenses is undeniably a step in the right direction.